Chapter 7

Inventory: Merchandising Transactions

172

on the balance sheet right below accounts receivable because it is a fairly liquid asset. Inventory has

a value that can change unpredictably and even decrease over time, but a merchandiser must sell

inventory for more than its cost in order to make profit. Senior management and accountants are

responsible to ensure controls are in place to accurately track the value of inventory from the point

of purchase to the point of sale.

Because merchandisers sell products instead of services, their revenue is called sales revenue. An

expense account called

cost of goods sold (COGS)

is used to track the cost of the inventory

that was sold during a particular period. For example, if a company purchased a television from a

supplier for $200 and sold it for $500, it would have sales revenue of $500 and cost of goods sold

of $200.The difference between sales revenue and cost of goods sold is called gross profit.

Gross Profit = Sales Revenue - Cost of Goods Sold

Gross profit is used to pay for all other expenses in the business. The television sale created $300

($500 − $200) of gross profit which is used to pay for operating expenses such as rent, salaries, and

advertising. After operating expenses have been deducted, the remaining amount is net income.

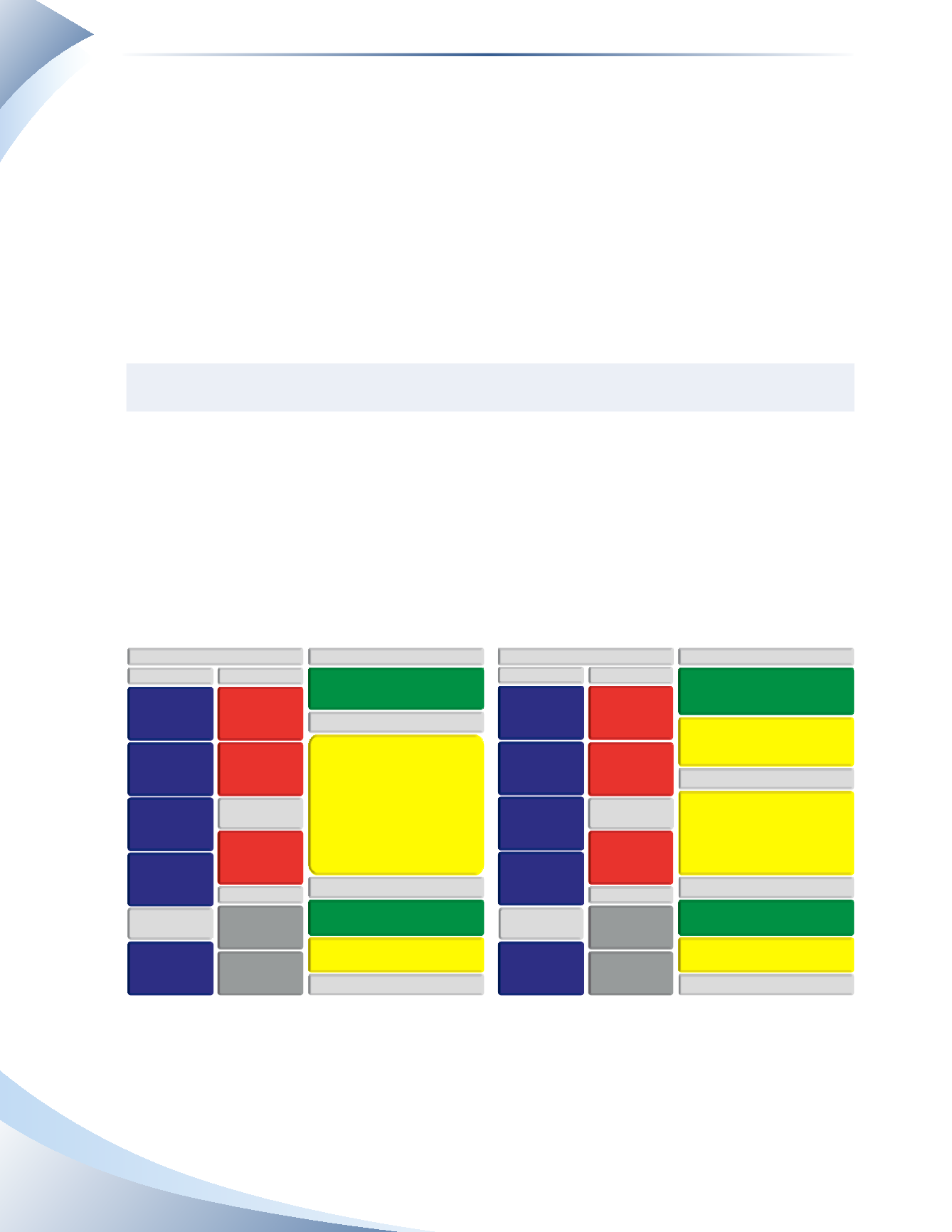

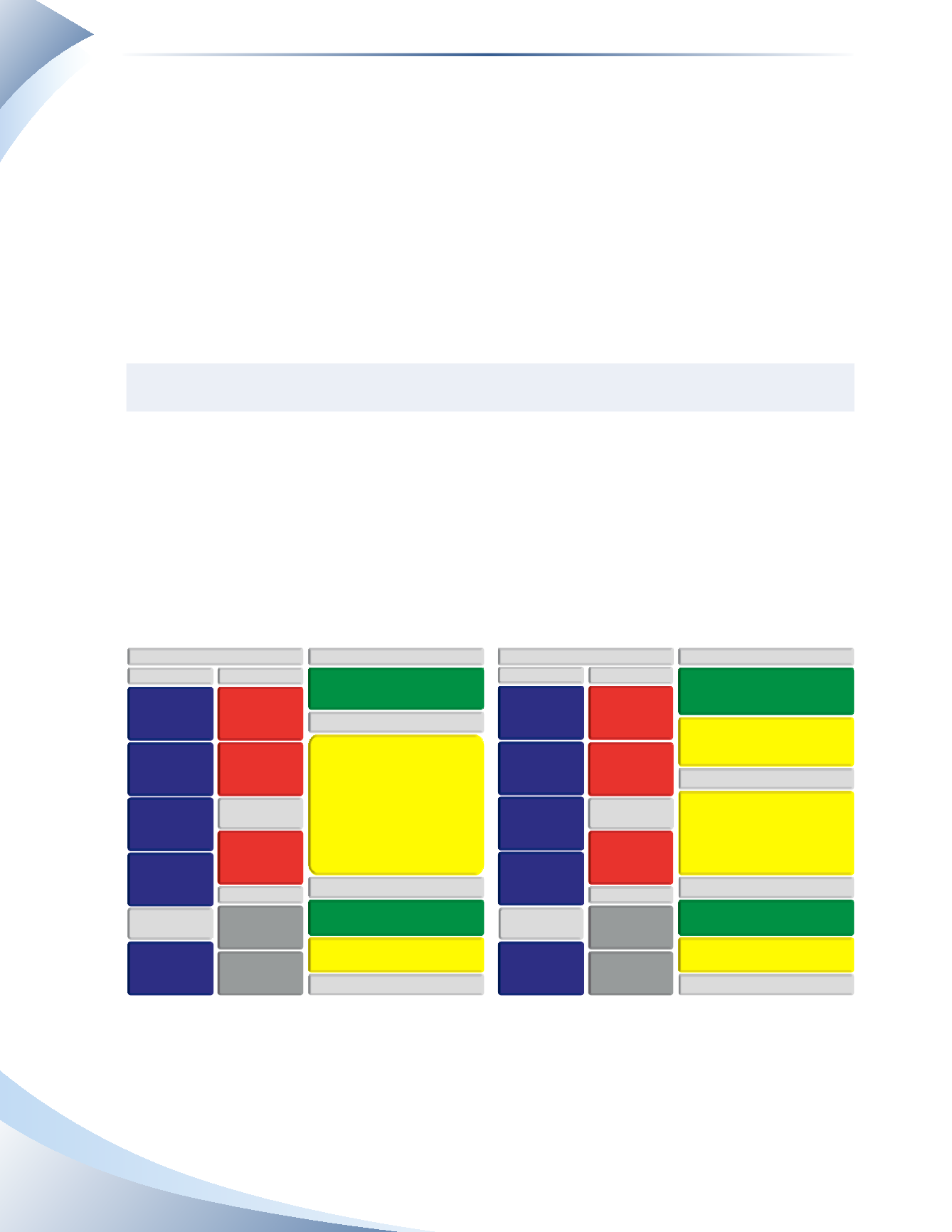

Figure 7.1 illustrates the difference in the configuration of the accounts of a merchandising business

