207

Inventory: Merchandising Transactions

Chapter 7 Appendix

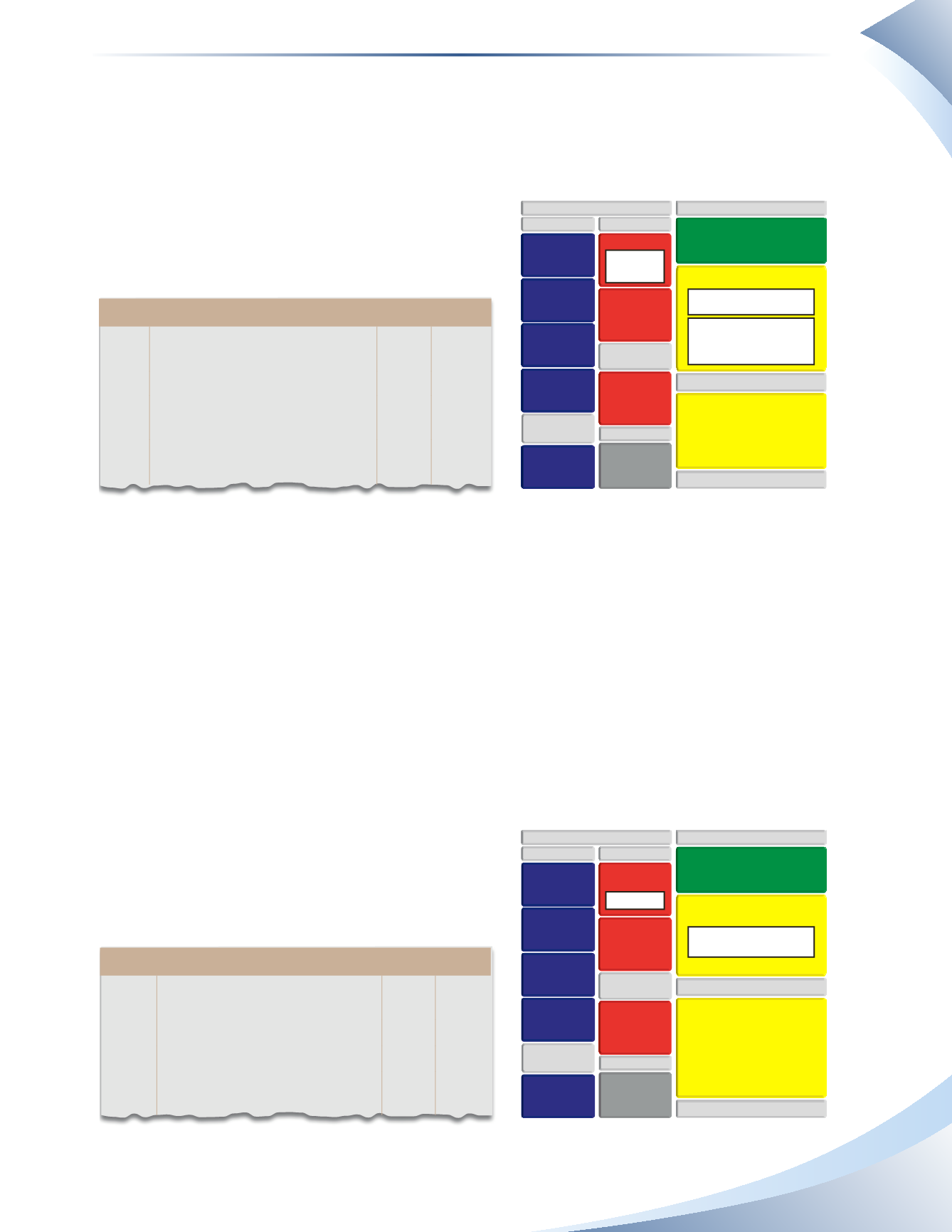

Purchase Allowances

Continuing with the above example, assume Tools 4U found another $300 worth of unsatisfactory

inventory. Suppose the supplier offers a 20% allowance to Tools 4U to keep the goods, rather

than return them. This results in an allowance of $60 ($300 x 20%). When a periodic inventory

system is used, the credit will also be recorded in the

purchase returns and allowances account as shown in

Figure 7A.5.

