208

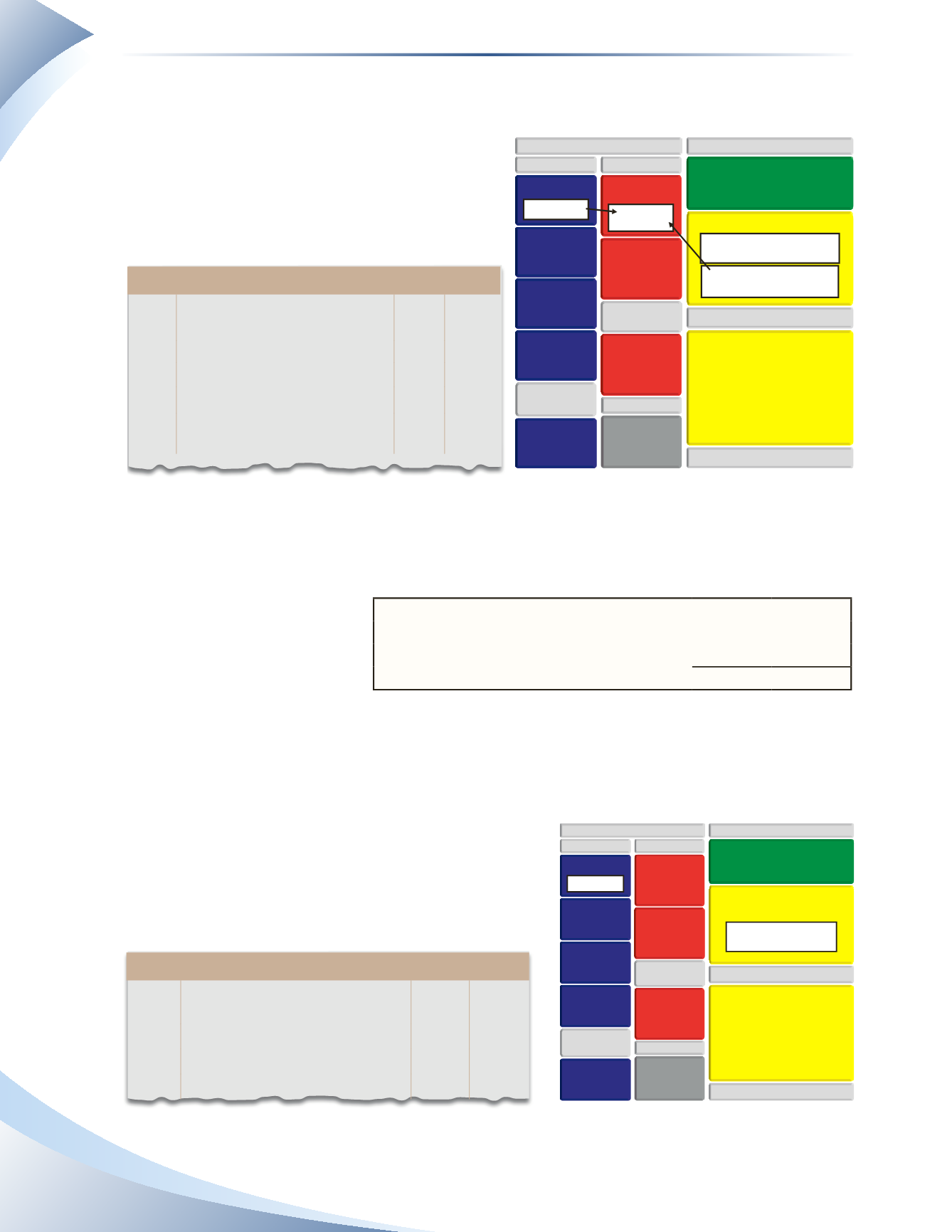

The payment amount for the bill would be $4,200 less the $84 discount ($4,200 × 2%). Since the

business is paying less for the purchases of

inventory, the value of the purchase must decrease

by the discount amount. The entry to record the

discount when the payment was made to Roofs

and More on January 12 is shown in Figure 7A.7.

Both purchase returns and allowances and purchase discounts are known as contra accounts as they

have the opposite balance to the account they are related to.They reduce the balance of purchases

when reported on the financial statements.

From the above journal entries,

the amount of net purchases is

determined in Figure 7A.8.

Freight-In and Freight-Out

In a periodic inventory system, shipping charges on inventory shipped FOB shipping point is

recorded by the purchaser debiting the

freight-in

account which is an income statement account

that is part of cost of goods sold. Similarly, the shipping charges on inventory that is shipped

FOB destination are recorded by the seller by debiting

the

freight-out

account. Assume Tools 4U paid $100

freight cost for the inventory on January 10, the journal

entry is shown in Figure 7A.9.

