Chapter 7

Inventory: Merchandising Transactions

176

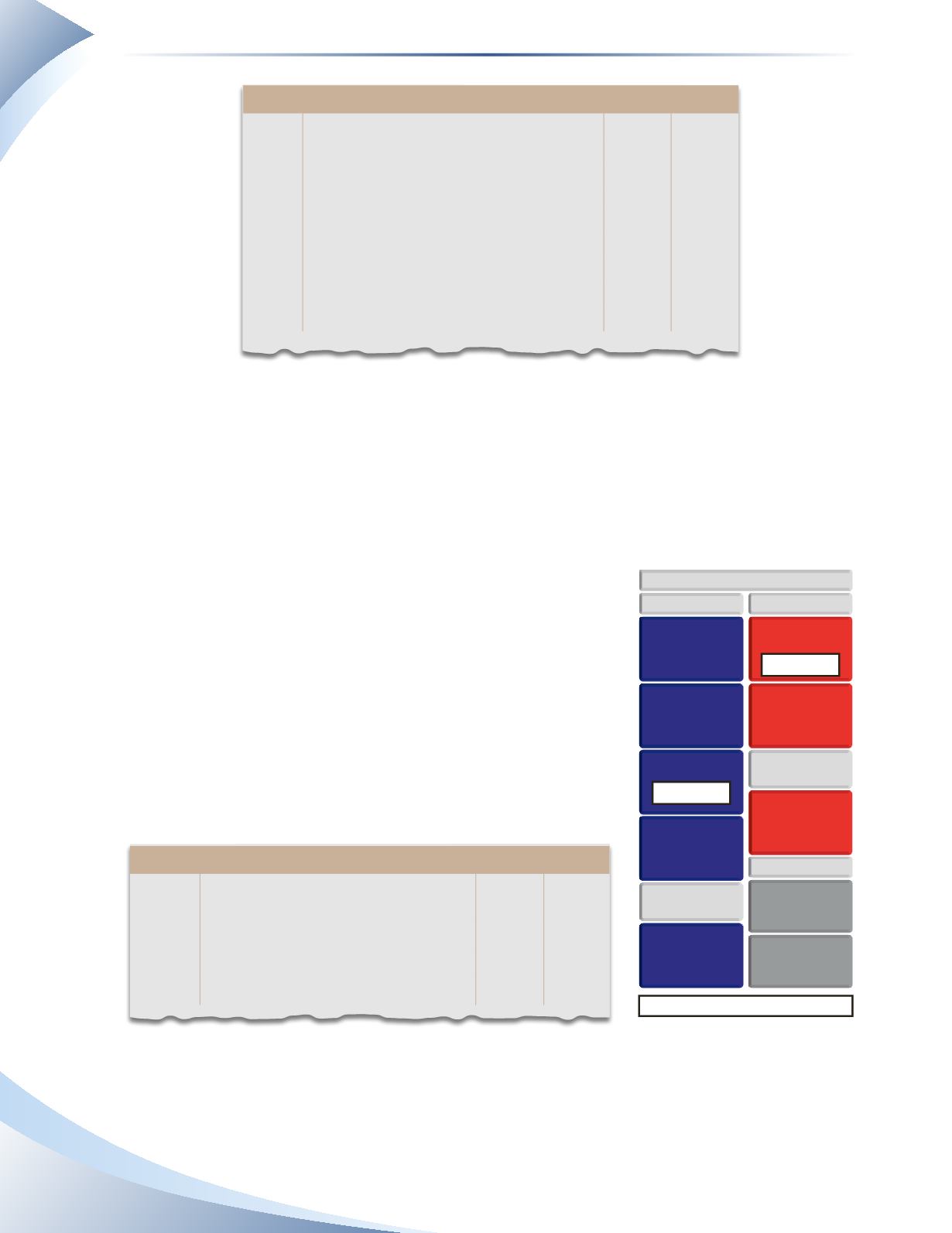

Journal

Page 1

date

account title and explanation

debit Credit

2016

Jan 15 Accounts Receivable

15,000

Sales Revenue

15,000

To record product sales on account

Jan 15 Cost of Goods Sold

7,200

Inventory

7,200

Sold inventory to a customer

________________

fIGuRe 7.6

When inventory is sold by a merchandiser, it can no longer be regarded as an asset by the company

because it is now owned by the customer.This is the reason for the second journal entry in Figure

7.6. In a service company, this entry is not recorded because assets are not sold in the ordinary

course of business.

