Chapter 7

Inventory: Merchandising Transactions

175

the Perpetual Inventory system

A perpetual inventory system involves recording all transactions affecting the balance of inventory

on hand, as they occur. In reality, most businesses have separate, detailed records for each type

of product they sell. For simplicity, our examples will focus on one type of product, where all

transactions affect a single inventory account directly.

We will demonstrate various inventory-related transactions using an example of a retail store called

Tools 4U, which buys and sells various tools.Tools 4U is a proprietorship owned byWayne Sanders.

Purchase and sale of Inventory

When inventory is purchased for resale using a perpetual inventory system, the inventory account

is debited and the cash or the accounts payable account is credited. Tools 4U purchased inventory

at a cost of $10,000 on January 1, 2016. Assume all purchases and sales are made on account.

Figure 7.5 shows how this purchase is journalized.

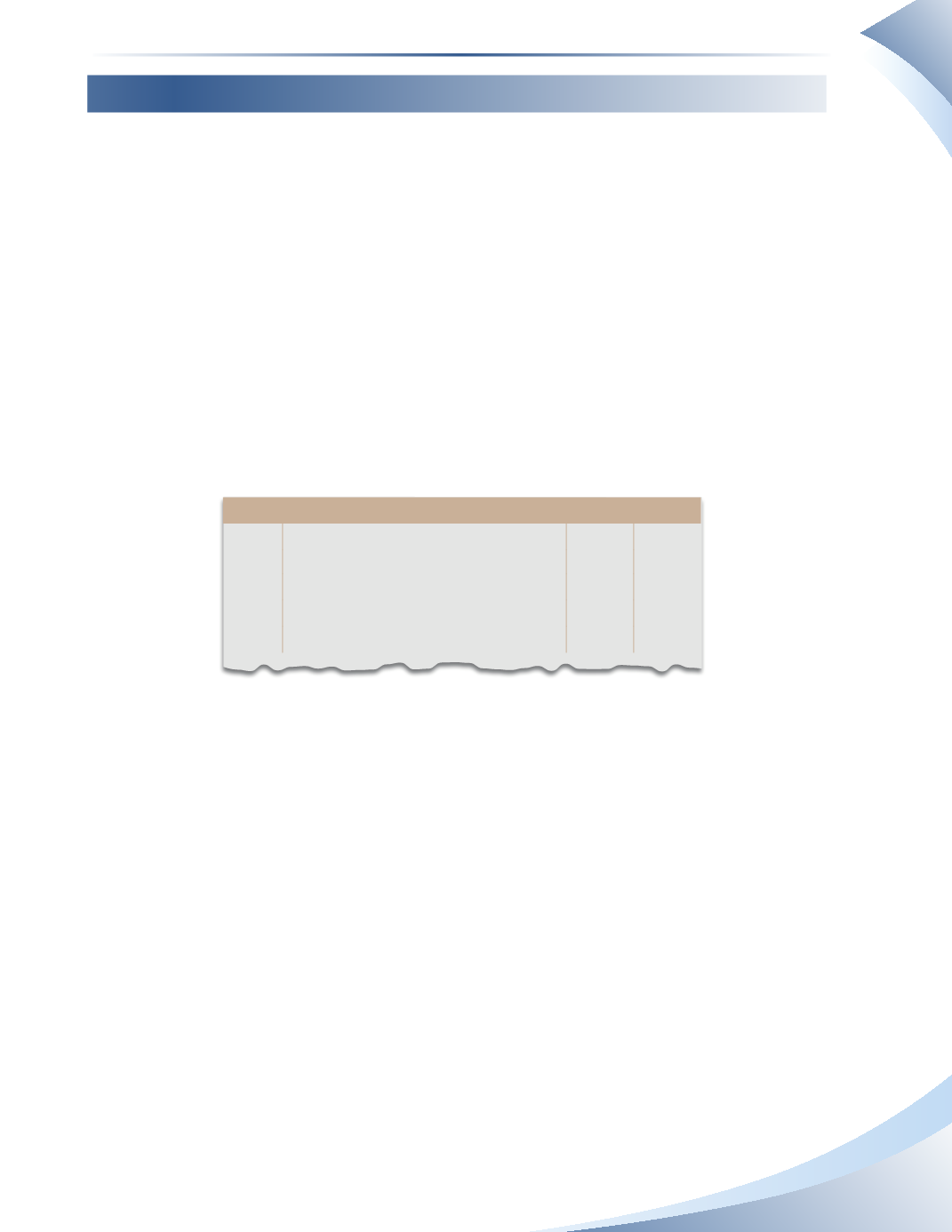

Journal

Page 1

date

