Chapter 7

Inventory: Merchandising Transactions

181

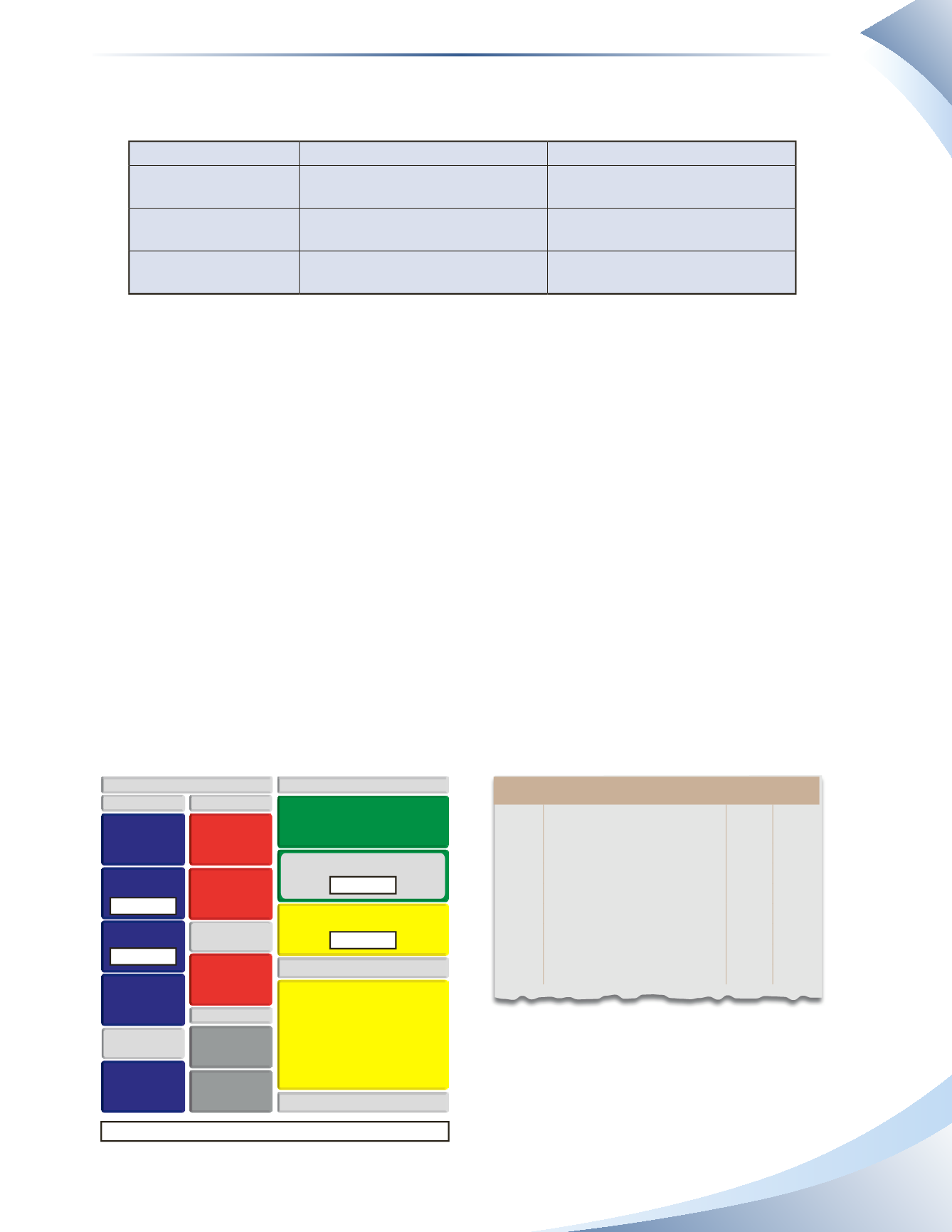

A summary of FOB shipping point and FOB destination is presented in Figure 7.14. Basically,

whoever pays for shipping owns the goods while they are being transported and bears the risk of loss.

FoB shipping Point

FoB destination

ownership Change

When goods leave the seller on a

common carrier

When goods arrive at the buyer’s

place of business

transportation Costs

Paid by the buyer and recorded in

inventory

Paid by the seller and recorded as

an expense

risk of loss

Buyer bears risk of loss during

transport

Seller bears risk of loss during

transport

______________

fIGuRe 7.14

Sales Returns

A merchandiser may have to deal with numerous returns from customers, and these returns

must be tracked over a period of time. High return levels may indicate serious problems with

the products being sold. Therefore, instead of reversing the revenue account with a debit when

recording returns, a contra-revenue account called

sales returns and allowances

is used to track

the amount of returns. Recall that contra means opposite and a contra account holds an opposite

normal balance of its related account.

Sales returns and allowances is a contra-revenue account with a normal debit balance. It is generally

used to record both sales returns and sales allowances.