and a service company. Notice the new inventory asset, cost of goods sold and gross profit in the

merchandising company. Other revenue and other expenses will be covered later in this chapter.

Service Company

Merchandising Company

INCOME STATEMENT

NET INCOME (LOSS)

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

BALANCE SHEET

OPERATING INCOME (LOSS)

OTHER REVENUE

(INTEREST, GAIN ON SALE OF ASSETS)

OTHER EXPENSES

(INTEREST, LOSS ON SALE OF ASSETS)

INCOME STATEMENT

NET INCOME (LOSS)

OPERATING INCOME (LOSS)

EXPENSES

SERVICE REVENUE

OTHER REVENUE

(INTEREST, GAIN ON SALE OF ASSETS)

OTHER EXPENSES

(INTEREST, LOSS ON SALE OF ASSETS)

OPERATING EXPENSES

CURRENT ASSETS

CASH

SUPPLIES

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

CURRENT ASSETS

CASH

INVENTORY

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

CURRENT LIABILITIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S CAPITAL

OWNER’S DRAWINGS

LONG-TERM

LIABILITIES

ACCOUNTS

PAYABLE

BANK LOAN

OWNER’S EQUITY

OWNER’S CAPITAL

OWNER’S DRAWINGS

CURRENT LIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

________________

figure 7.1

To see how revenue, cost of goods sold, gross profit and operating expenses interact, consider the

following example. A business purchases T-shirts for $5.00 each and plans to sell them for $7.00

each.The business also incurs a variety of operating expenses, totaling $700. Figure 7.2 shows the

results of selling 200 T-shirts.