Chapter 4

The Accounting Cycle: Journals and Ledgers

81

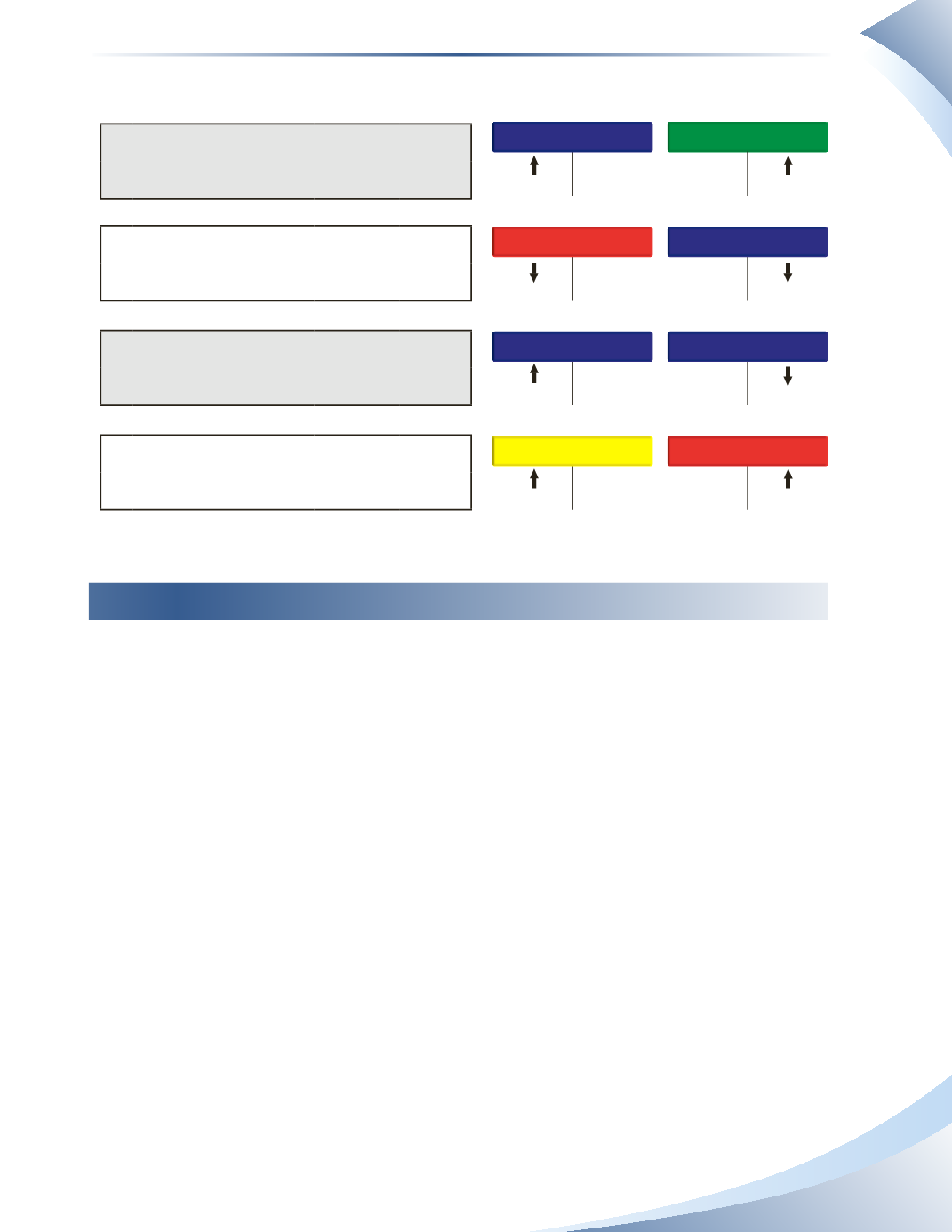

These transactions are summarized in a table and illustrated in T-accounts in Figure 4.2.

1. Cash

Increase Debit

Service Revenue

Increase Credit

2. Bank Loan

Decrease Debit

Cash

Decrease Credit

3. Prepaid Insurance

Increase Debit

Cash

Decrease Credit

4. Maintenance Expense Increase Debit

Accounts Payable

Increase Credit

________________

figure 4.2

The Accounting Cycle

As discussed in the previous chapter, the purpose of accounting is to prepare financial statements

which help users to make informed decisions. There are many transactions during an accounting

period and it is important to summarize them all within the financial statements.The framework

to make sure this is done properly is called the accounting cycle.

The

accounting cycle

refers to the steps required to complete the financial statements. Businesses

prepare financial statements at the end of each accounting period, whether it is a month, quarter,

year, etc. Every period, the cycle repeats. Over the next three chapters, the accounting cycle will be

illustrated using a monthly period for a sample company.

Figure 4.3 shows the steps required to generate a formal set of financial statements for a given

period. A computerized system will either perform most of these steps automatically or have them

available immediately, while a manual system requires each step to be completed by hand.The first

three steps (in blue) are performed repeatedly during the accounting period while the remaining

steps are all completed at the end of the current period and prepare the accounts for the next pe-

riod.This chapter will cover the first four steps of the accounting cycle.

CASH

BANK LOAN

PREPAID INSURANCE

MAINTENANCE EXPENSE

SERVICE REVENUE

CASH

CASH

ACCOUNTS PAYABLE

Debit

Credit

Credit

Debit

Credit

Debit

Debit

Credit