Chapter 7

Inventory: Merchandising Transactions

199

Part 2

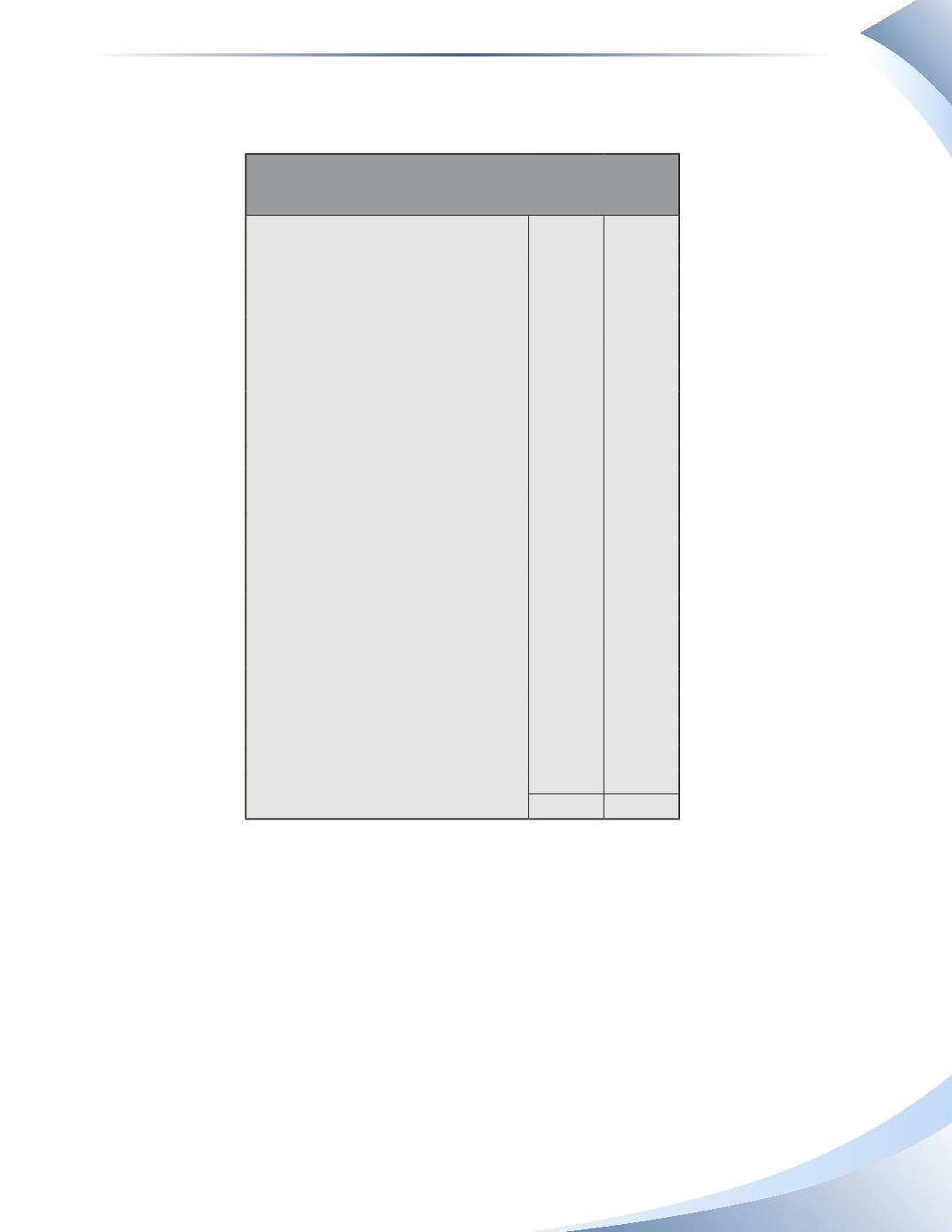

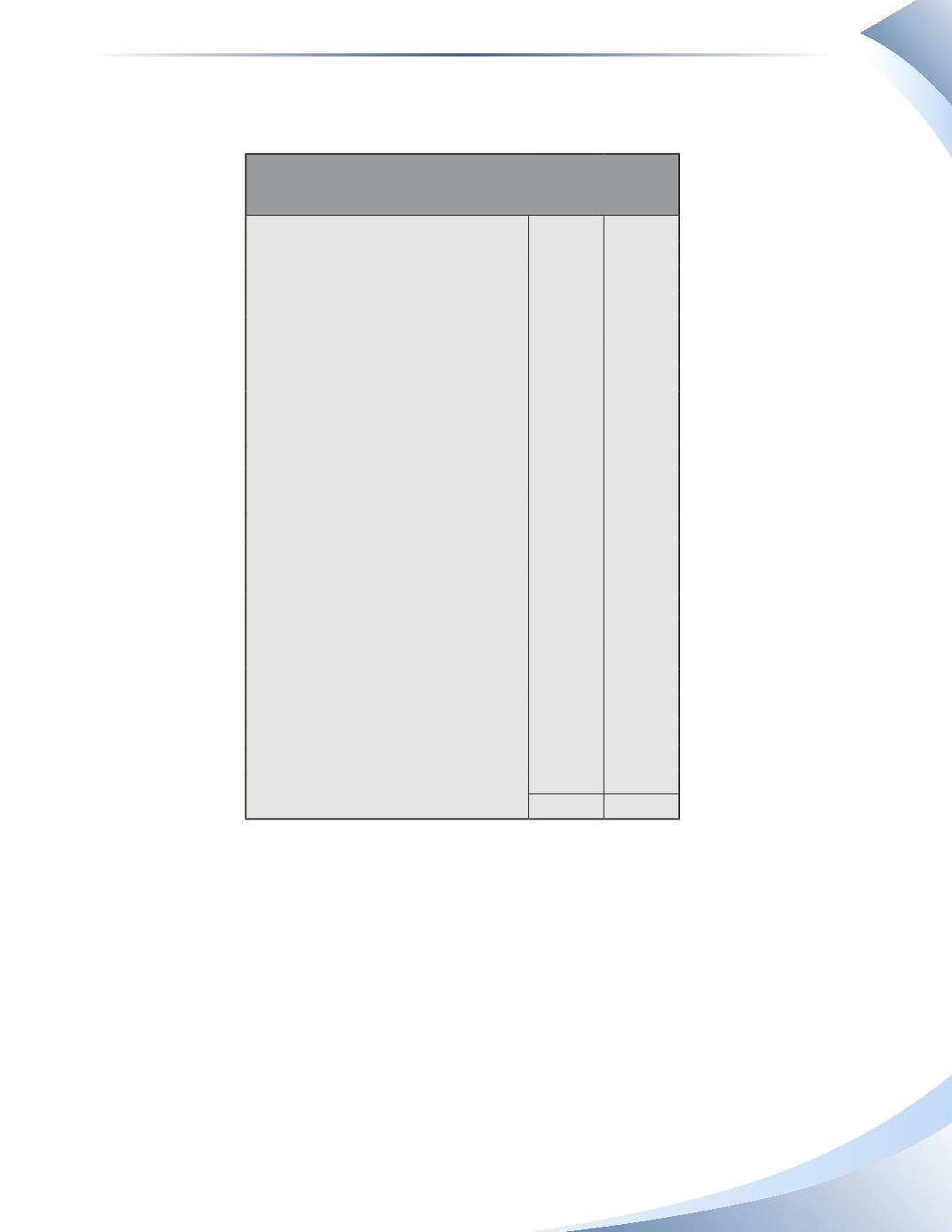

Below is the adjusted trial balance for George’s Gardening Supplies at the end of the year.

George's Gardening Supplies

Adjusted Trial Balance

December 31, 2016

Account Titles

DR

CR

Cash

$54,830

Accounts Receivable

33,500

Inventory

33,440

Prepaid Insurance

3,600

Equipment

45,000

Accumulated Depreciation

$5,000

Accounts Payable

10,000

Bank Loan

30,000

Gregg, Capital

90,000

Gregg, Drawings

5,000

Sales Revenue

113,500

Interest Revenue

6,500

Sales Returns & Allowances

1,000

Sales Discounts

1,580

Cost of Goods Sold

44,700

Depreciation Expense

5,000

Insurance Expense

2,500

Interest Expense

2,600

Rent Expense

6,000

Salaries Expense

11,000

Supplies Expense

4,500

Utilities Expense

750

Total

$255,000 $255,000

Note: $10,000 of the bank loan will be paid by December 31, 2017.

Required

a) Prepare a single-step income statement for George’s Gardening Supplies for the year ended

December 31, 2016.

b) Prepare a multistep income statement for George’s Gardening Supplies for the year ended

December 31, 2016. Calculate the gross margin percentage.

c) Prepare a classified multistep income statement for George’s Gardening Supplies for the year

ended December 31, 2016 using the following information

• The equipment is used solely for selling purposes.

• Supplies are used for administrative purposes only.

• Insurance, salaries, rent, and utilities are allocated 85% to selling and 15% to

administration.