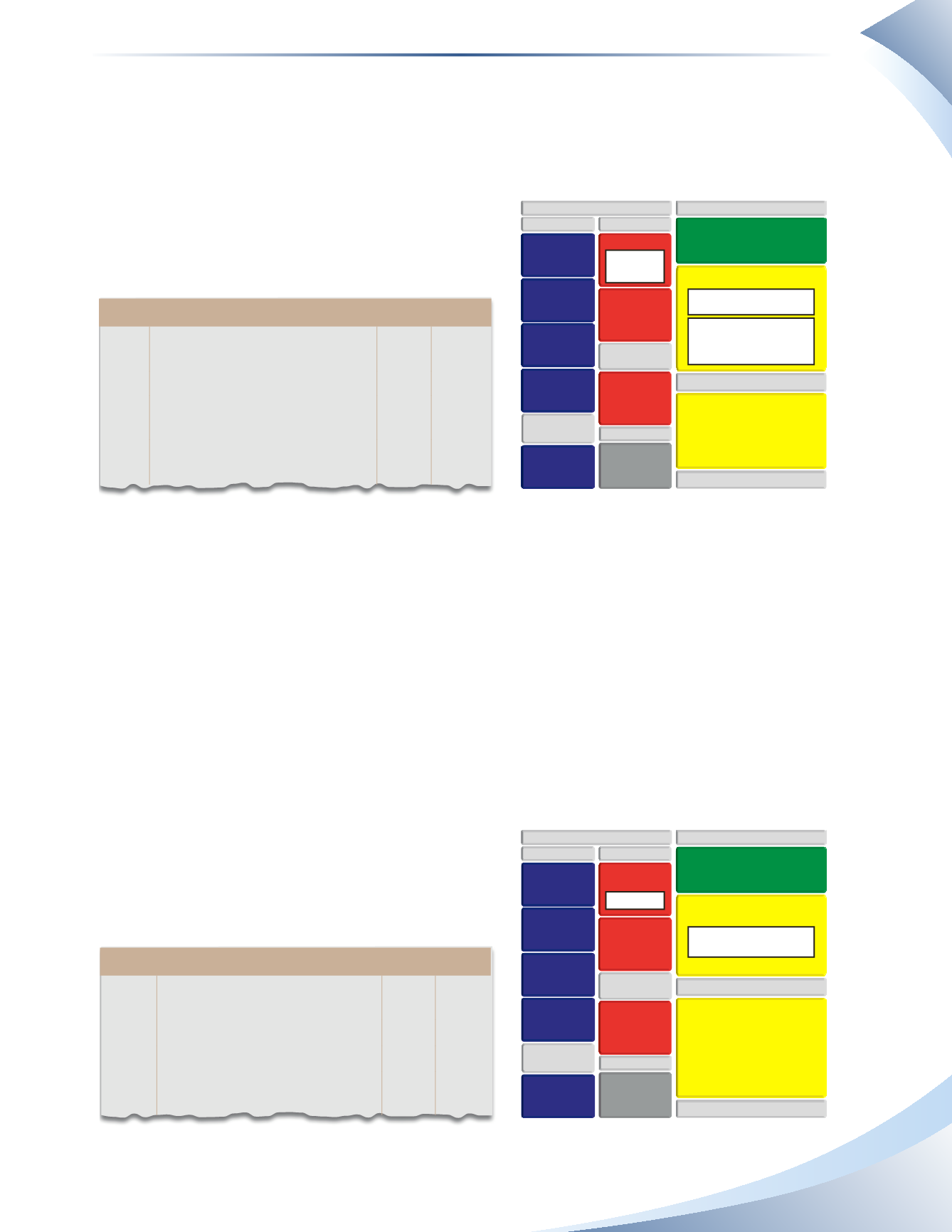

Purchase Discounts

The supplier may offer credit terms and a discount period to encourage early payments. In a periodic

inventory system, the amount of the discount is credited to another contra expense to purchases

called

purchase discounts

.This is another account that is part of cost of goods sold. By crediting

this account, instead of simply crediting the inventory account as in the perpetual inventory system,

management is able to track the amount it is saving by paying suppliers within the discount period.

We will now show the journal entries for both the purchase and payment from Tools 4U who

bought goods from Roofs and More in the amount of $4,200 on January 10. The supplier allows

2/10, n/30 on all invoices. Since Tools 4U had excess cash at this time, the manager chose to take

advantage of the cash discount by paying the invoice within 10 days.

The original entry for the purchase is shown in Figure

7A.6.

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 5 Accounts Payable

60

Purchase Returns and

Allowances

60

Record purchase allowance for a

supplier

____________

fIGuRe 7A.5

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

CURRENT ASSETS

CASH

INVENTORY

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

LONG-TERM

ASSETS

ACCOUNTSPAYABLE

BANK LOAN

CURRENTLIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

OWNER’S EQUITY

OWNER’S

CAPITAL

OPERATING INCOME

PURCHASES

$10,000 DR

PURCHASE RETURNS

& ALLOWANCES

+ $300 CR

+ $60 CR

$10,000 CR

– $300 DR

– $60 DR

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 10 Purchases

4,200

Account Payable

4,200

Purchase of goods from Roofs and

More

____________

fIGuRe 7A.6

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

CURRENT ASSETS

CASH

INVENTORY

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

CURRENTLIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

OWNER’S EQUITY

OWNER’S

CAPITAL

OPERATING INCOME

PURCHASES

+$4,200 DR

+$4,200 CR