Chapter 12

Using Accounting Information

359

A way to describe this trend is that the cash balance decreased by 75% between 2014 and 2016.

This could be the reason why Star Hotel needs a loan, because the company does not have enough

cash to pay for renovations.

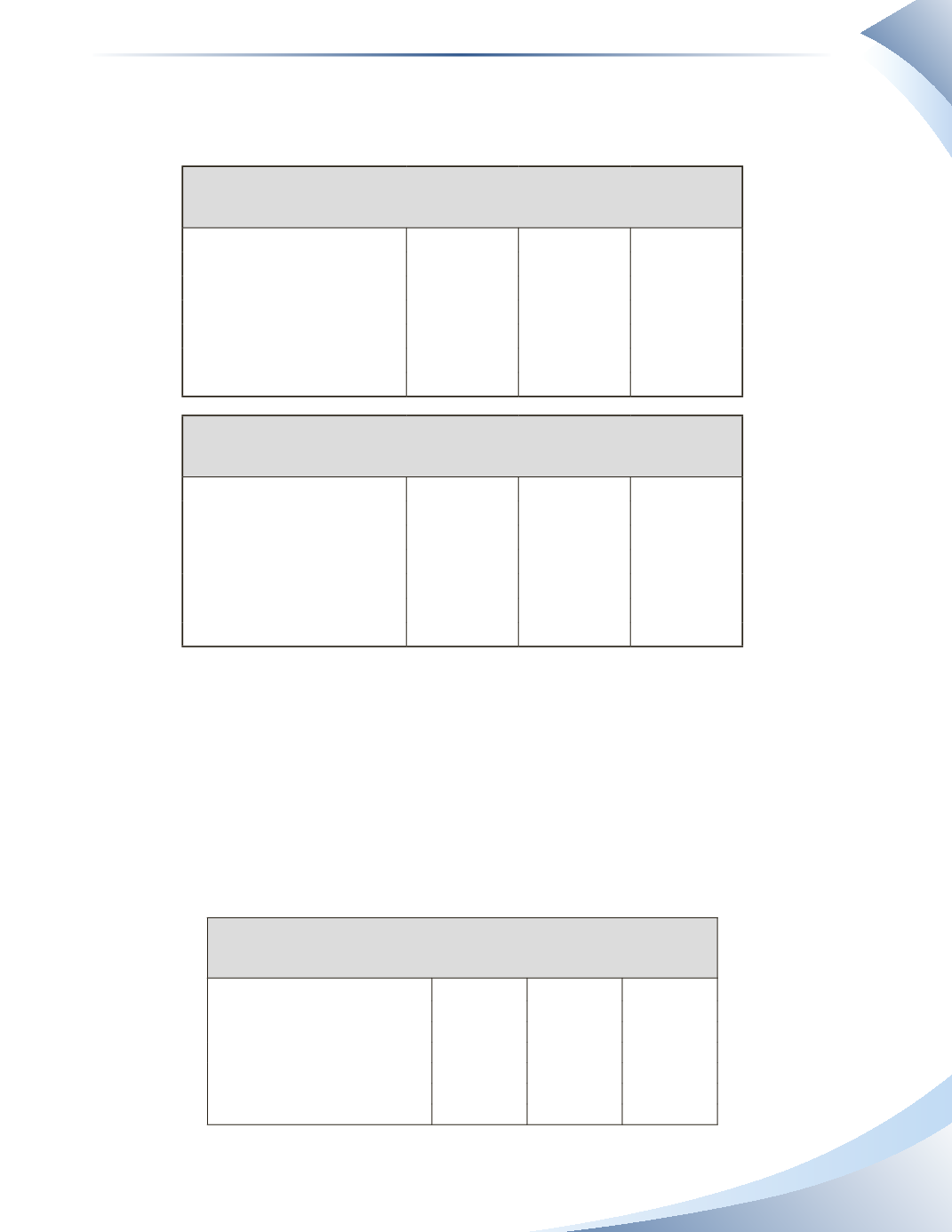

Star Hotel

Key Figures

As at December 31, 2014 - 2016

2016

2015

2014

Cash

$8,000

$20,000

$32,000

Total Current Assets

160,000

130,000

100,000

Property, Plant & Equipment

440,000

455,000

470,000

Total Assets

600,000

585,000

570,000

Total Current Liabilities

80,000

85,000

100,000

Total Shareholders’ Equity

520,000

500,000

470,000

Star Hotel

Percentage Changed with 2014 Base-Year

As at December 31, 2014 - 2016

2016

2015

2014

Cash

-75%*

-38%

0%

Total Current Assets

60%

30%

0%

Property, Plant & Equipment

-6%

-5%

0%

Total Assets

5%

3%

0%

Total Current Liabilities

-20%

-15%

0%

Total Shareholders’ Equity

11%

6%

0%

*($8,000 − $32,000) ÷ $32,000 = -75%

_______________

Figure 12.7

One item to note in Figure 12.6 is that there 0% changes for 2014.There is no percent change from

the base-year figure, because they are the same dollar amounts (i.e. $32,000 minus $32,000 equals

$0. Next, $0 divided by $32,000 equals $0).