Sales returns

occur when undesirable

products are returned to the seller.

Sales allowances

occur when the customer decides to keep such

undesirable products at a reduced price.

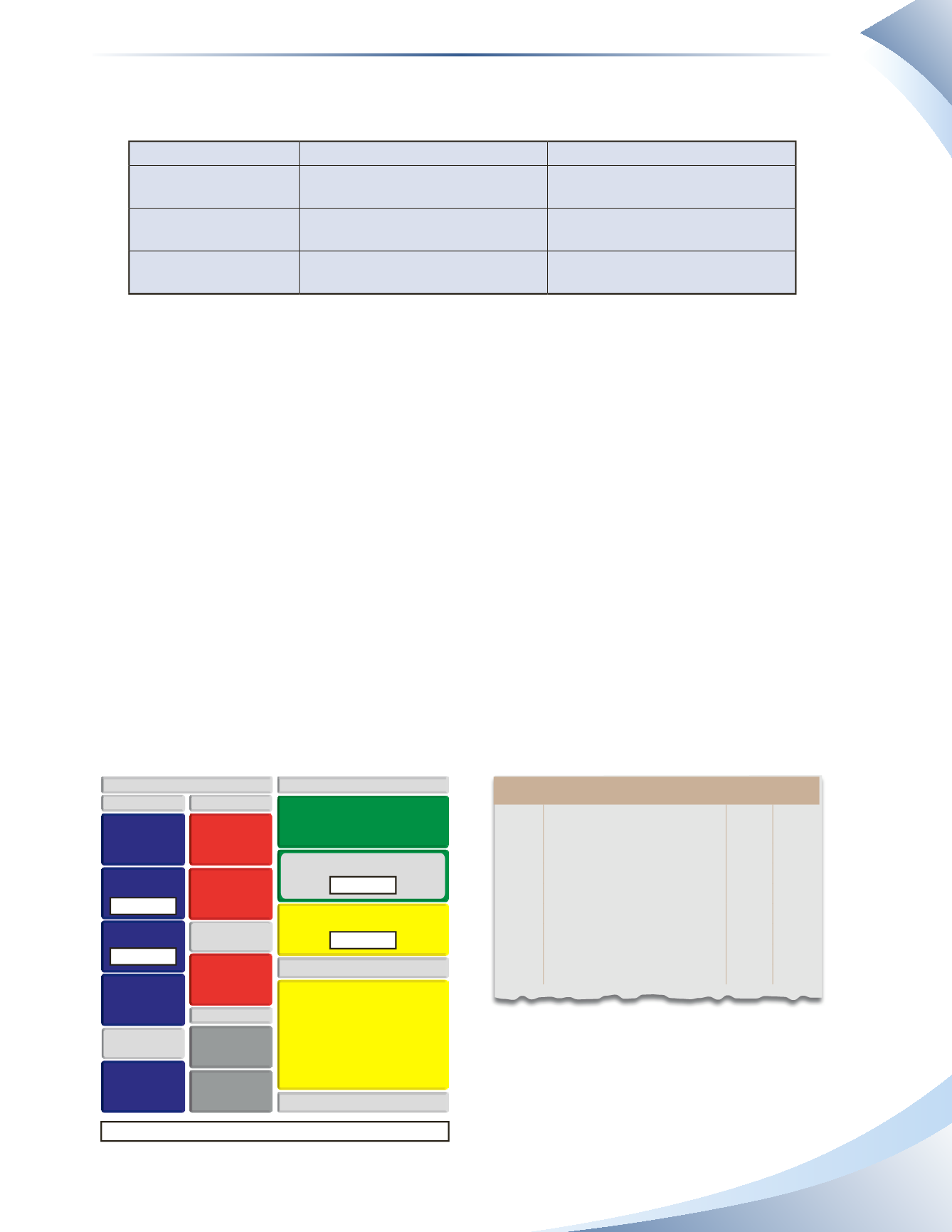

Continuing with our example, suppose that a customer returned $4,000 worth of undesirable goods

to Tools 4U (the original cost of the inventory was $3,000).There is nothing wrong with the goods

and they can be resold.The journal entries to record this return, using the contra-revenue account,

are shown in Figure 7.15. Note that two entries are required: one to record the reduction in sales

and accounts receivable (or cash, if applicable) and one to reverse the reduction of inventory.

Owner’s equity decreases by $1,000 (– $4,000 + $3,000)

SALES RETURNS & ALLOWANCES

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

OPERATING INCOME (LOSS)

CURRENT ASSETS

CASH

INVENTORY

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

OWNER’S EQUITY

CURRENT LIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

– $4,000 CR

+ $4,000 DR

– $3,000 CR

+ $3,000 DR

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 18 Sales Returns & Allowances

4,000

Accounts Receivable

4,000

Customer returned items

Jan 18 Inventory

3,000

Cost of Goods Sold

3,000

Restock returned inventory

______________

fIGuRe 7.15