Chapter 1

Financial Statements: Personal Accounting

16

Even though your cash decreased by $500 when you made a payment to reduce the loan, your net

worth decreased by $400 as a result of the expense.

Buying and Selling Assets

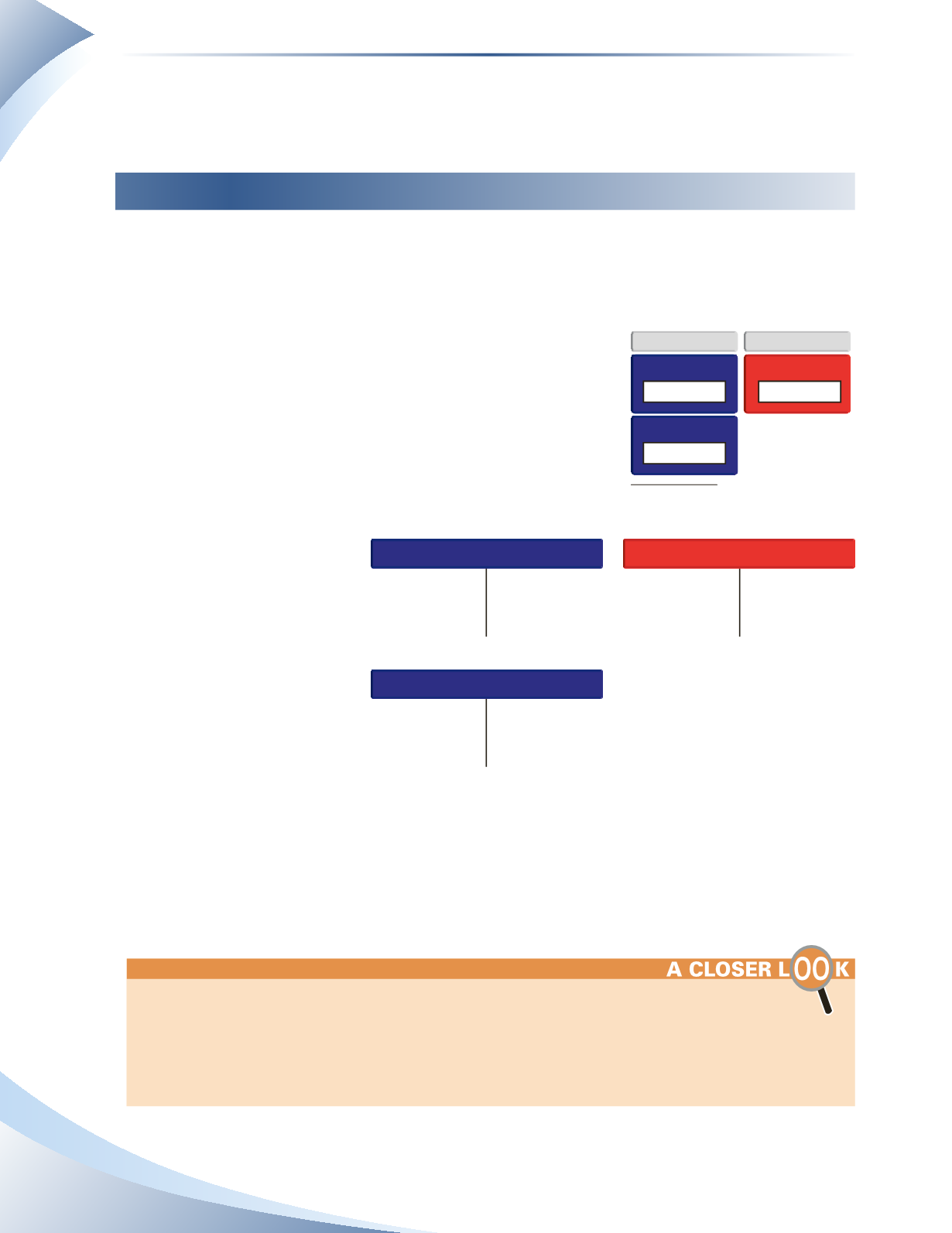

Buying or selling assets (according to the value stated in the balance sheet) has no

impact on net

worth. For example, you purchase a new car for $10,000; pay $3,000 cash and take a loan from the

bank for the remaining $7,000.

The cash used to purchase the car is just an exchange of one asset

for another (cash for the car), so there is no change in net worth.

The loan is borrowed to pay for the car, so the liability increases

as does the asset (car). Again there is no change in net worth.The

affect on the accounts is shown in Figure 1.29. Although you now

own a $10,000 car, there has been no change in your net worth.

