Chapter 7

Inventory: Merchandising Transactions

189

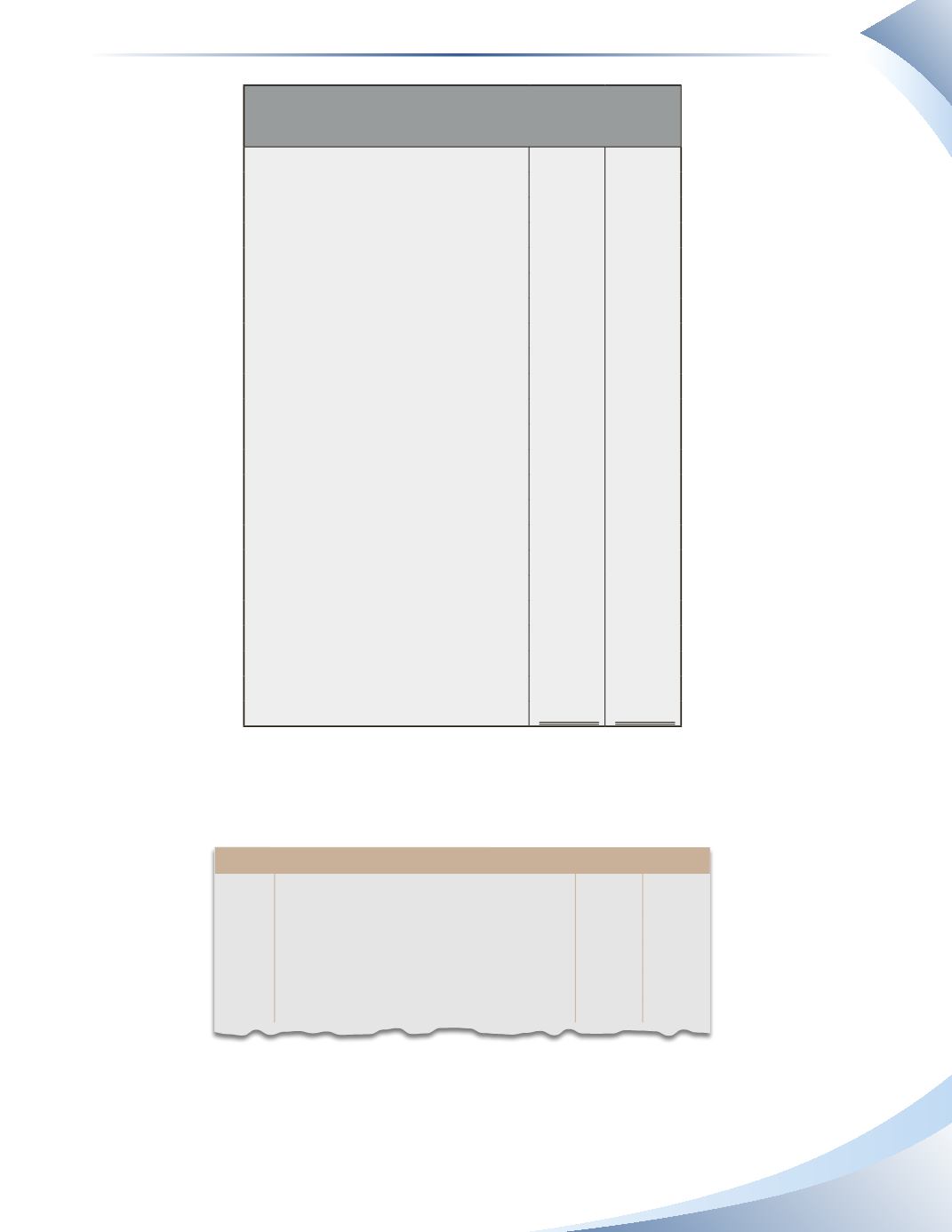

tools 4u

adjusted trial Balance

december 31, 2016

account titles

dr

Cr

Cash

$25,000

Accounts Receivable

18,000

Inventory

45,000

Prepaid expenses

12,000

equipment

180,000

Accumulated Depreciation

$60,000

Accounts Payable

34,000

unearned Revenue

8,000

Bank Loan

100,000

Sanders, Capital

48,000

Sales Revenue

200,000

Interest Revenue

8,000

Sales Returns & Allowances

4,000

Sales Discounts

2,000

Cost of Goods Sold

100,000

Depreciation expense

5,000

Interest expense

4,000

Rent expense

10,000

Salaries expense

40,000

Supplies expense

7,000

utilities expense

