Chapter 12

Using Accounting Information

361

income has doubled since 2015 which is a good sign of profitability. However, if the bank grants a

loan, Star Hotel will be required to incur an interest expense which would reduce the profitability

of the company.The bank decides to look at other trends in the company.

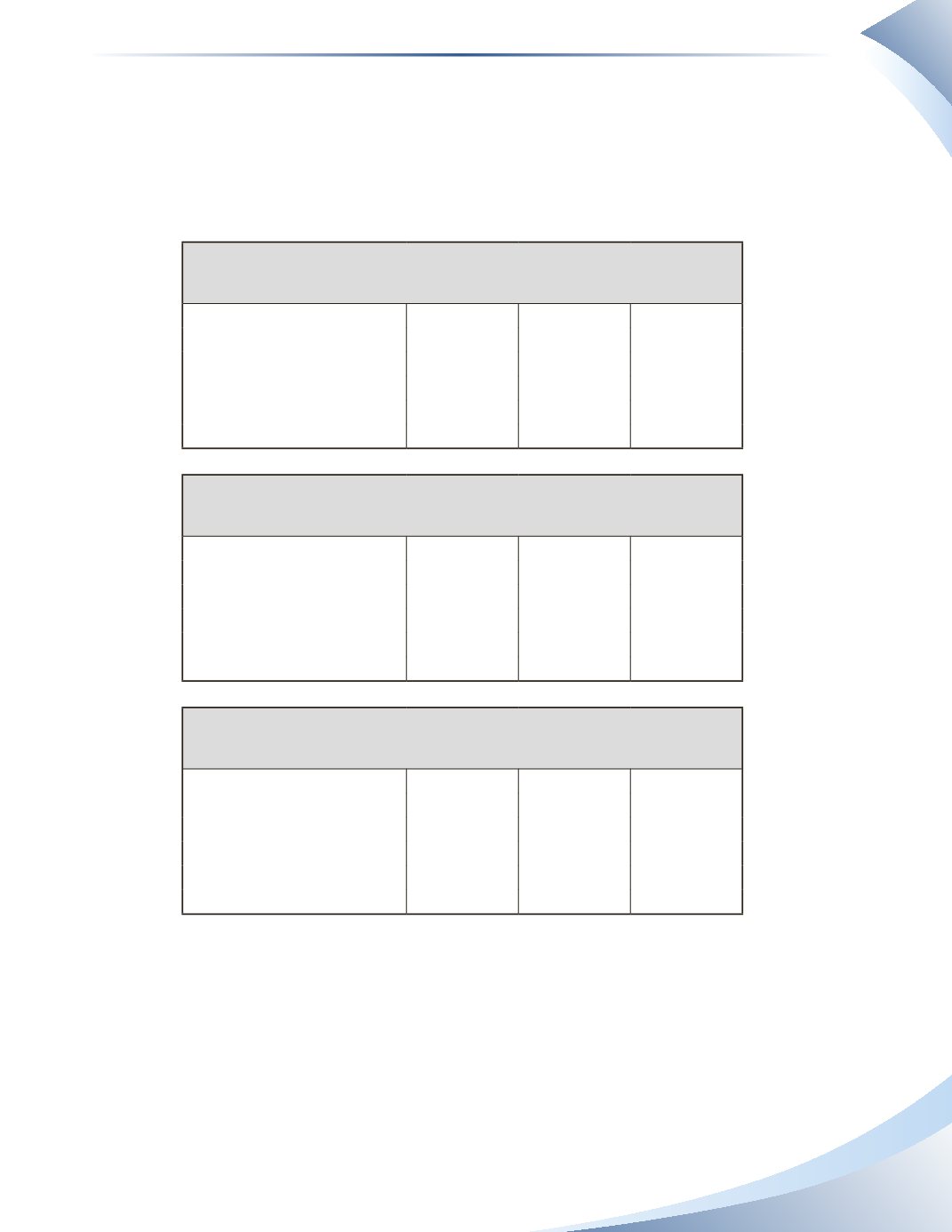

Figure 12.10 lists the key figures from the income statement for the previous three years as dollars,

percentage of, as well as percentage changed for the base year of 2014.

Star Hotel

Key Figures

For the Year Ended December 31, 2014 - 2016

2016

2015

2014

Total Revenue

$350,000

$250,000

$220,000

Cost of Goods Sold

50,000

30,000

25,000

Gross Profit

300,000

220,000

195,000

Total Expenses

280,000

210,000

187,500

Net Income

20,000

10,000

7,500

Star Hotel

Percentage of 2014 Base-Year

For the Year Ended December 31, 2014 - 2016

2016

2015

2014

Total Revenue

160%

114%

100%

Cost of Goods Sold

200%

120%

100%

Gross Profit

154%

113%

100%

Total Expenses

150%

112%

100%

Net Income

267%

133%

100%

Star Hotel

Percentage Changed with 2014 Base-Year

For the Year Ended December 31, 2014 - 2016

2016

2015

2014

Total Revenue

60%

14%

0%

Cost of Goods Sold

100%

20%

0%

Gross Profit

54%

13%

0%

Total Expenses

50%

12%

0%

Net Income

167%

33%

0%

_______________

Figure 12.10

Star Hotel’s sales have been increasing at a faster rate than its expenses, resulting in higher net

income. After seeing these trends, the bank decides that the company is likely to continue operating

profitably into the future.

Finally, the bank can also use vertical analysis on Star Hotel’s income statement by converting

everything to a percentage of total revenue for each year, as shown in Figure 12.11.