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 12 Accounts Payable

4,200

Cash

4,116

Purchase Discounts

84

Paid invoice owing to Roofs and More

less discount for early payment

___________

fIGuRe 7A.7

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

CURRENT ASSETS

CASH

INVENTORY

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

CURRENT LIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

OWNER’S EQUITY

OWNER’S

CAPITAL

OPERATING INCOME

PURCHASES

+$4,200 DR

PURCHASE DISCOUNTS

+$84 CR

$4,200 CR

– $4,200 DR

+ $4,116 CR

Purchases

$14,200

Less: Purchase Returns and Allowances

$360

Purchase Discounts

84

444

Net Purchases

$13,756

______________

fIGuRe 7A.8

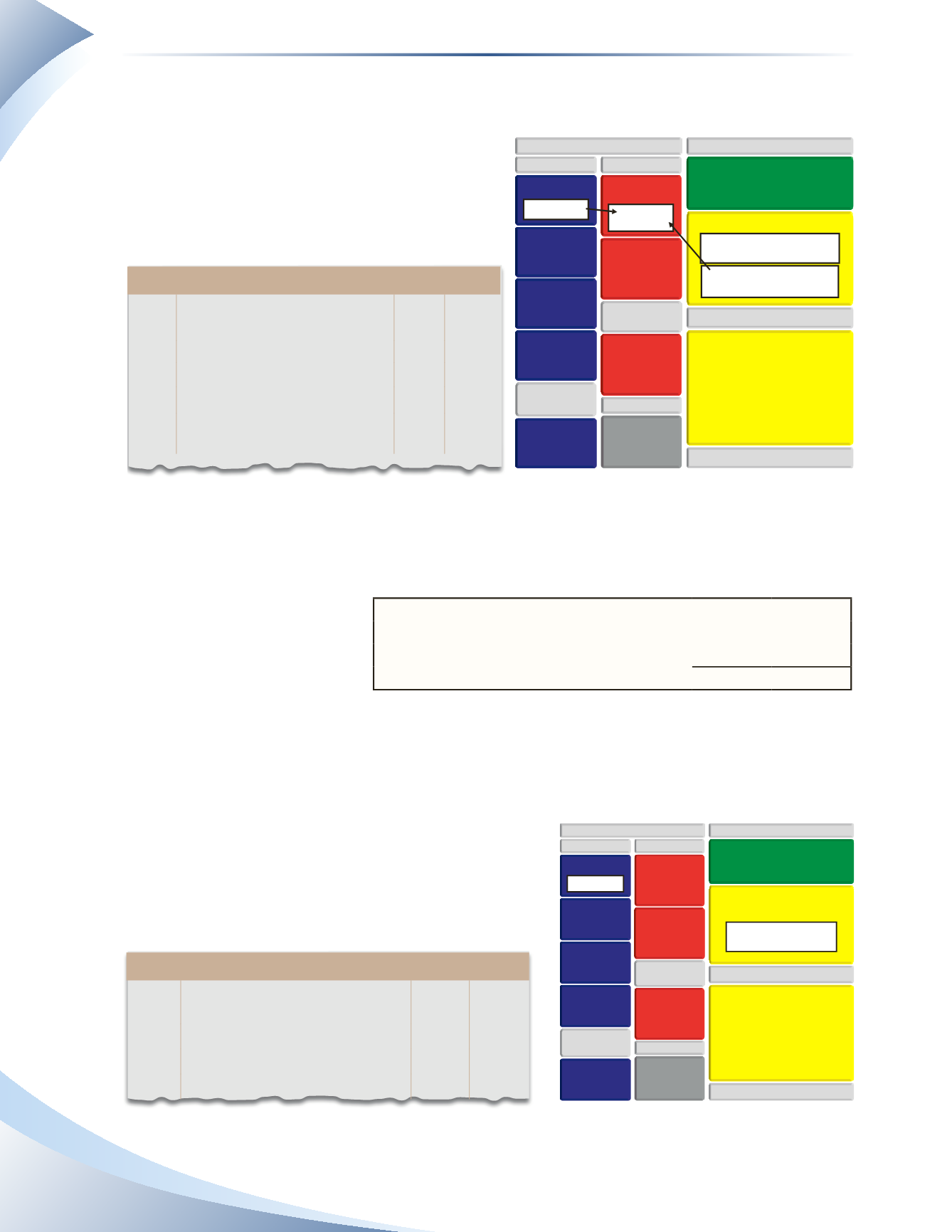

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

CURRENTASSETS

CASH

INVENTORY

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

PROPERTY,PLANT

&EQUIPMENT

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

CURRENTLIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

OWNER’SEQUITY

OWNER’S

CAPITAL

OPERATING INCOME

FREIGHT-IN

+ $100 DR

– $100 CR

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 10 freight-In

100

Cash

100

Record the payment of freight cost

____________

fIGuRe 7A.9

Inventory: Merchandising Transactions

Chapter 7

Appendix