Chapter 10

Cash Controls

309

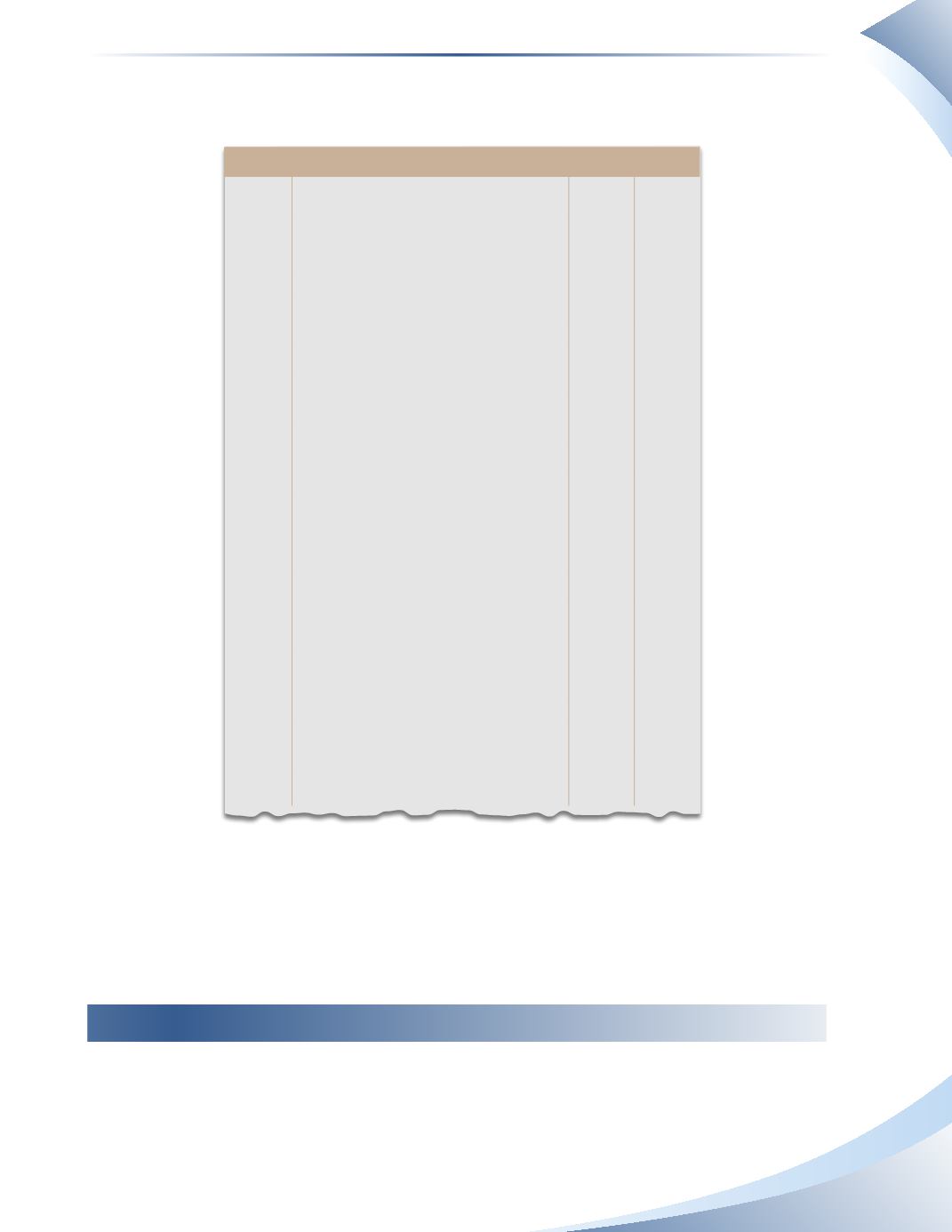

Once the bank is reconciled to the ledger, all items that increase or decrease the ledger balance

must be recorded in the journal.The journal entries are shown in Figure 10.27.

Journal

Page 1

Date

2016

account title and explanation

Debit Credit

Oct 31 Cash

300

Accounts Receivable

300

Collection from customer

Oct 31 Rent Expense

1,300

Cash

1,300

Payment for rent

Oct 31 Accounts Receivable

200

Cash

200

NSF cheque from customer

Oct 31 NSF Charges Expense

15

Cash

15

Record NSF fee

Oct 31 Bank Charges Expense

10

Cash

10

Record bank service charge

Oct 31 Advertising Expense

180

Cash

180

Correct error on cheque

______________

FIGURE 10.27

An alternate way to record the journal entries is to make compound journal entries to combine

similar transactions. For example, all transactions that credit cash could be combined into a single

transaction. Each of the debited accounts would still be listed, but there would be a single credit to

cash for $1,705.

Petty Cash

At times, a business may require small amounts of cash to pay for petty (small) expenses such as

parking, postage stamps and courier fees. Instead of issuing a cheque each time, the business will

set up a petty cash fund to pay for these small amounts in cash.