Chapter 7

Inventory: Merchandising Transactions

173

1. Travel

$100

2. Business cards

100

3. Flyers for advertising

300

4. Temporary rental space

200

Total Operating Expenses

$700

Sales Revenue (200 x $7.00)

$1,400

Less

Cost of Goods Sold

1,000

= Gross Profit

400

Less

Operating Expenses

700

= Net Income (Loss)

($300)

Every business has various monthly operating

expenses that will occur regardless of services

or products sold. The sale of merchandise, less

merchandise cost, contributes toward paying

these expenses.

These T-shirts may have been purchased

several months earlier. You are now recognizing

(matching) the cost of the shirts against the

value of the sale. If you only sell 200 T-shirts

(COGS = 200 x $5.00), there is not enough gross

profit to pay operating expenses, resulting in a

net loss of $300.

Operating expenses of the business

Sell 200 T-shirts

________________

figure 7.2

The business needs to sell more T-shirts to provide enough gross profit to pay for operating

expenses. Figure 7.3 shows the results of selling 350 T-shirts and 500 T-shirts.

Sales Revenue (500 x $7.00)

$3,500

Less

Cost of Goods Sold

2,500

= Gross Profit

1,000

Less

Operating Expenses

700

= Net Income (Loss)

$300

By selling 350 T-shirts (COGS = 350 x $5.00),

you manage to break even (which means that

revenues equal expenses). Therefore, you have

not produced net income or suffered a net loss.

By selling 500 T-shirts (COGS = 500 x $5.00),

you have made sufficient gross profit to cover

operating expenses and produce net income.

Sell 350 T-shirts

Sell 500 T-shirts

Sales Revenue (350 x $7.00)

$2,450

Less

Cost of Goods Sold

1,750

= Gross Profit

700

Less

Operating Expenses

700

= Net Income (Loss)

$0

________________

figure 7.3

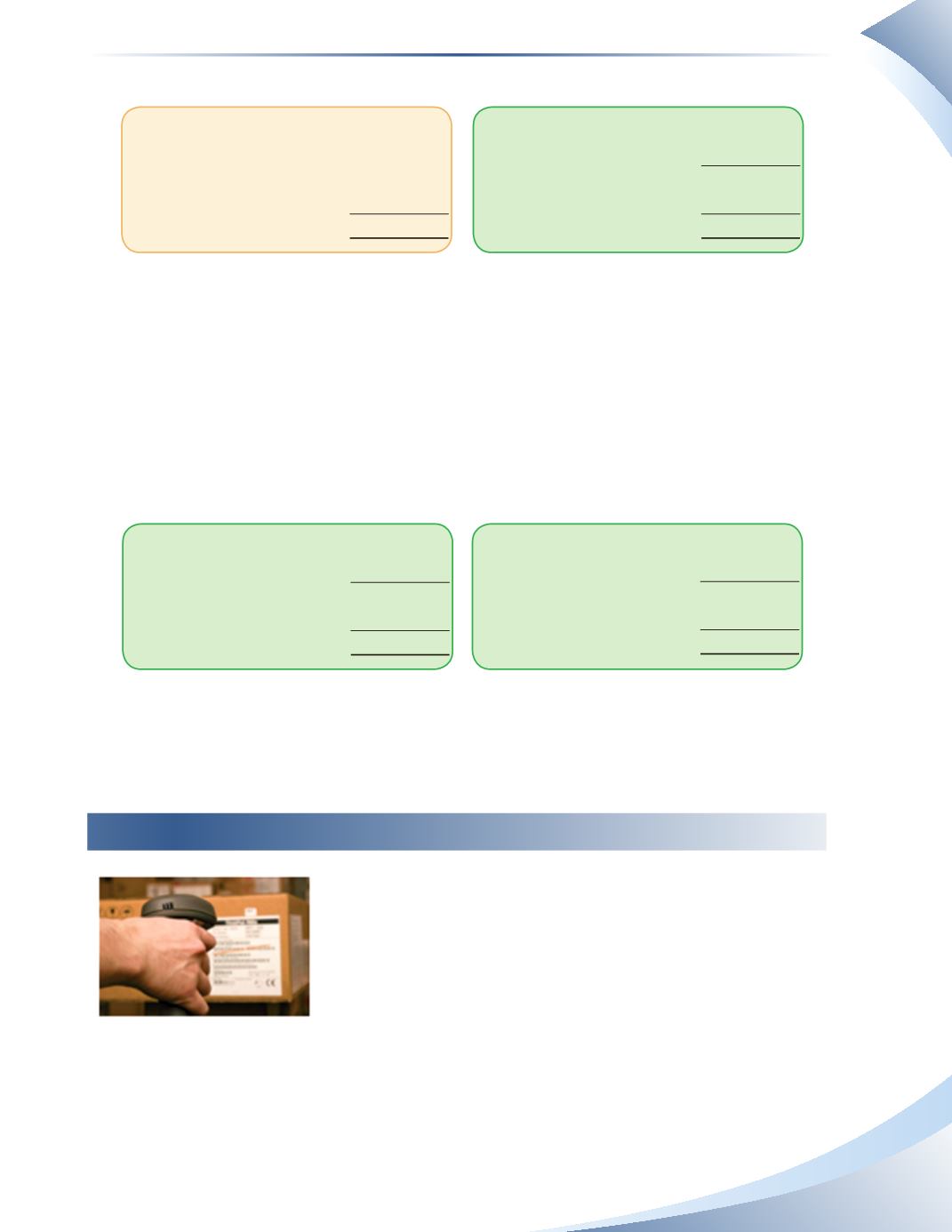

Perpetual vs. Periodic Inventory

Imagine you are shopping for a particular item at a department store.

You cannot find it on the shelf, so you ask an employee if there are

any left. The employee checks the computer, which says there is one

left.The employee finds it in the storage room, gives it to you and you

go to the cashier.The cashier scans the item, you pay the bill and you

leave the store. If another customer asked for that same item after you

bought it, the computer would show that there are none in stock.

This example illustrates the perpetual inventory system. The

perpetual inventory system

updates

inventory levels after every purchase and sale. Most merchandising companies use technology

such as scanners to update their records for inventory, as well as COGS. All the updates happen

automatically when the item is scanned.