Chapter 4

The Accounting Cycle: Journals and Ledgers

89

6

Enter the ledger number into the posting reference in the journal as a checking process

once the amount has been posted.

7

Repeat the steps for all lines in the journal entry.

It is good practice to double check that the balance shown in the ledger for each account is a nor-

mal balance (e.g. cash is an asset and assets have a debit normal balance). If an account does not

have a normal balance, this may indicate that an error has occurred. Double check that the balance

was calculated correctly, the amount in the ledger was correctly copied from the journal and the

journal entry was created correctly.

In the modern accounting system, the posting process is automatically done by the computer system.

Accountants no longer need to refer to a specific page in the journal book to look for transactions.

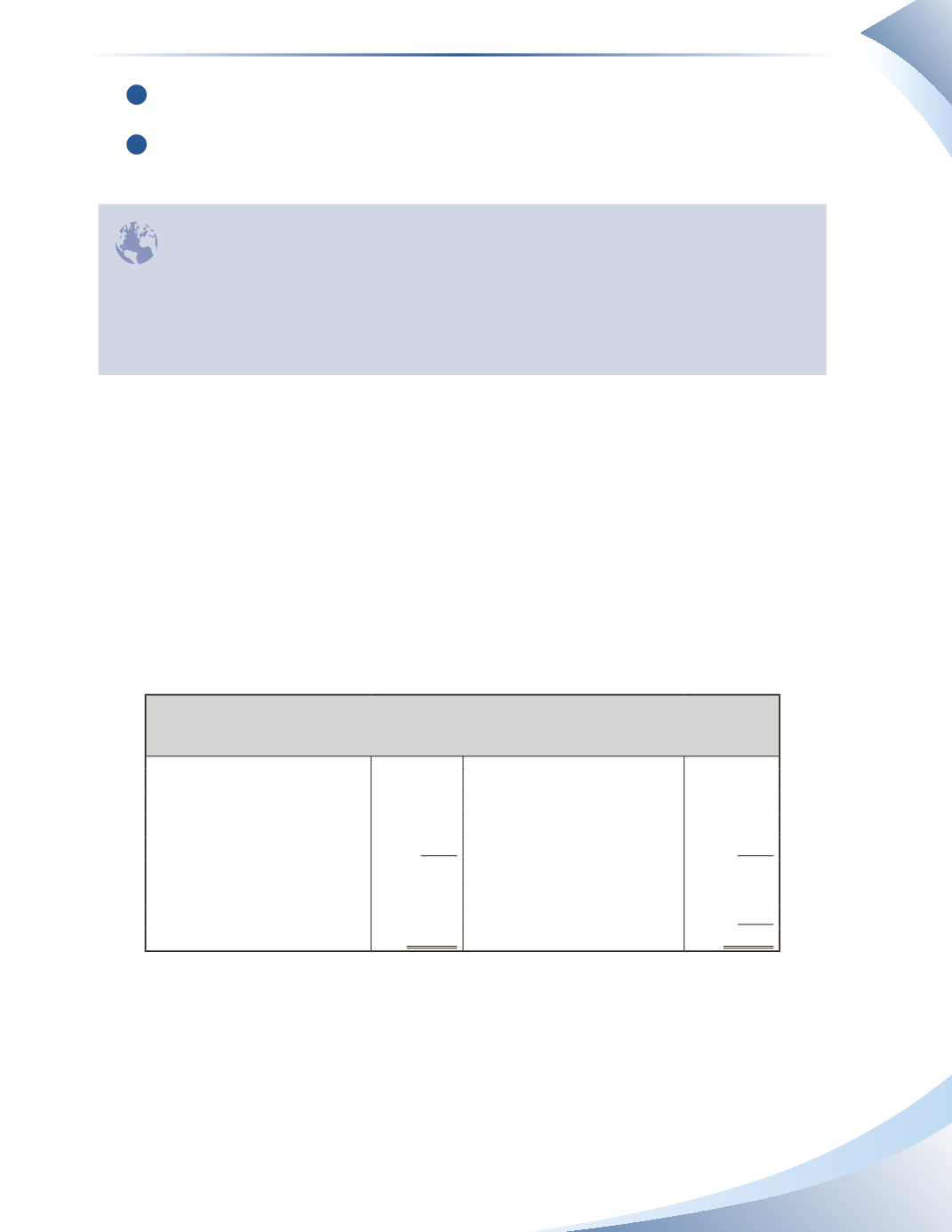

Return to Mark Parish’s company, MP Consulting, to see how a full set of journals would be pre-

pared and posted to the ledger accounts. First examine the opening balances of the company from

the previous period’s balance sheet in Figure 4.11.

MP Consulting

Balance Sheet

As at December 31, 2015

Assets

Liabilities

Cash

$3,000 Accounts Payable

$1,000

Accounts Receivable

1,200 Unearned Revenue

900

Equipment

6,000 Bank Loan

3,000

Total Liabilities

4,900

Owner’s Equity

Parish, Capital

5,300

Total Assets

$10,200

Total Liabilities & Equity

$10,200

________________

figure 4.11

Note that the above balance sheet is dated December 31, 2015. It shows the ending account bal-

ances for the month of December 2015, which are also the beginning balances for the month of

January 2016. In general, a balance sheet account’s ending balance for a given accounting period

is the beginning balance of the next period. In this textbook, the term “opening balance” will be

Accounting software such as QuickBooks® and Sage automatically perform the functions of double

entries. For example, assume that a cash payment is received by the company and the user defines

the payment as a payment for services or goods provided. The user is usually the company’s

bookkeeper or accountant. The software will automatically realize that an asset account must be debited

and the revenue account must be credited. After the entry is journalized by the software, the amounts are

automatically posted to the general ledger and the trial balance. There is a significant level of automation

provided by accounting software, which can reduce the number of accounting errors and misstatements if

used correctly.

INTHE REAL WORLD