Chapter 4

The Accounting Cycle: Journals and Ledgers

87

It is important to assign account numbers in a logical manner and to follow specific industry stan-

dards. One example of a numbering system is

Account Numbering

100–199:

Asset

accounts

200–299:

Liability

accounts

300–399:

Equity

accounts

400–499:

Revenue

accounts

500–599:

Expense

accounts

Separating each account by several numbers will allow new accounts to be added while maintain-

ing the same logical order. Note that the account numbering follows the order of the financial

statements: balance sheet (assets, liabilities and equity); income statement (revenue and expenses).

Different types of businesses utilize different types of accounts. For example, a manufacturing busi-

ness will require various accounts for reporting manufacturing costs. A retail business, however, will

have accounts for the purchase of inventory.

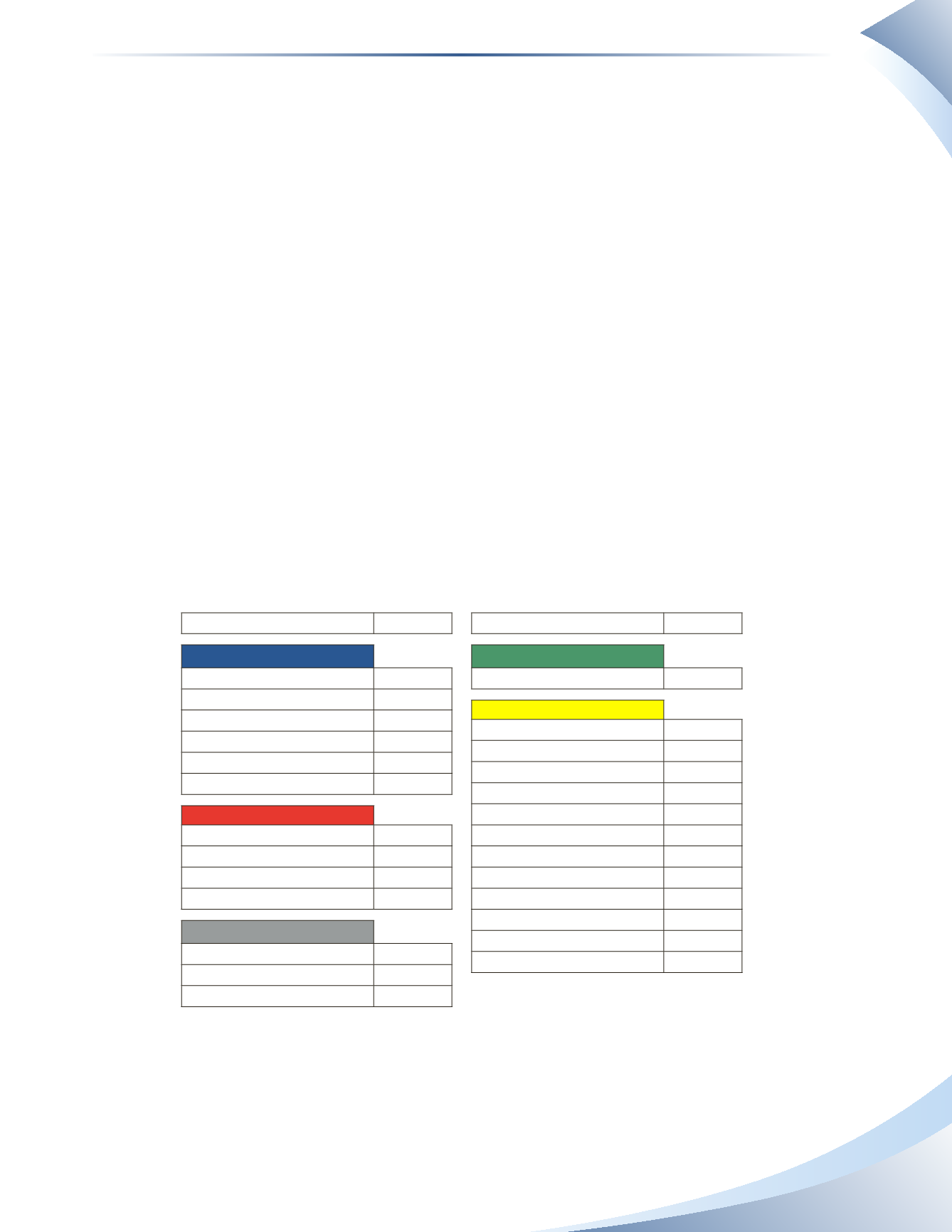

Figure 4.8 shows how a service company may set up its accounts. Some of the accounts listed here

will be introduced in later chapters. Other accounts can be set up as needed. For example, if the

business has more than one bank account, the chart of accounts would include an account for each

bank account.

Account Description

Account #

ASSETS

Cash

101

Accounts Receivable

105

Prepaid Insurance

110

Office Supplies

115

Equipment

120

Accumulated Depreciation

125

LIABILITIES

Accounts Payable

200

Interest Payable

205

Unearned Revenue

210

Bank Loan

215

OWNER’S EQUITY

Owner’s Capital

300

Owner’s Drawings

310

Income Summary

315

Account Description

Account #

REVENUE

Service Revenue

400

EXPENSES

Advertising Expense

500

Bad Debt Expense

505

Depreciation Expense

510

Insurance Expense

515

Interest Expense

520

Maintenance Expense

525

Office Supplies Expense

530

Professional Fees Expense

535

Rent Expense

540

Salaries Expense

545

Telephone Expense

550

Travel Expense

555

________________

figure 4.8

Each of the accounts listed above will have its own ledger account. Think of the ledger as an ex-

panded T-account. In Figure 4.9, notice the red “T” under the debit and credit columns. This is

shown to illustrate its similarity to the T-accounts you have been working with.