Chapter 7

Inventory: Merchandising Transactions

177

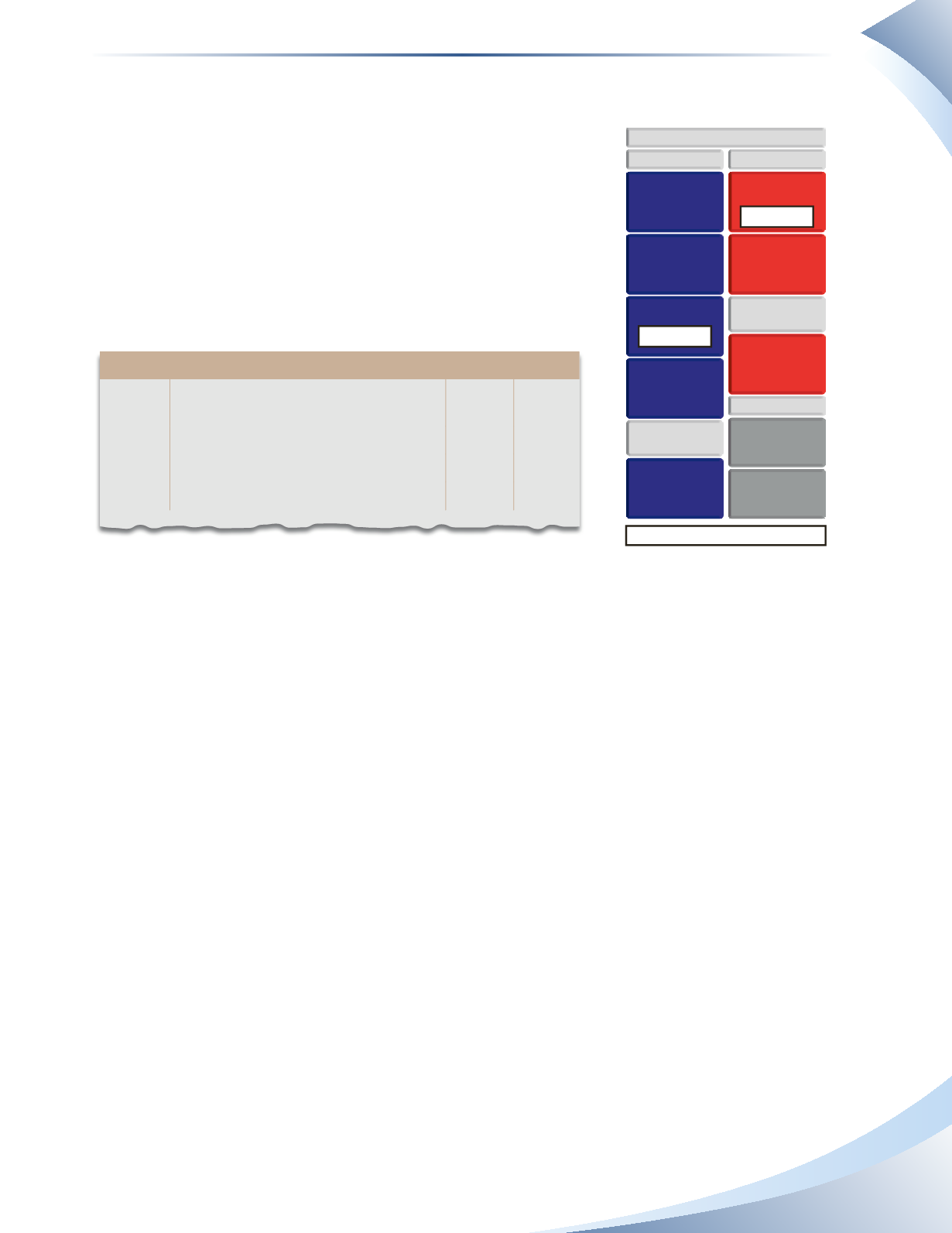

Purchase Allowances

Purchase allowances occur when the buyer agrees to keep

the undesirable goods at a reduced cost. Continuing with the

above example, assume Tools 4U found another $500 worth of

unsatisfactory goods and the supplier offered a 20% allowance for

the company to keep the goods, rather than returning them. The

journal entry is recorded by debiting accounts payable and crediting

inventory as shown in Figure 7.8. The transaction amount is $100

($500 × 20%).

A balance of $4,200 ($4,800 − $500 − $100) is still owing to Roofs and More.

Purchase Discounts

Various types of discounts exist when purchasing products or services. Sellers often give discounts

to encourage customers to purchase more and to encourage early payments.

Two types of common discounts given are trade discounts and cash discounts. Only cash discounts

will be discussed in detail in this chapter.

Cash discounts

are offered to encourage prompt payment from customers in the form of a

percentage off the final bill for paying in a short amount of time. For example, a seller may offer a

2% cash discount if the payment is made within 10 days of the date of invoice, otherwise the full

amount is payable within 30 days.The term for this arrangement is commonly shown as 2/10, n/30

(read as: “two-ten, net thirty”). This means that a 2% discount is applied if payment is received

within 10 days; otherwise the net amount owing is due within 30 days. Another example is 3/15,

n/30, which means a 3 percent discount is applied if payment is received within 15 days, otherwise

the net amount owing is payable within 30 days. The following example illustrates how to record

a purchase discount.

Tools 4U made the original purchase from Roofs and More on January 1, 2016 for $4,800. The

amount Tools 4U owes has been reduced by $600 due to returns and allowances, so only $4,200

remains to be paid. The supplier (Roofs and More) allows 2/10, n/30 on all invoices. Since Tools

4U has excess cash at this time, the manager decides to take advantage of the cash discount by

paying the invoice within 10 days.

No change in owner’s equity

BALANCE SHEET

INVENTORY

– $100 CR

CURRENT ASSETS

CASH

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

– $100 DR

CURRENT LIABILITIES

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

LONG-TERM

LIABILITIES

Journal Page 1

date

2016

account title and explanation

debit Credit

Jan 4 Accounts Payable

100

Inventory

100

Allowance from Roofs and More

______________

fIGuRe 7.8