Chapter 10

Cash Controls

312

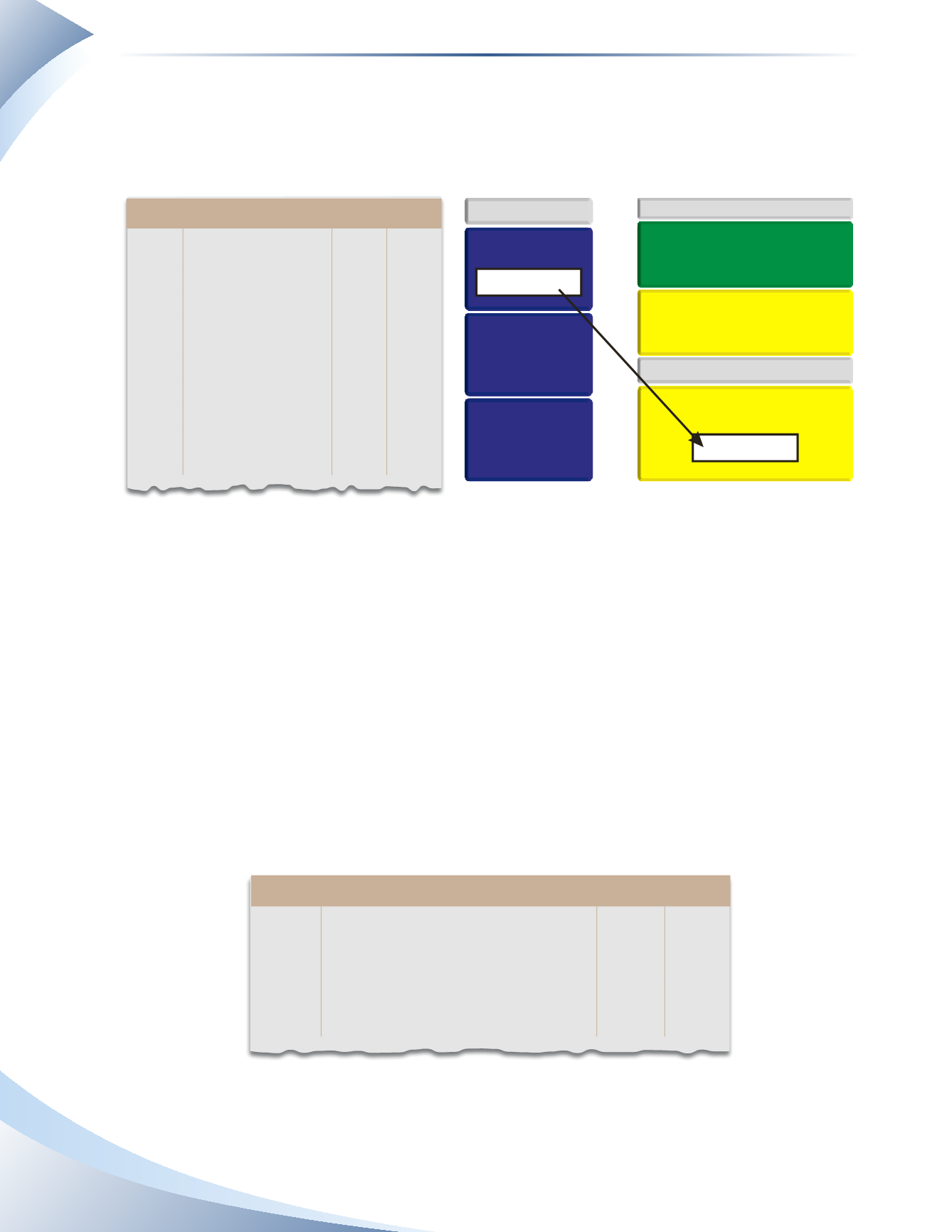

The cheque is recorded with a debit to various expenses (parking, delivery, office supplies, gasoline,

cash over and short), and a credit to cash in the amount of $85. Figure 10.31 shows this transaction.

Notice that the journal entry includes the numerous expenses. On the Accounting Map, these

expenses are listed under operating expenses on the income statement.

Journal

Page 1

Date

2016

account title and

explanation

Debit Credit

Dec 17 Parking Expense

21

Delivery Expense

24

Office Supplies

Expense

20

Gasoline Expense

18

Cash Over and Short

2

Cash

85

Replenish the petty

cash fund

______________

FIGURE 10.31

INVENTORY

ASSETS

CASH

PETTY CASH

–$85 CR

INCOME STATEMENT

GROSS PROFIT

SALES REVENUE

COST OF GOODS SOLD

OPERATING EXPENSES

+$85 DR

The cash over and short account behaves like an expense account when there is a shortage. It will

be debited in the journal entry. If there is an overage, the cash over and short account behaves like

a revenue account. It will be credited in the journal entry.