6,000

total

$458,000 $458,000

______________

fIGuRe 7.23

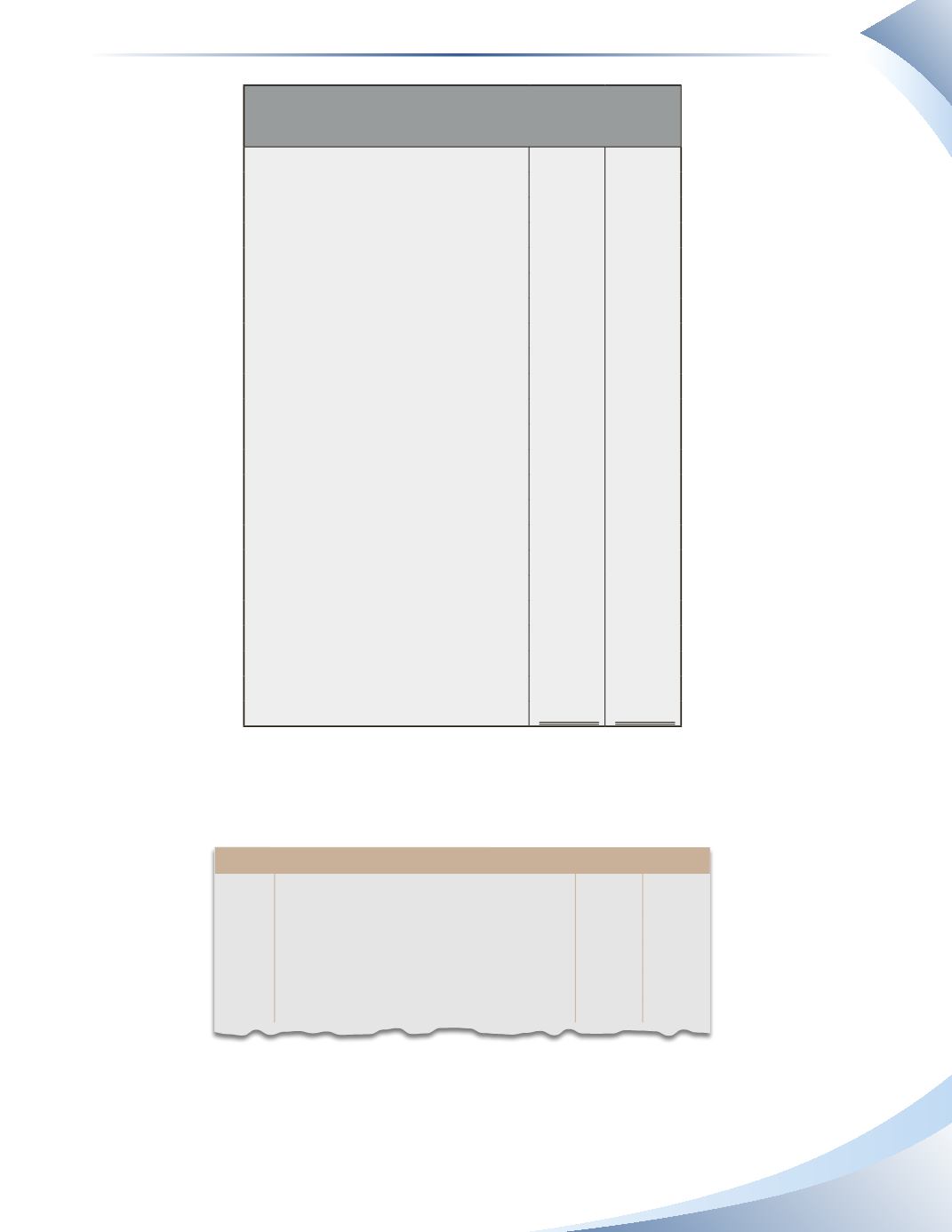

The steps to close the books of a merchandising company are similar to closing a service company.

Step 1 is to close the revenue account, as shown in Figure 7.24.

Journal

Page 1

date

2016

account title and explanation

debit Credit

Jan 31 Sales Revenue

200,000

Interest Revenue

8,000

Income Summary

208,000

Close revenue accounts

______________

fIGuRe 7.24

Step 2 is to close expenses. In this step, we will also close the two contra-revenue accounts (sales

returns and allowances and sales discounts) because they have debit balances like the rest of the

expense accounts.