Chapter 10

Cash Controls

304

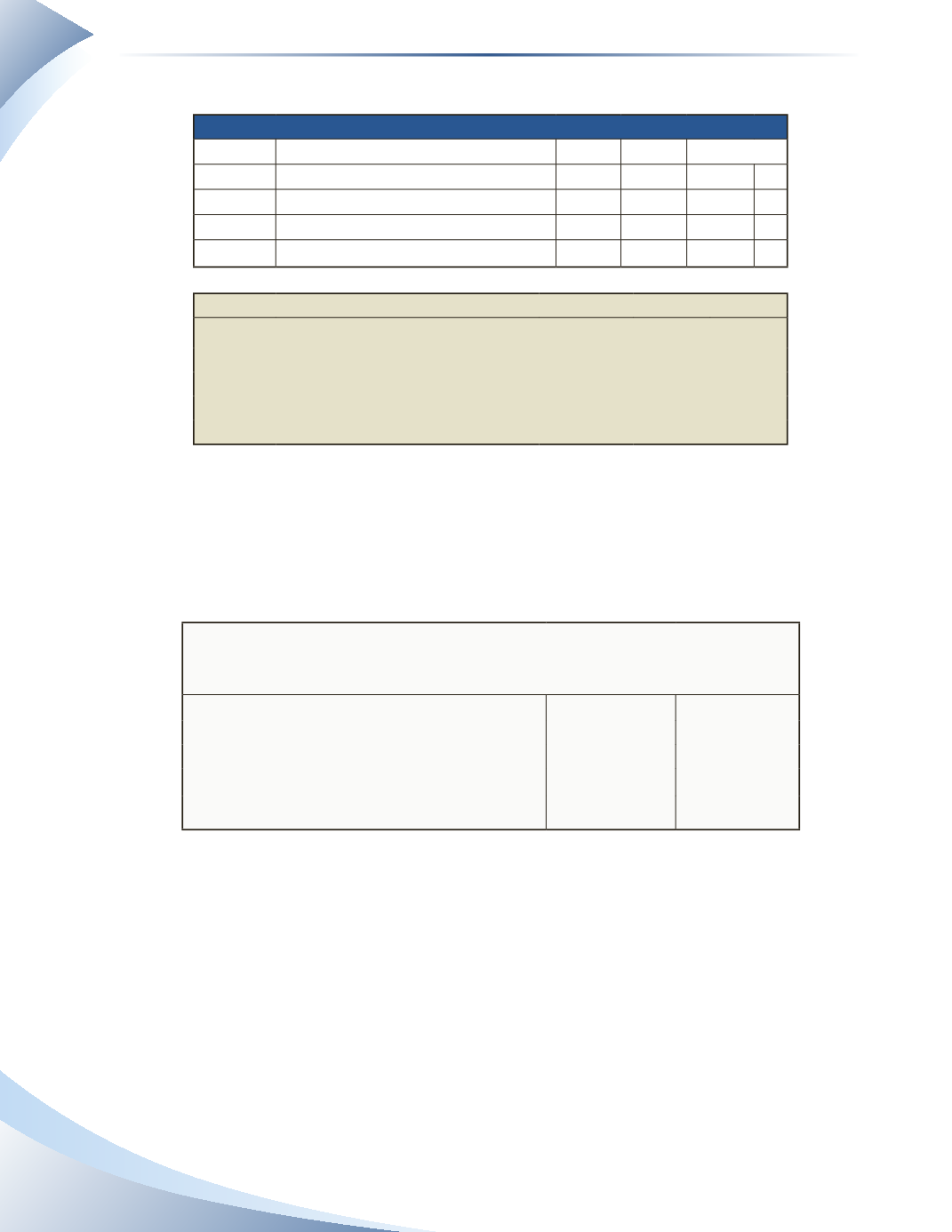

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

DR CR

Balance

Jun 1 Opening Balance

5,000 DR

Jun 2 Cheque #1

300 4,700 DR

Jun 3 Cheque #2

950 3,750 DR

Jun 10 Cheque #3

700 3,050 DR

Bank Statement

June 1–June 30, 2016

Date

Description

Withdrawal Deposit Balance

Jun 1 Opening Balance

5,000

Jun 2 Cheque #1

300

4,700

Jun 3 Cheque #2

590

4,110

Jun 10 Cheque #3

700

3,410

______________

Figure 10.20

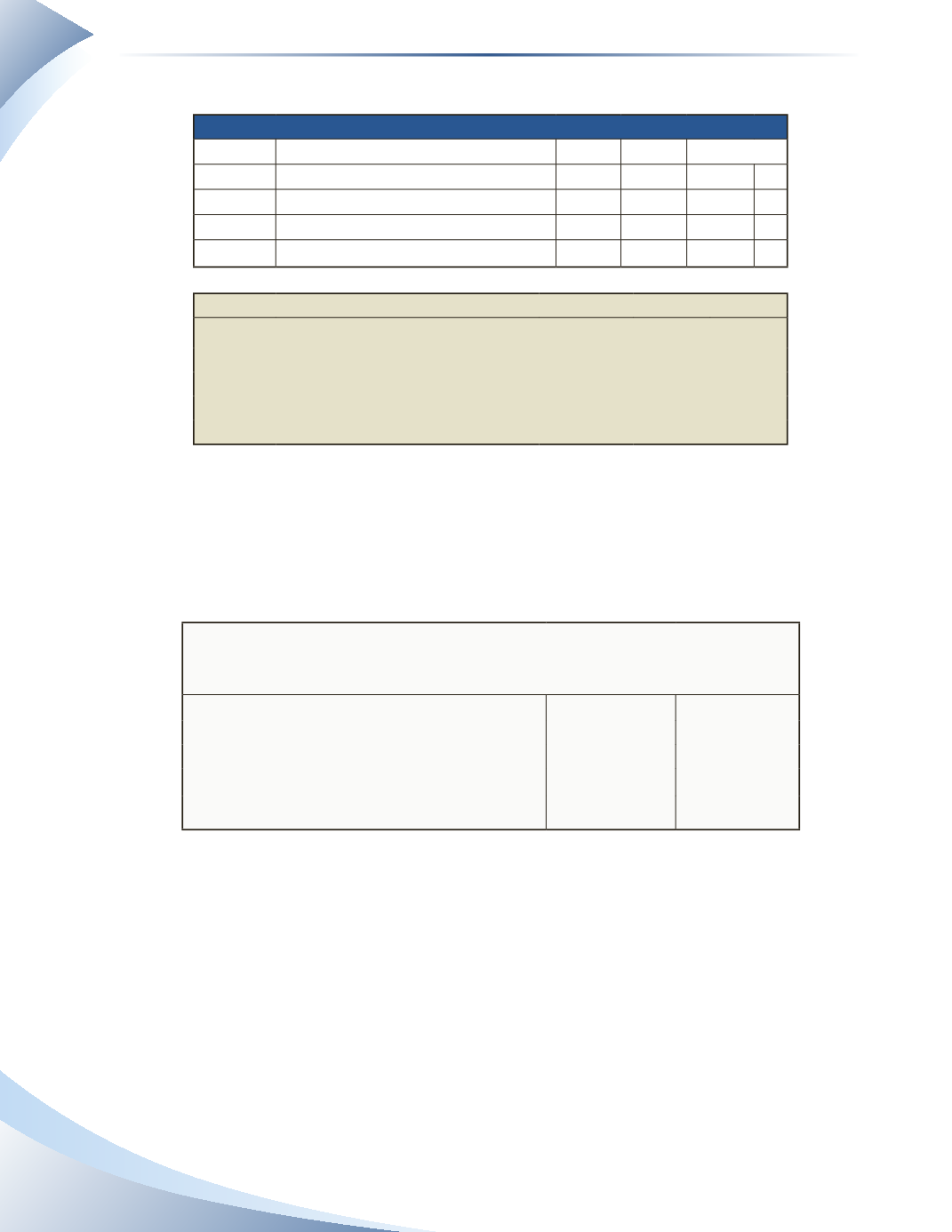

In this situation, more was deducted from the general ledger than was on the cheque. To correct

this error, the bookkeeper will have to add to the general ledger the difference between what was

recorded and the actual amount deducted by the bank. This amounts to $360 ($950 − $590). The

bank reconciliation would appear as shown in Figure 10.21.

HR Clothing

Bank Reconciliation

June 30, 2016

Ledger

Bank

Balance as per records

$3,050

$3,410

Recording error

Add:

Error on cheque #2

360

Reconciled balance

$3,410

$3,410

______________

Figure 10.21

Because the correcting entry is in the ledger column, an adjusting entry must be recorded in the

journal. Assuming the original cheque was written to purchase inventory by using a perpetual

method, the journal entry to correct the ledger is shown in Figure 10.22.