Chapter 10

Cash Controls

306

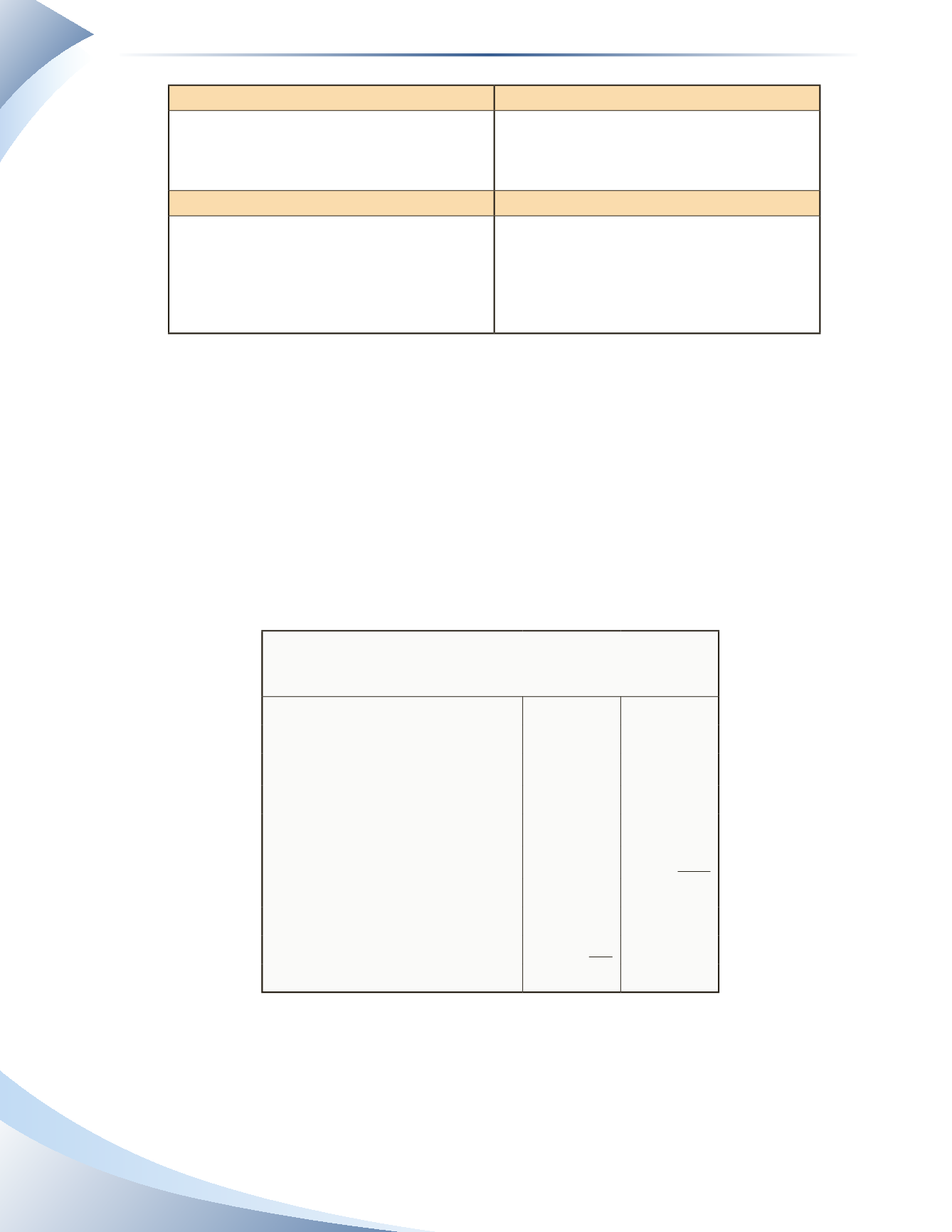

Add to Ledger Balance*

Add to Bank Balance

• Interest earned

• Direct deposit from customer

• Receipts through EFT

• Bookkeeper error

• Outstanding deposits

• Bank error

Subtract from Ledger Balance*

Subtract from Bank Balance

• Loan interest charges

• Repayment of bank loan

• Bank service charges

• Payments through EFT

• NSF cheques

• Bookkeeper error

• Outstanding cheques

• Bank error

*Must also create a journal entry to update the ledger balance.

