Chapter 4

The Accounting Cycle: Journals and Ledgers

83

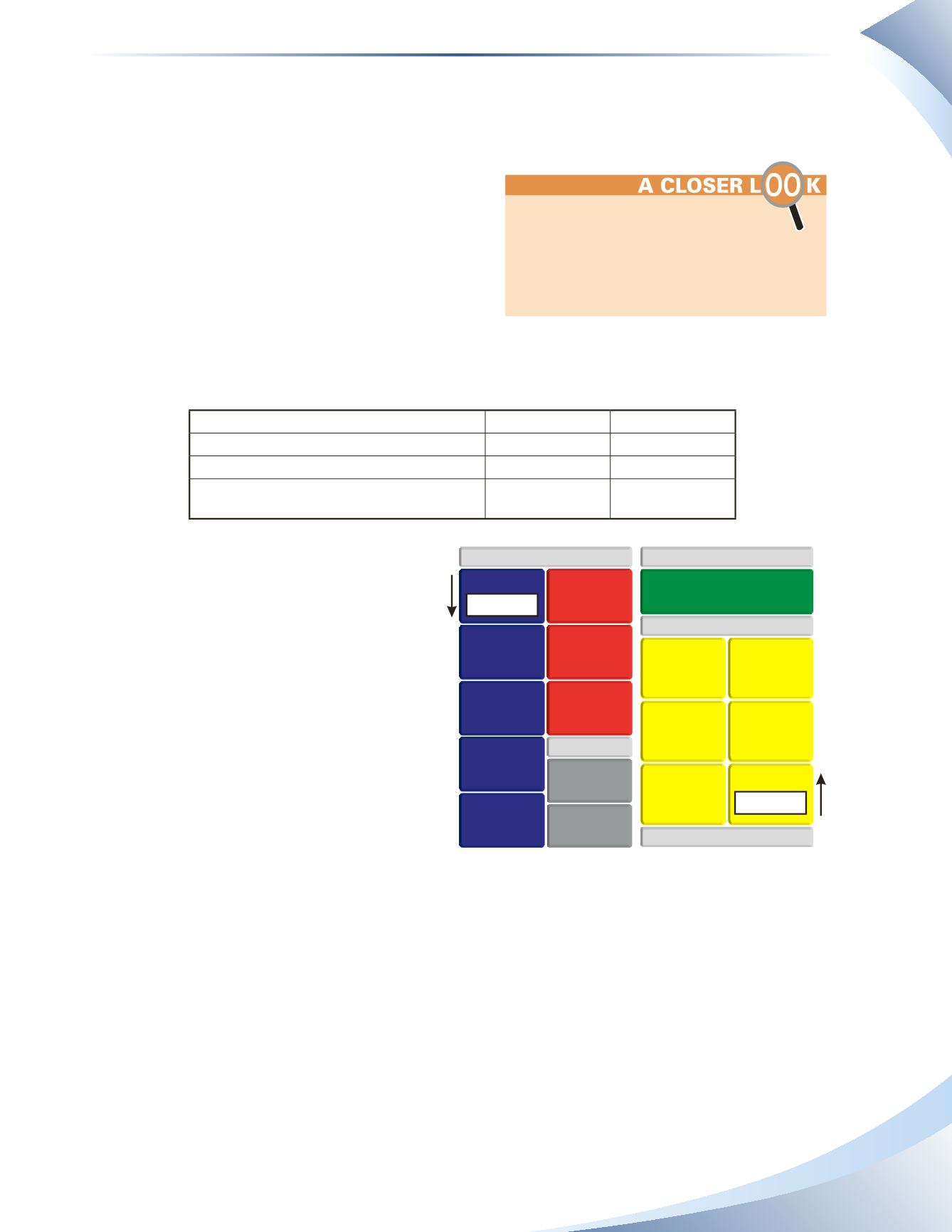

For example, suppose you pay a $100 utility bill with cash. To analyze this, first determine which

accounts will be affected. In this example, the accounts would be utilities expense and cash. Now,

for each account, answer the following questions

•

What category does the account belong to?

•

Is the account increasing or decreasing?

•

Is the increase or decrease a debit or credit?

The full analysis for the transaction is shown in the

table below. It is important to note that the analysis

is just to determine whether the account will be

debited or credited. At this point, which account is analyzed first is irrelevant. Later, in step two of

the accounting cycle, we will record the accounts in a standardized format.

Which accounts will be affected?

Utilities Expense

Cash

What category does the account belong to?

Expense

Asset

Is the account increasing or decreasing?

Increasing

Decreasing

Is the increase or decrease a debit or credit?

(Use the Debit and Credit Reference Guide)

Debit

Credit

From this analysis, we can illustrate how

the accounts would be affected. Notice in

Figure 4.4 that utilities expense increases

with a debit and cash decreases with a

credit.

This type of analysis can be done for any

transaction. Keep this in mind as you prog-

ress and come across new accounts and new

types of transactions. To help you analyze

how increases and decreases translate into

debits and credits, consider these common

transactions

1.

Provided consulting services for a customer for cash.

2.

Received a bill for advertising, which will be paid later.

3.

Received cash from a customer for work to be completed next month.

4.

Paid cash toward the principal of a bank loan.

5.

Prepaid cash for four months’ rent.

6.

Purchased office furniture with cash.

7.

Provided consulting services to a customer on account.

8.

Paid cash toward the advertising bill received in transaction 2.

9.

A customer paid an amount they owed.

If a transaction involves cash, you may

find it easiest to analyze cash first for the

increase or decrease. Then you can turn

your attention to why cash was received or

cash was paid out.

BALANCE SHEET

CASH

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

OFFICE

SUPPLIES

INCOME STATEMENT

NET INCOME (LOSS)

EXPENSES

SERVICE REVENUE

ADVERTISING

INTEREST

INSURANCE

RENT

SALARIES

UTILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOANS

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

- $100 CR

+ $100 DR

________________

figure 4.4