Chapter 4

The Accounting Cycle: Journals and Ledgers

91

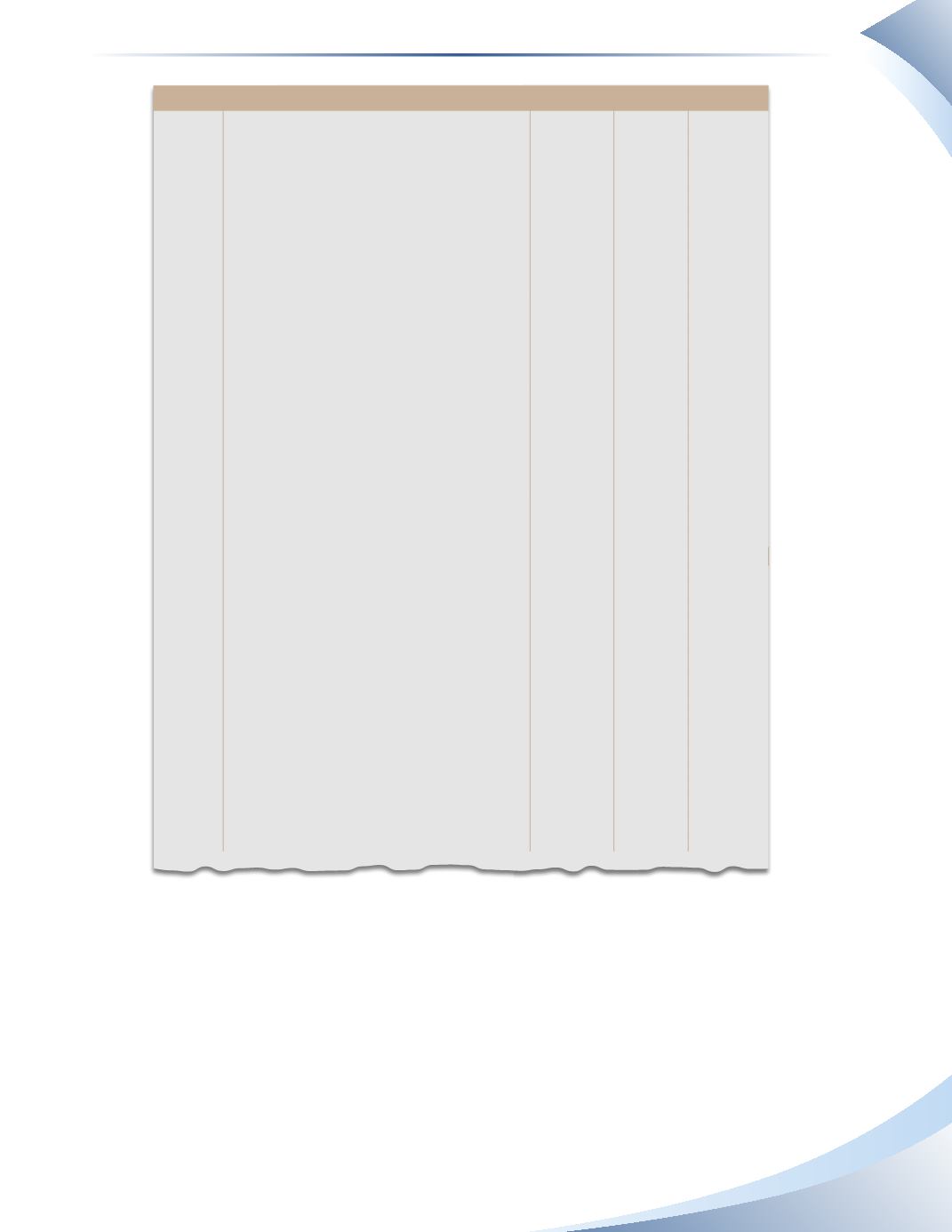

JournAl

Page 1

Date

Account Titles and Explanation

PR

Debit

Credit

2016

Jan 2 Cash

101

1,500

Service revenue

400

1,500

Completed work for client

Jan 3 rent expense

540

800

Cash

101

800

Paid rent for month of January

Jan 4 Prepaid Insurance

110

1,200

Cash

101

1,200

Prepaid annual insurance policy

Jan 5 Cash

101

5,000

Parish, Capital

300

5,000

Owner invested cash

Jan 7 equipment

120

2,300

Cash

101

2,300

Bought equipment

Jan 10 Accounts receivable

105

1,800

Service revenue

400

1,800

Completed work on account

Jan 16 Bank Loan

215

500

Cash

101

500

Paid bank loan principal

Jan 19 Cash

101

1,100

unearned revenue

210

1,100

Received customer deposit

Jan 20 Telephone expense

550

250

Accounts Payable

200

250

Received telephone bill

Jan 30 Parish, Drawings

310

2,000

Cash

101

2,000

Owner took cash for personal use

________________

FIgure 4.12