______________

Figure 10.23

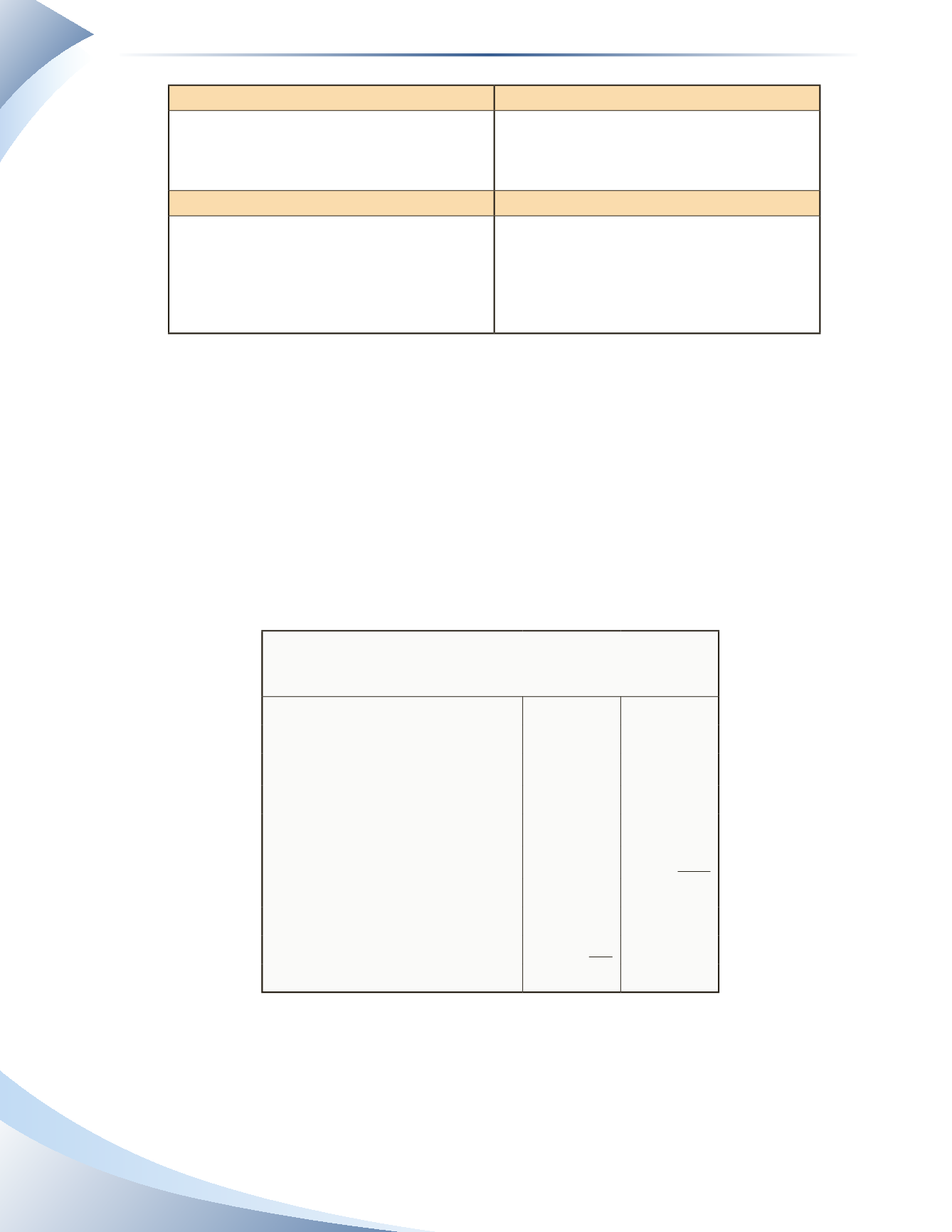

To illustrate, we will complete a bank reconciliation with journal entries for HR Clothing for the

month of October 2016. Before comparing the new items, it is always important to consider the

outstanding items from the last period. We need to ensure these items have been cleared. The

completed bank reconciliation from September is shown in Figure 10.24. There are three items

in the bank column that are outstanding as of September 20, 2016: the deposit for $2,200 and

cheques #57 and #59. It is likely that these will clear the bank in October and must be compared

to the October bank statement. If they appear on the bank statement, we will check the items on

the September bank reconciliation and the October bank statement.

HR Clothing

Bank Reconciliation

September 30, 2016

Ledger

Bank

Balance as per records

$7,360

$4,930

Add: Outstanding Deposit

3

2,200

Less: Outstanding Cheques

Cheque #57

3

(350)

Cheque #59

3

(480)

Add: EFT Deposit

250

Less: EFT Rent

(1,300)

Service Charge

(10)

Reconciled Balance

$6,300

$6, 300

______________

Figure 10.24