Chapter 12

Using Accounting Information

362

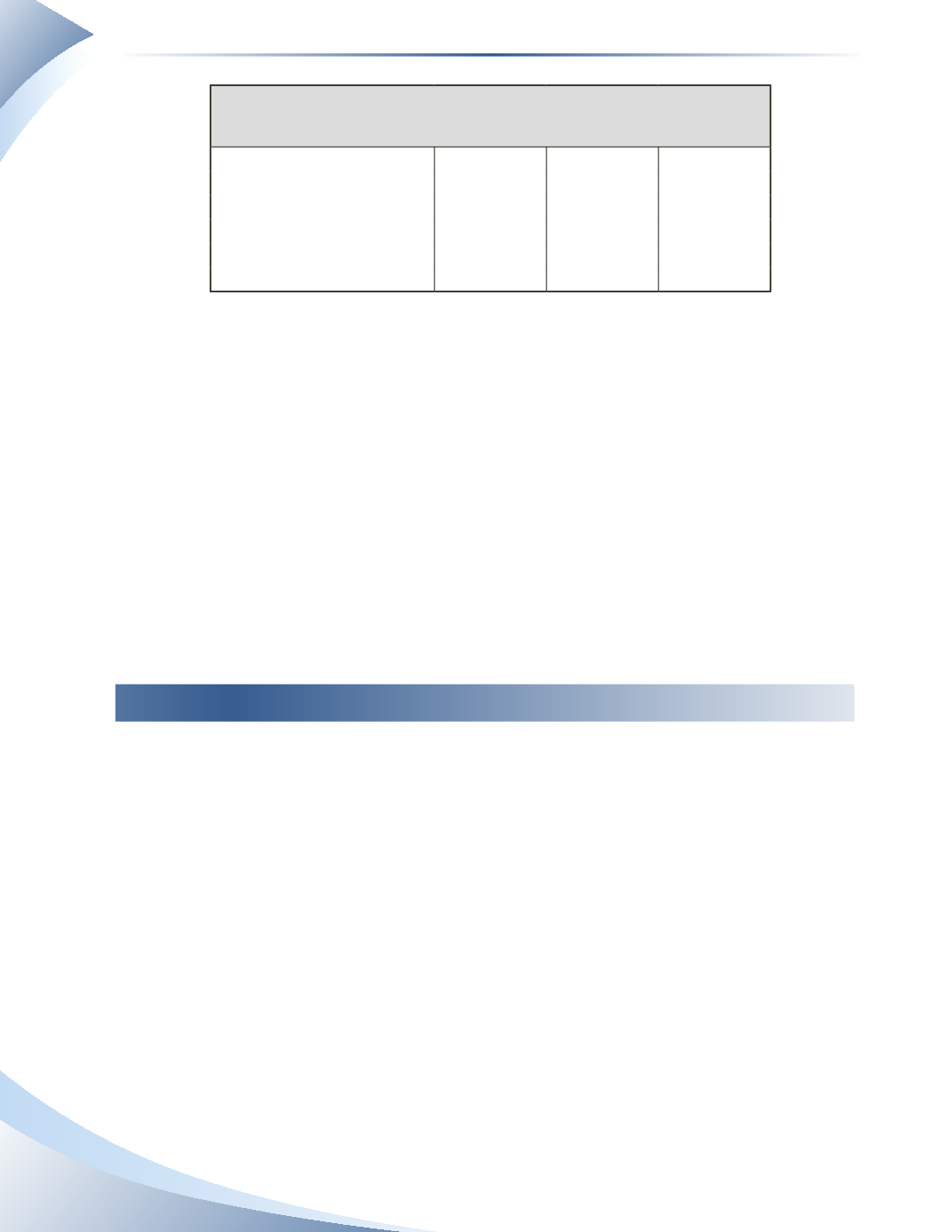

Star Hotel

Percentage of Base-Figure Total Revenue

For the Year Ended December 31, 2014 - 2016

2016

2015

2014

Total Revenue

100%

100%

100%

Cost of Goods Sold

14%

12%

11%

Gross Profit

86%

88%

89%

Total Expenses

80%

84%

85%

Net Income

6%

4%

3%

_______________

Figure 12.11

This analysis reveals that gross profit has remained quite steady, but operating expenses have been

gradually falling in relation to total revenue.This indicates that sales have risen without causing as

much of an increase to operating expenses, allowing for more net income per dollar of sales.

Considering all of the conclusions, the bank decides to grant the loan to Star Hotel because it has

been growing steadily over the past three years and is in a healthy enough financial position to

expand operations without much risk.

The Star Hotel example used horizontal and vertical analysis tools to make a decision.While these

tools are helpful in providing insight on a company’s financial position, there are limitations to

what they can actually show. The tools do not consider errors in the figures. Also, the trends may

not continue because businesses change and evolve constantly. Fortunately, there are many other

analysis tools available to users.These will be discussed next.

Analyzing the Statements

Now that the balance sheet for a corporation has been introduced, it is time to discuss its analysis in

depth. We will use the financial statements of Second Cup Coffee Co. (Second Cup), a Canadian

corporation that sells specialty coffee and baked goods.The comparative balance sheet is shown in

Figure 12.12. As you have learned, this is an important tool in conducting horizontal and vertical

analysis, but it also allows users to easily calculate various financial ratios for the company to even

better understand its finances. There are several assets and liabilities listed which you may have

never seen before, but we will focus on the analysis of the statement as a whole rather than on

individual accounts.

We will dissect sections of the balance sheet to perform our analysis.The analysis will involve the

calculation of ratios. Ratios measure different aspects of a company’s financial situation, and they

are divided into four categories based on what they measure: liquidity, profitability, operations

management and leverage.