209

sales

The major difference between the periodic and perpetual system occurs at the point of sale. Unlike

the perpetual system which immediately records cost of goods sold when revenue from the sale

of inventory is recognized, the periodic system calculates cost of goods sold at the end of the

period when ending inventory is determined with a physical count. Assuming inventory is sold on

account, the entry should be recorded by debiting accounts receivable and crediting revenue.

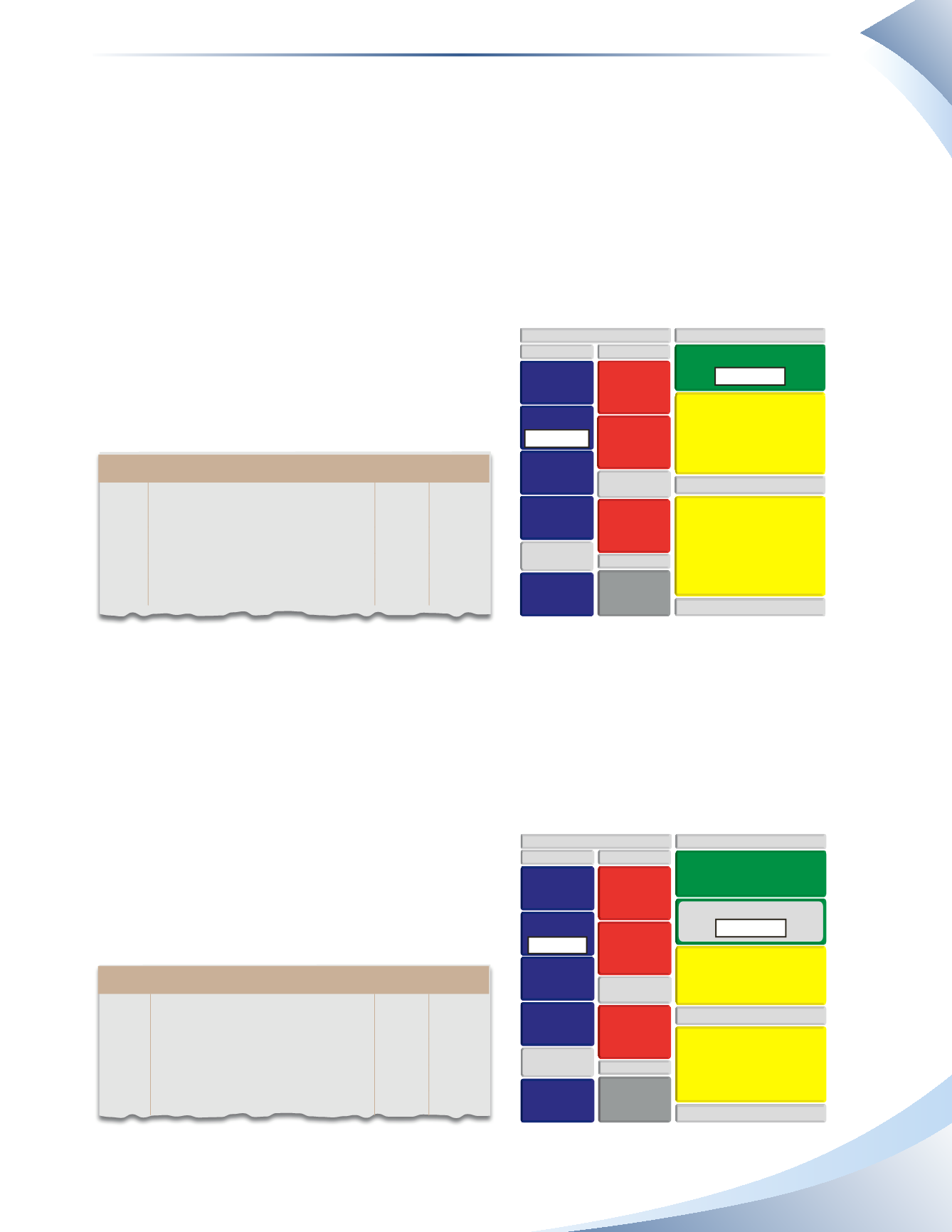

Assume Tools 4U sold $13,000 of goods for $20,000 on January 15. In a periodic system, this

transaction would be recorded as in Figure 7A.10.

The entry is recorded by debiting accounts receivable

and crediting sales. The cost of goods sold and

inventory accounts are not updated immediately.

Instead, they will be updated at the end of the period

when the physical count is taken.