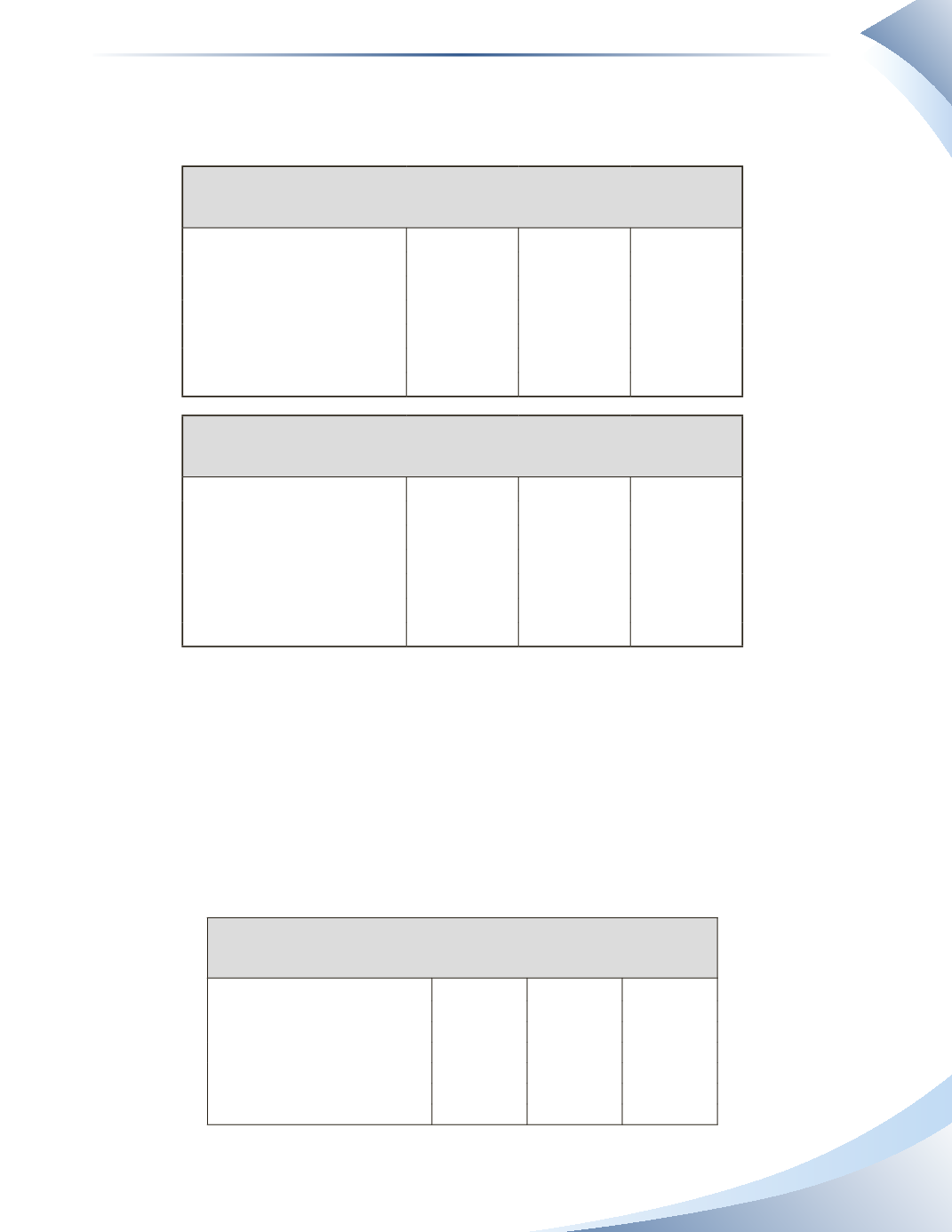

Instead of comparing the dollars to a base year, the bank could use one of the line items as a base-

figure. Usually, the

base-figure

is a total dollar amount such as total assets. Figure 12.8 shows the

percentage of line items by using total assets as the base. This is called

vertical analysis

because

each separate line item is being compared to the base-figure within the specific year.

Star Hotel

Key Percentages

As at December 31, 2014 - 2016

2016

2015

2014

Cash

1%*

3%

6%

Total Current Assets

27%

22%

18%

Property, Plant & Equipment

73%

78%

82%

Total Assets

100% 100% 100%

Total Current Liabilities

13%

15%

18%

Total Shareholders’ Equity

87%

85%

82%

*$8,000 ÷ $600,000 = 1%

_______________

Figure 12.8