Chapter 10

Cash Controls

311

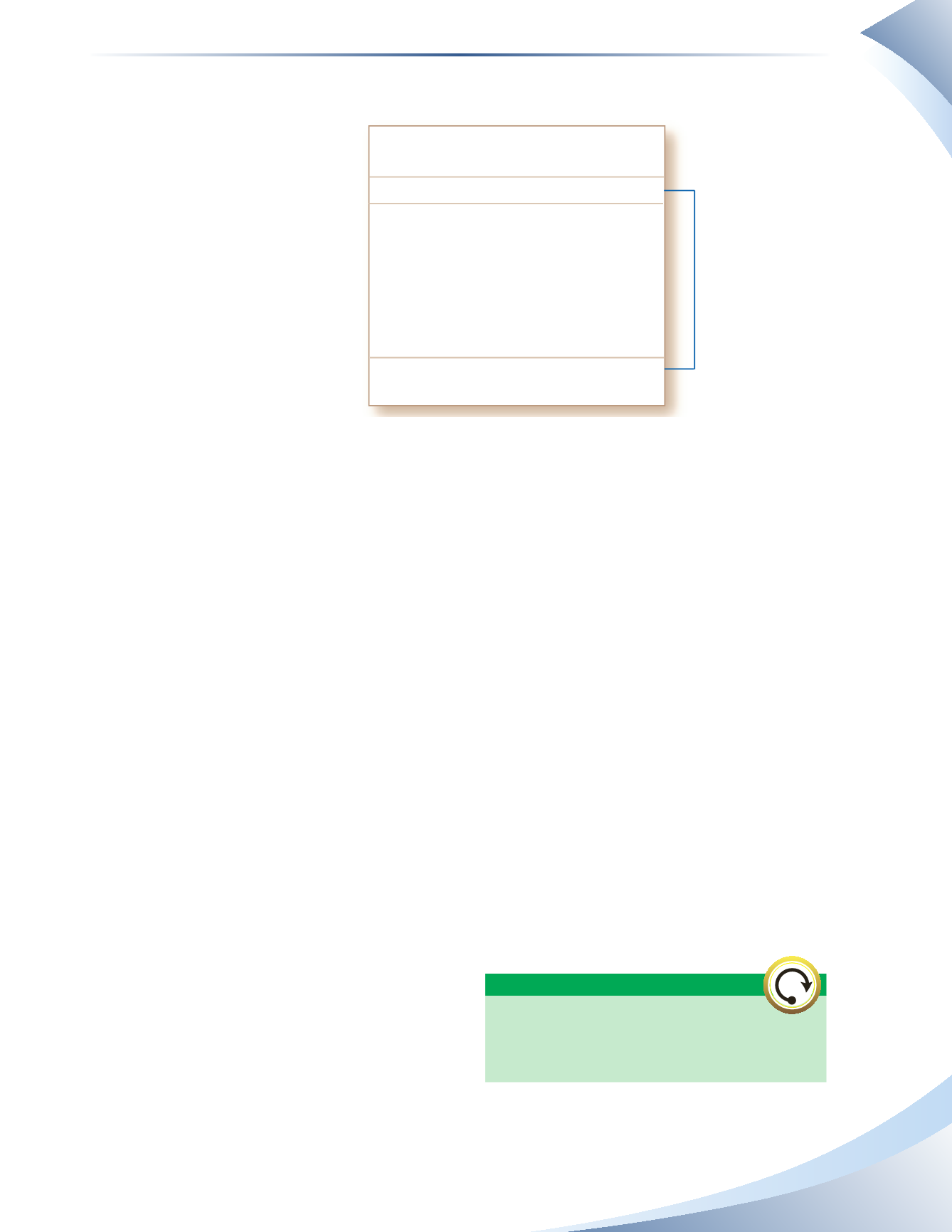

5.

Provide a summary of petty cash.

At the end of the period, which in this example is one week,

the petty cash custodian

prepares a summary that lists

the details of the fund before

it is reimbursed. The

summary sheet is shown in

Figure 10.30.

The petty cash summary

should include a list of

all the items, in groups,

paid with the petty cash

fund. Both subtotals and

a grand total should be

calculated. In this example

the grand total comes to

$83. Subtracting $83 from the original balance of $100 gives us an amount of $17.This should

be the remaining balance in the petty cash box.

6.

Reconcile any overage or shortage.

The petty cash custodian must take care of any amounts short

or over in the petty cash box.This is done by making additions or subtractions to the account called

cash over and short. In our current example, there was only $15 in the petty cash box,meaning there

was a $2 shortage. Such discrepancies can result from a miscount of coins, an overpayment during

the period, or rounding cash transactions to the nearest nickel. The total disbursements recorded,

along with any cash short or over, constitute the total amount to be reimbursed to petty cash to

restore it to its original value of $100. In this case, the amount is $85.

7.

Present summary slip to a supervisor.

The petty cash custodian presents her supervisor with

a summary slip, together with all supporting vouchers. After reviewing these documents, the

supervisor provides the petty cash custodian with a cheque to reimburse the petty cash fund.

The receipts are stamped “paid” so that they cannot be reused.

8.

Reimburse the petty cash fund.

The petty cash custodian cashes the cheque (in this example

the cheque is for $85) and replenishes the fund to its original amount ($100).

Posting Petty Cash to the General Ledger

We have examined the steps that an organization must take when establishing a petty cash fund.

Now look at how this process affects the organization’s general ledger.

We have already described the transaction that occurs

when thepetty cash fund is initially established.Cash is

credited and petty cash is debited—both for the same

amounts, which in our example was $100 as shown

in Figure 10.28. Until now, all the activity has been in

the physical petty cash box itself, with no transactions

affecting the ledger.When it is time to replenish the fund, we need to increase the amount of petty cash to

$100 and allocate the amounts used to the appropriate expense accounts.

______________

Figure 10.30

Petty Cash Summary Sheet

Period:

Dec. 10–Dec. 17

Opening Balance $100.00

Parking

Dec. 10 $10.00

Dec. 12 6.00

Dec. 14 5.00 $21.00

Delivery

Dec. 10 $18.00

Dec. 11 6.00 $24.00

Office Supplies

Dec. 13 $ 7.00

Dec. 16 13.00 $20.00

Gasoline

Dec. 14 $18.00 $18.00

Total Disbursements $83.00

Cash over and short $2.00

Total to be reimbursed to Petty Cash $85.00

Opening balance

less disbursements

FIGURE 8.26

Transferring assets from one account

(e.g. cash) to another account (e.g. petty cash)

has no impact on owner’s equity.

WORTH REPEATING