No change is made in the amount of the petty cash ledger account when the reimbursement

cheque is issued, and the reimbursed cash is placed in the petty cash box. You may think that the

transaction should be recorded by debiting expenses and crediting petty cash, followed by a debit

to petty cash and a credit to cash. However, in practice, when the bookkeeper records the cheque

there is no change to the petty cash account.

It is important to note that the

only

time the petty cash account in the ledger is debited or credited is

when the account is established or when the amount in the petty cash fund is increased or decreased.

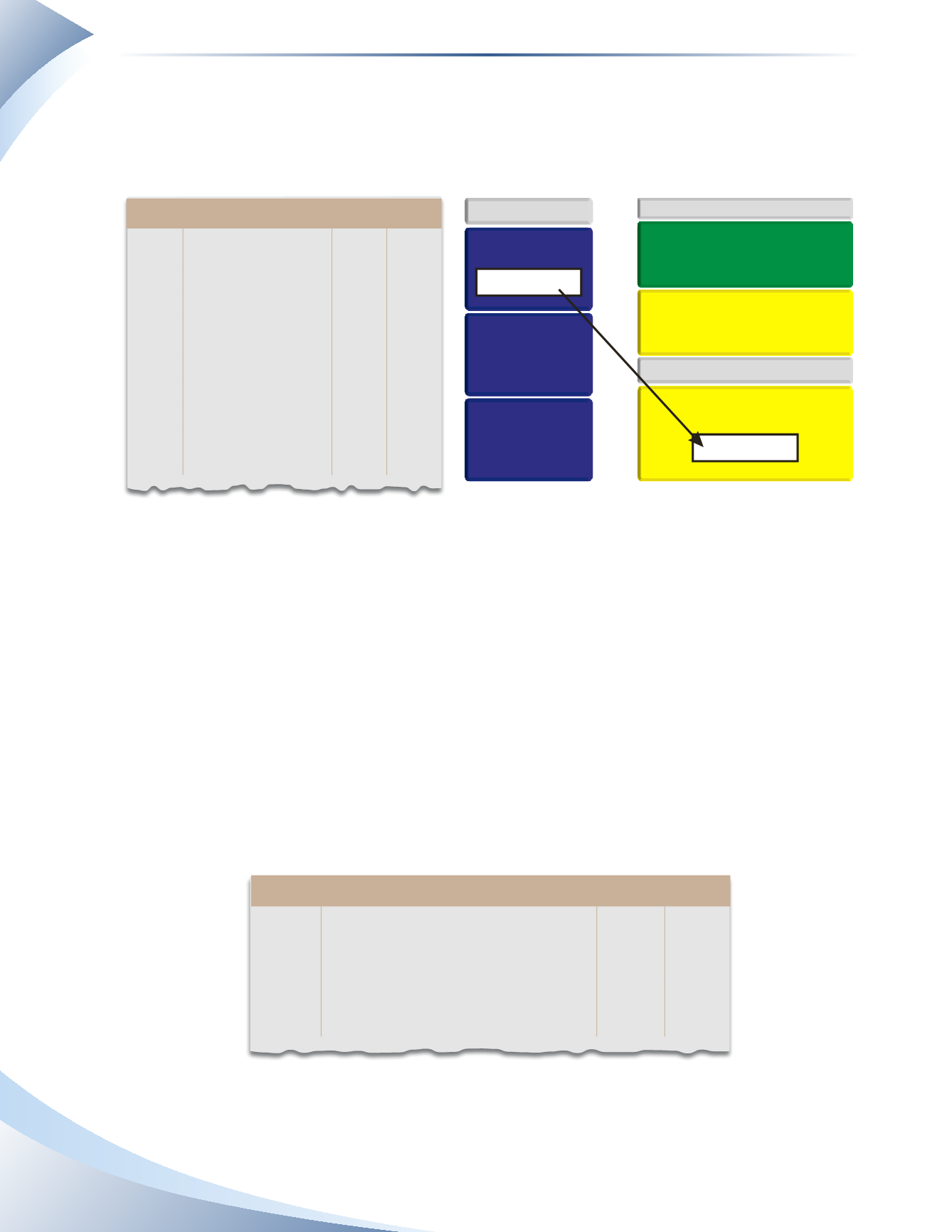

Assume that on December 31, the manager decided to increase the petty cash fund to $150. The

journal entry to record the $50 increase is shown in Figure 10.32.

Journal

Page 1

Date

2016

account title and explanation

Debit Credit

Dec 31 Petty Cash

50

Cash

50

Increase the petty cash fund

______________

FIGURE 10.32

When the petty cash fund is increased, the petty cash account should be debited (increased) and

the cash account should be credited (decreased).