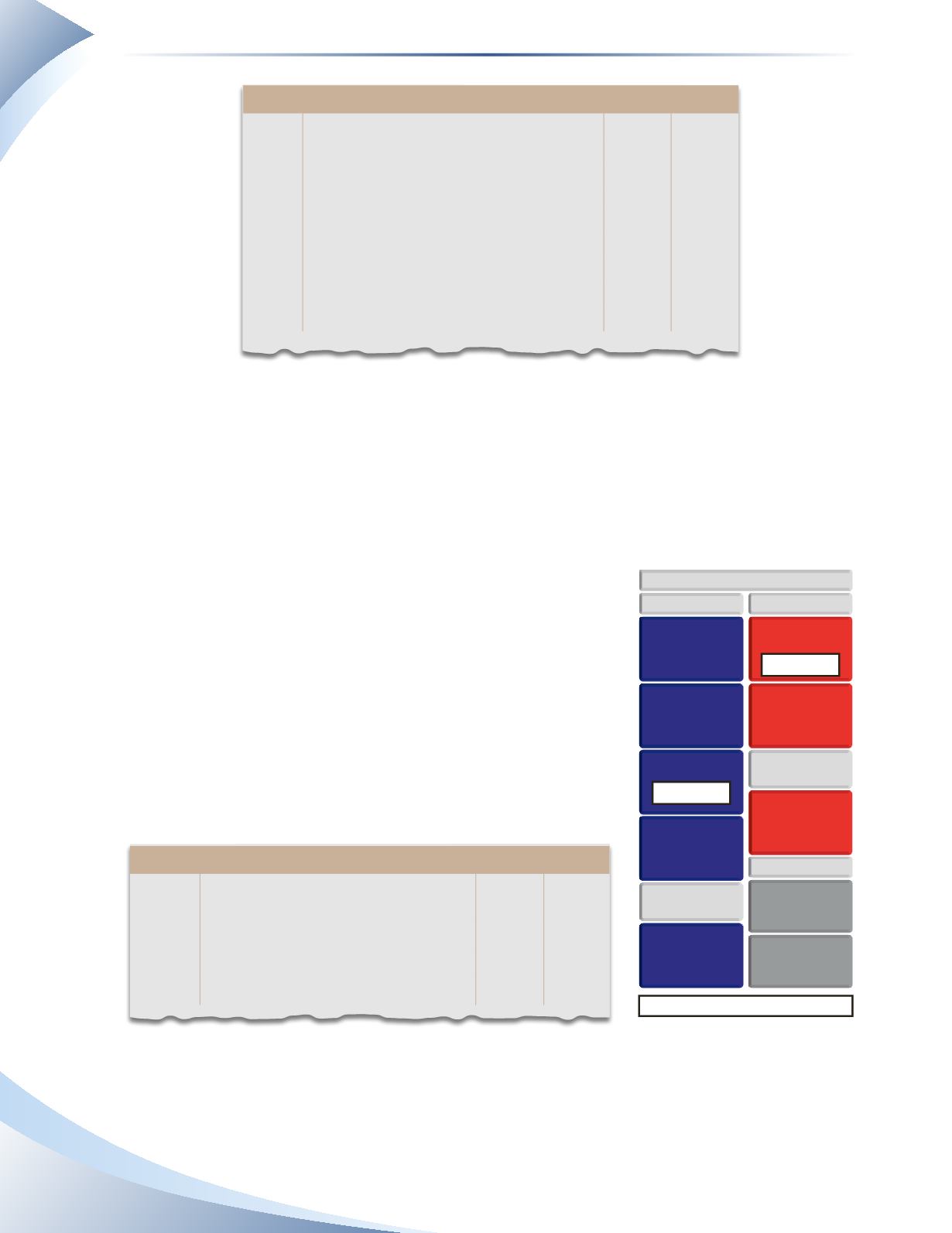

Purchase Returns

Goods often need to be returned for reasons such as incorrect

product, over-shipments, or inferior product quality.

When the manager of Tools 4U examined the new shipment

of inventory from the company’s supplier, Roofs and More, he

noticed that there were some damaged goods in the shipment.

The damaged goods cost $500. The goods were returned and a

journal entry for $500 was recorded to reverse part of the original

purchase transaction as shown in Figure 7.7.

No change in owner’s equity

BALANCE SHEET

INVENTORY

– $500 CR

CURRENT ASSETS

CASH

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

– $500 DR

CURRENT LIABILITIES

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

LONG-TERM

LIABILITIES

Journal Page 1

date

2016

account title and explanation

debit Credit

Jan 2 Accounts Payable

500

Inventory

500

Goods returned to Roofs and More

______________

fIGuRe 7.7