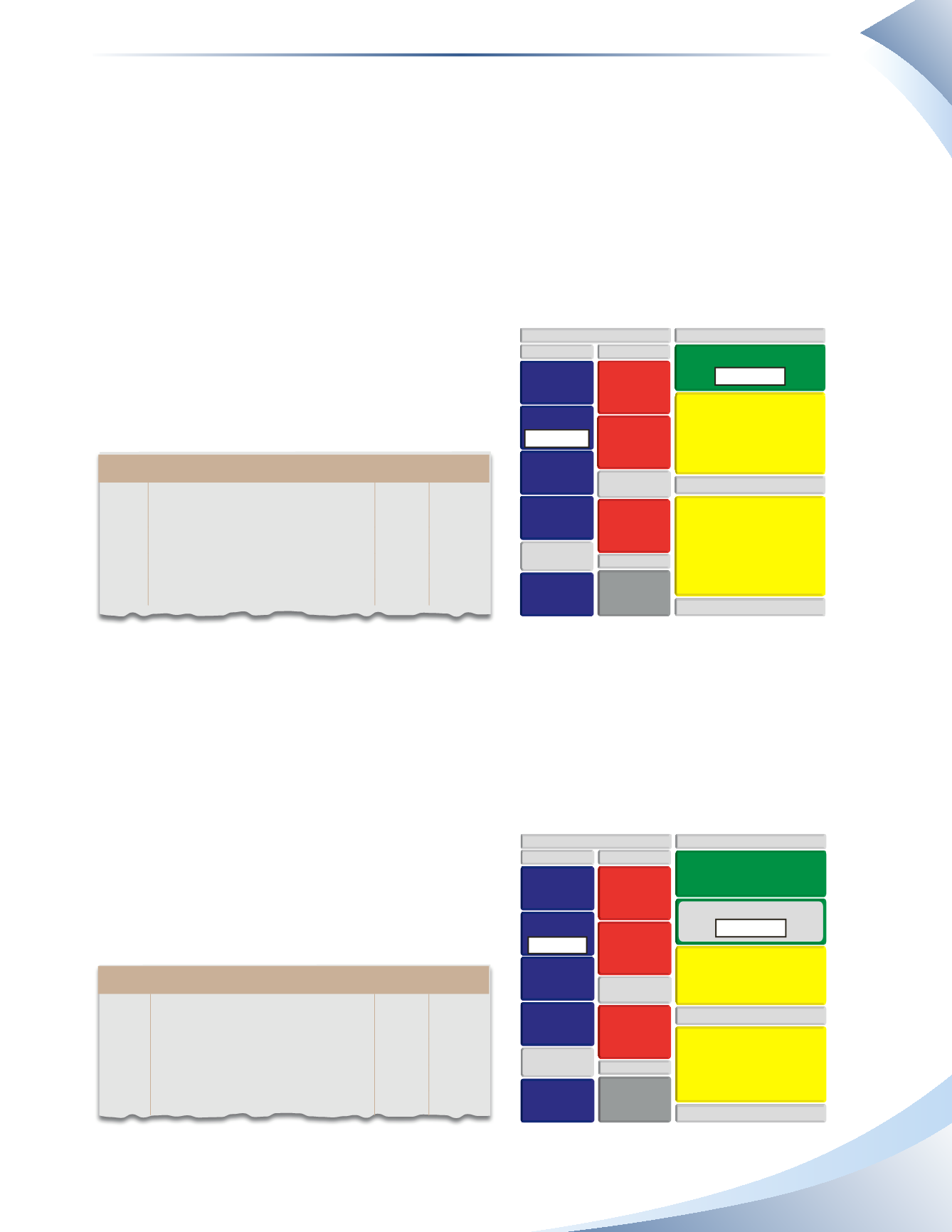

Sales Returns

If a customer returns goods, in a periodic inventory system, only one journal entry is required

to record the sales return and credit the amount owing from the customer (assuming the goods

were sold on account).The journal entry for a return of $4,000 worth of goods by a customer on

January 16 is shown in Figure 7A.11.

The entry is recorded by debiting sales returns and

allowances and crediting accounts receivable. Unlike

the perpetual inventory system, the cost of goods sold

and inventory are not updated immediately.

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 15 Accounts Receivable

20,000

Sales

20,000

Record sales on account

____________

fIGuRe 7A.10

+ $20,000 CR

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

CURRENT ASSETS

CASH

INVENTORY

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

CURRENTLIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

OWNER’S EQUITY

OWNER’S

CAPITAL

OPERATING INCOME

+ $20,000 DR

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 16 Sales Returns and Allowances

4,000

Accounts Receivable

4,000

Record sales return

____________

fIGuRe 7A.11

SALES RETURNS & ALLOWANCES

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

CURRENT ASSETS

CASH

INVENTORY

ACCOUNTS

RECEIVABLE

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

CURRENTLIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

OWNER’S EQUITY

OWNER’S

CAPITAL

OPERATING INCOME

– $4,000 CR

+ $4,000 DR

Inventory: Merchandising Transactions

Chapter 7 Appendix