account title and explanation

debit Credit

2016

Jan 1 Inventory

10,000

Accounts Payable

10,000

Purchased inventory on account

________________

fIGuRe 7.5

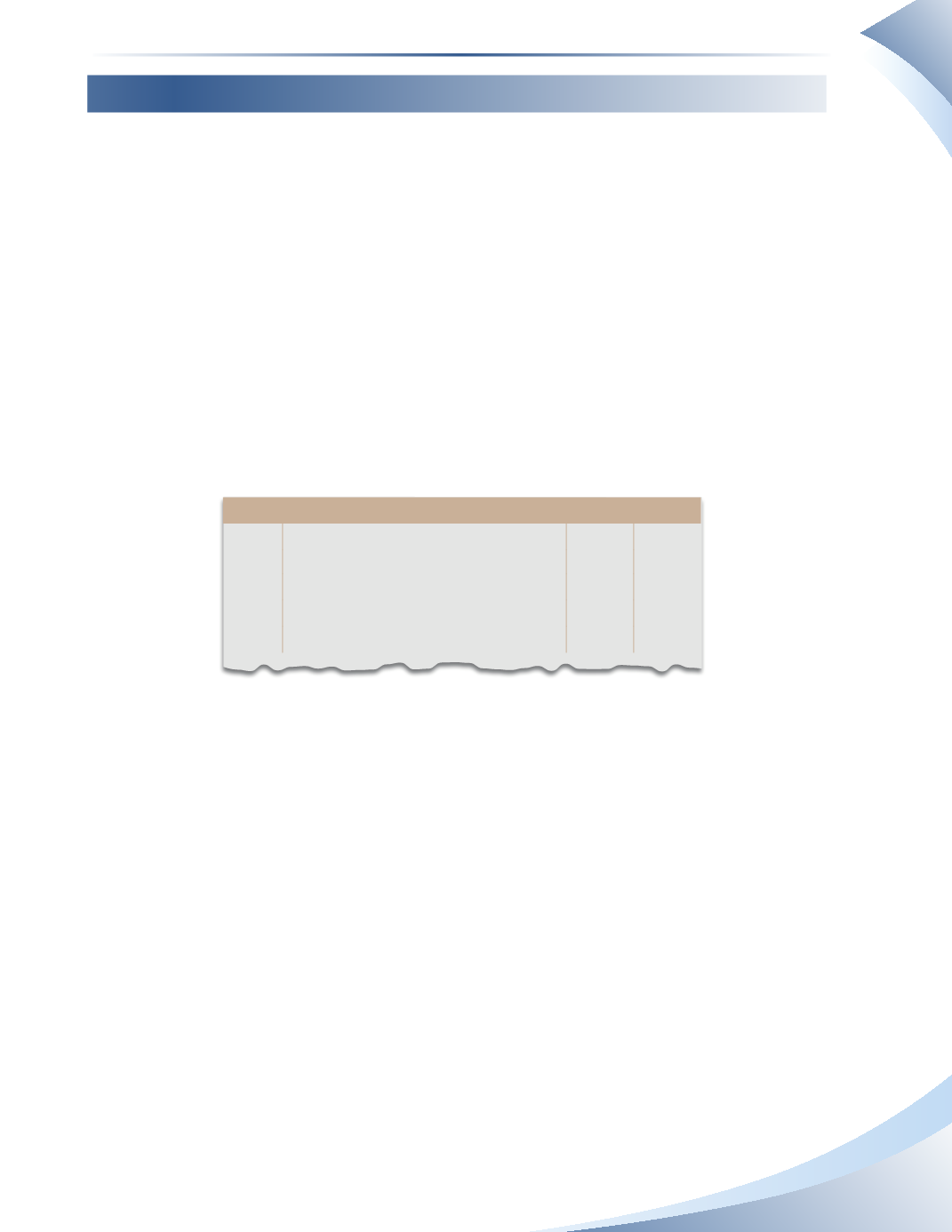

Tools 4U adds this purchase to the inventory it already has on hand that is ready to sell. Suppose

inventory worth $7,200 is sold for $15,000 on January 15 on account. The sale of inventory is

recorded by using two journal entries

1. Debit accounts receivable and credit sales revenue each for $15,000 to show the sale on

account.This records the proceeds from the sale. If the sale was made for cash, then the cash

account would be debited instead of accounts receivable.

2. Debit COGS and credit inventory each for $7,200 to show that inventory has been reduced.

This entry is necessary because it removes the inventory sold from the balance sheet and

records its cost on the income statement as a cost of doing business for the period.

These transactions are shown in Figure 7.6. Note that the gross profit generated by this sale is equal

to $7,800 ($15,000 − $7,200).