Chapter 10

Cash Controls

314

Petty Cash Controls

Using petty cash funds can be a convenient way to purchase small items. However, the funds also

provide opportunities for abuse. It is therefore important to regulate the use of the petty cash fund

to ensure that it is not mishandled.Here are a few tips to ensure that petty cash is used appropriately.

1.

Establish guidelines.

The first step in ensuring that your petty cash is used properly is to draw

up a list of items that can be purchased with petty cash. Determine what purchases may be

made with purchase orders, and then make a list of other types of regular purchases.The fund

should be reserved strictly for small (“petty”) expenses and not for items such as long-term

assets or inventory, or for paying accounts payable and independent contractors.

2.

Maintain documentation.

It is difficult to keep accurate records unless you have a uniform

documentation system. Establish an easy-to-use system and follow it consistently.The easiest way

to do this is by keeping track of all receipts, whether they are register receipts or written invoices.

Each receipt should have the date of purchase, the name of the vendor, a list of the items or services

purchased, the price of each item and the total cost. Accurate recordkeeping also requires that

• the person who made the purchase signs the receipt

• all receipts are filed correctly so they can be checked for discrepancies

3.

Review the rules with employees.

If the regulations are not well known, abuse of the petty

cash fund becomes easier. Keep everyone up-to-date and do not allow exceptions to the rules.

4.

One person should be responsible for petty cash—the petty cash custodian.

The

appointment of one person to administer and be exclusively responsible for the fund limits

the opportunities for mismanagement.

5.

Periodically count the petty cash fund.

Have a person independent from the petty cash

custodian, such as a manager, count the fund with the custodian present.This discourages

misuse of the funds and can detect shortages early.

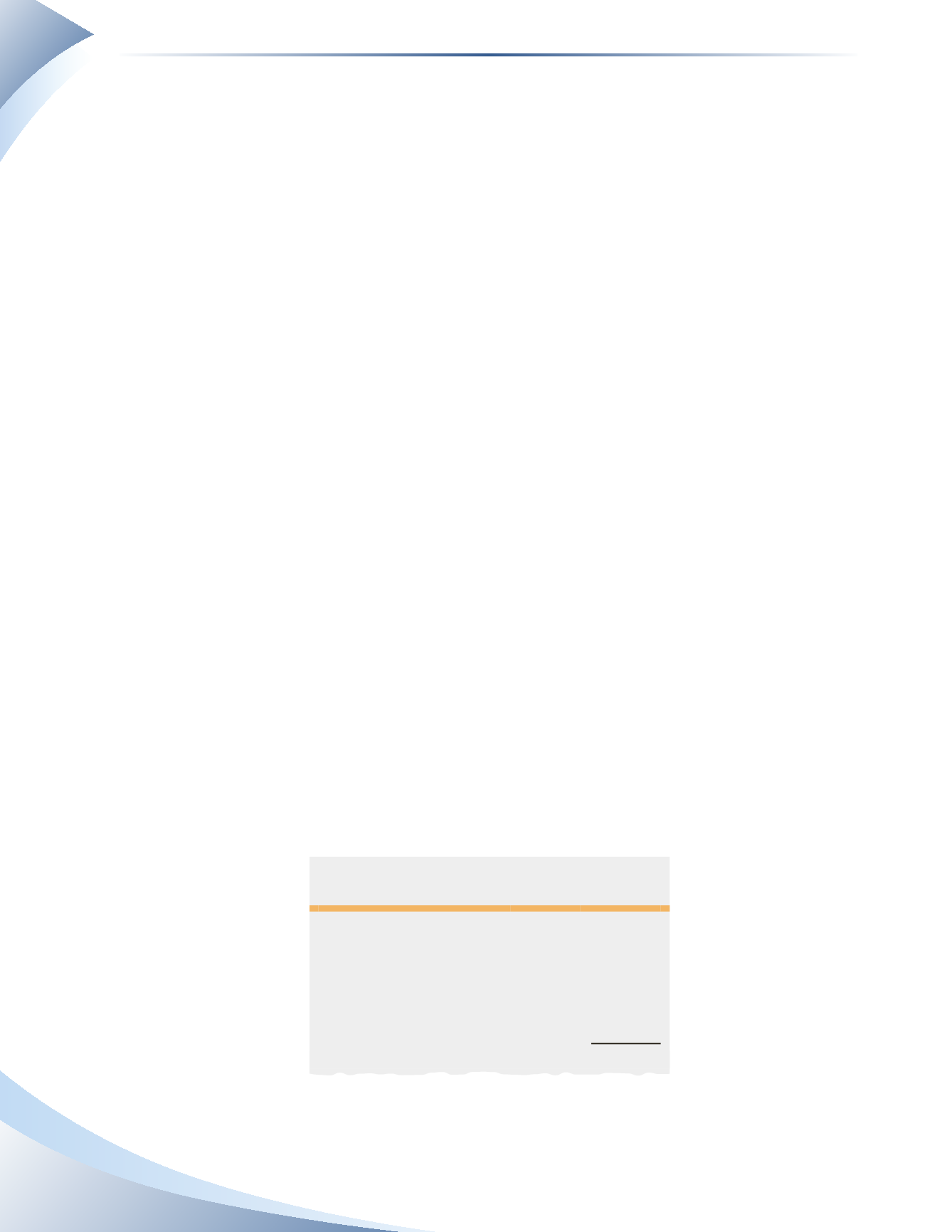

This chapter discusses cash equivalents and petty cash as separate functions within a business. At

this point, we can look at the impact of these two items and how they affect the balance sheet and

its presentation. Figure 10.35 shows a partial balance sheet of Donatello’s restaurant.

Donatello’s restaurant

Balance sheet

as at December 31, 2016

assets

Current assets

Cash and cash equivalents

Bank account—chequing

$13,220

Bank account—savings

4,700

Petty cash fund

300

Cash equivalents

6,500

total cash and cash equivalents

$24,720

_______________

FIGURE 10.35