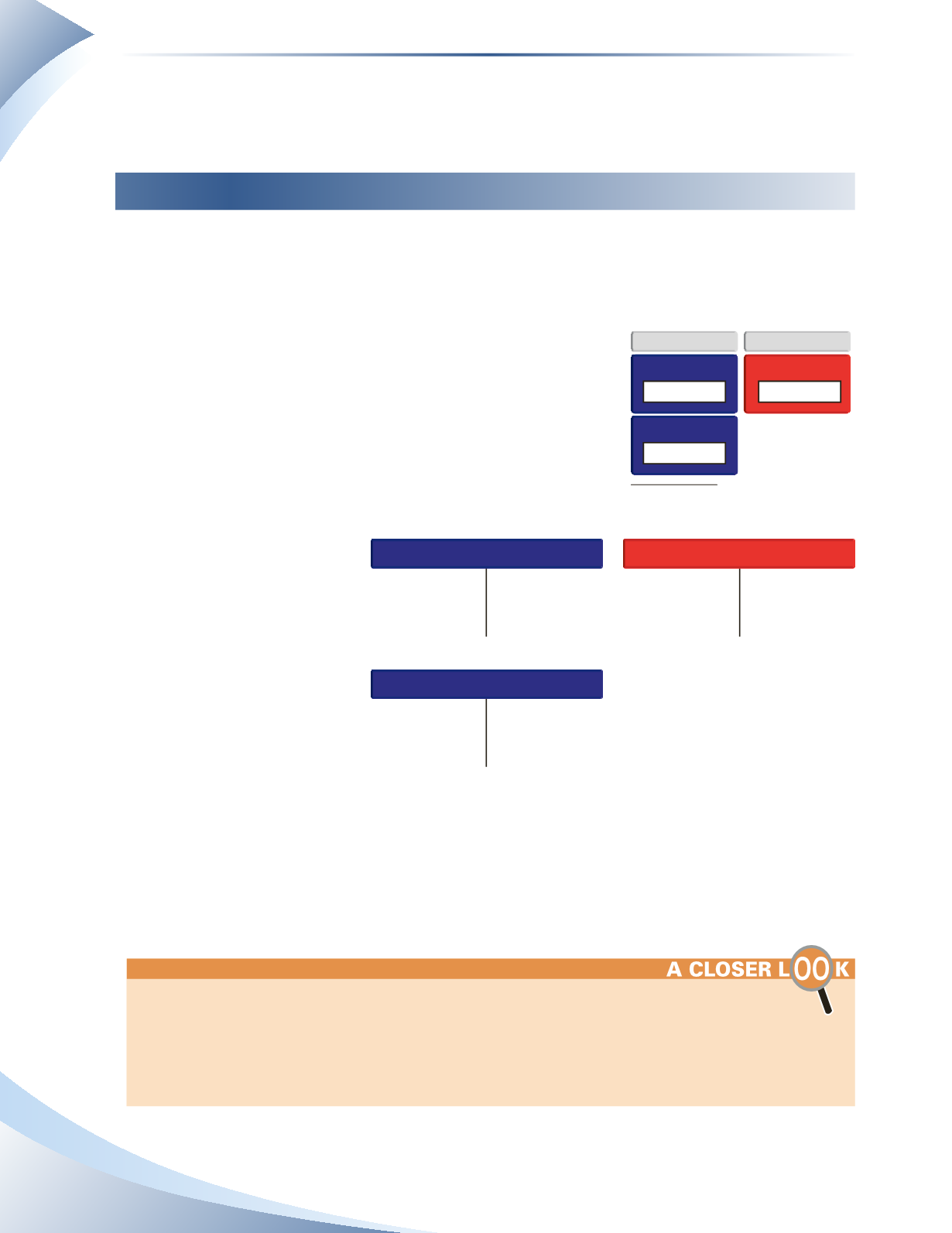

The transactions would appear

on the T-accounts as shown

in Figure 1.30. Cash decreases

by $3,000 and your loan

increases by $7,000. In the

end, you have an increase to

your automobile account for

$10,000.

If you exchange cash for

an item, how do you know

whether the item should be

considered an asset or an

expense? Typically, it is a question of how long it will provide a benefit to you and the cost of the

item. The $10,000 car that was just purchased is an asset because it will benefit you for several

years. On the other hand, spending $200 on food or entertainment would be an expense since

they will only benefit you for a short period of time.

Over time, the assets you own will change in value based on usage and changes in the market.

The car you purchased for $10,000 will not always be worth that amount. After several years of use,

it will be worth less than what you paid for it. Your house on the other hand may increase in value if

you maintain it and the area you live in is desirable. On personal financial statements, there are no rules

preventing you from changing the values of these assets as the market values change. In business,

though, there are strict rules on how values of assets are recorded. This will be covered in later chapters.

ASSETS

LIABILITIES

AUT

CASH

OMOBILE

+ $10,000

- $3,000

FIGURE 1.29

LOAN

+ $7,000

+

+

CASH

AUTOMOBILE

-

-

INCREASE

INCREASE

DECREASE

DECREASE

-

LOAN

+

DECREASE

INCREASE

3,000

10,000

No change in net worth

7,000

______________

FIGURE 1.30