Chapter 12

Using Accounting Information

364

Liquidity Analysis

Liquidity

refers to the ability of a company to convert current assets into cash. This is important

because paying off liabilities, purchasing assets, and paying for business expenses are generally

done using cash.The more liquid a company is, the easier it is to cover obligations such as accounts

payable and loan payments.There are several ways to measure liquidity detailed in this section.

Working Capital

Working capital is a measure of liquidity. It can be quickly calculated and easily understood. The

formula for working capital is shown below.

Working Capital = Current Assets – Current Liabilities

Working capital is a dollar figure, not a ratio, so it is difficult to say how much working capital is

enough. A positive working capital indicates that the company has enough liquid assets to pay off

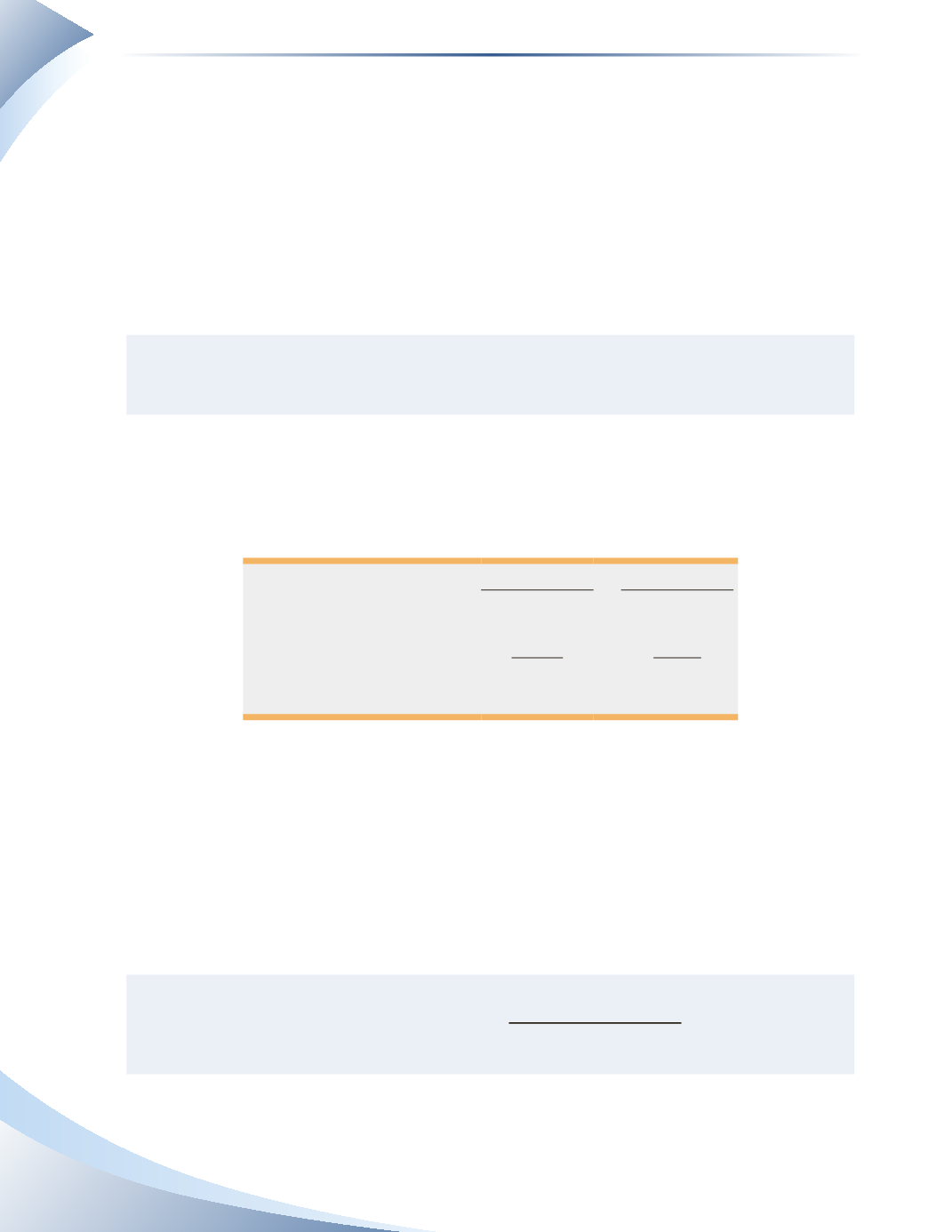

its upcoming debts.The working capital of Second Cup is calculated in Figure 12.13 for 2013 and

2014.

2014

2013

Current Assets

$16,430

$11,402

Current Liabilities

$23,684

$11,061

Working Capital

$(7,254)

$341

_______________

Figure 12.13

The working capital has gone from positive to negative which is an indication of poor liquidity.

The company may have to sell a long-term asset or raise cash through other means to pay off its

current liabilities.

Current Ratio

The current ratio is a useful ratio for determining the company’s ability to repay its upcoming debts

and obligations.The current ratio is calculated as shown below.

=

Current Assets

Current Ratio

Current Liabilities