Chapter 7

Inventory: Merchandising Transactions

182

There is a $4,000 increase in the sales returns and allowances account. This amount decreases

revenue since the contra-revenue account has the opposite effect than the revenue account.

In the example in Figure 7.15, the inventory that was returned was not what the customer wanted.

There was nothing wrong with the product in terms of quality, so it was placed back on the shelf

to be sold again. If the items returned by the customer were damaged, then the inventory cannot

be sold again. In that case, Tools 4U would not record the second journal entry from Figure 7.15

because the damaged inventory is worthless.

Sales Allowances

There are circumstances where a reduction to the original selling price is given to a customer.

Assume the customer from January 15 discovered that some goods were damaged during

shipping. Instead of returning the items, the customer agreed to accept an allowance of 5% on

the price of the goods it kept.The customer kept $11,000 ($15,000 original sale − $4,000 return)

of goods, so it will get a $550 ($11,000 × 5%) reduction on what it owes Tools 4U.

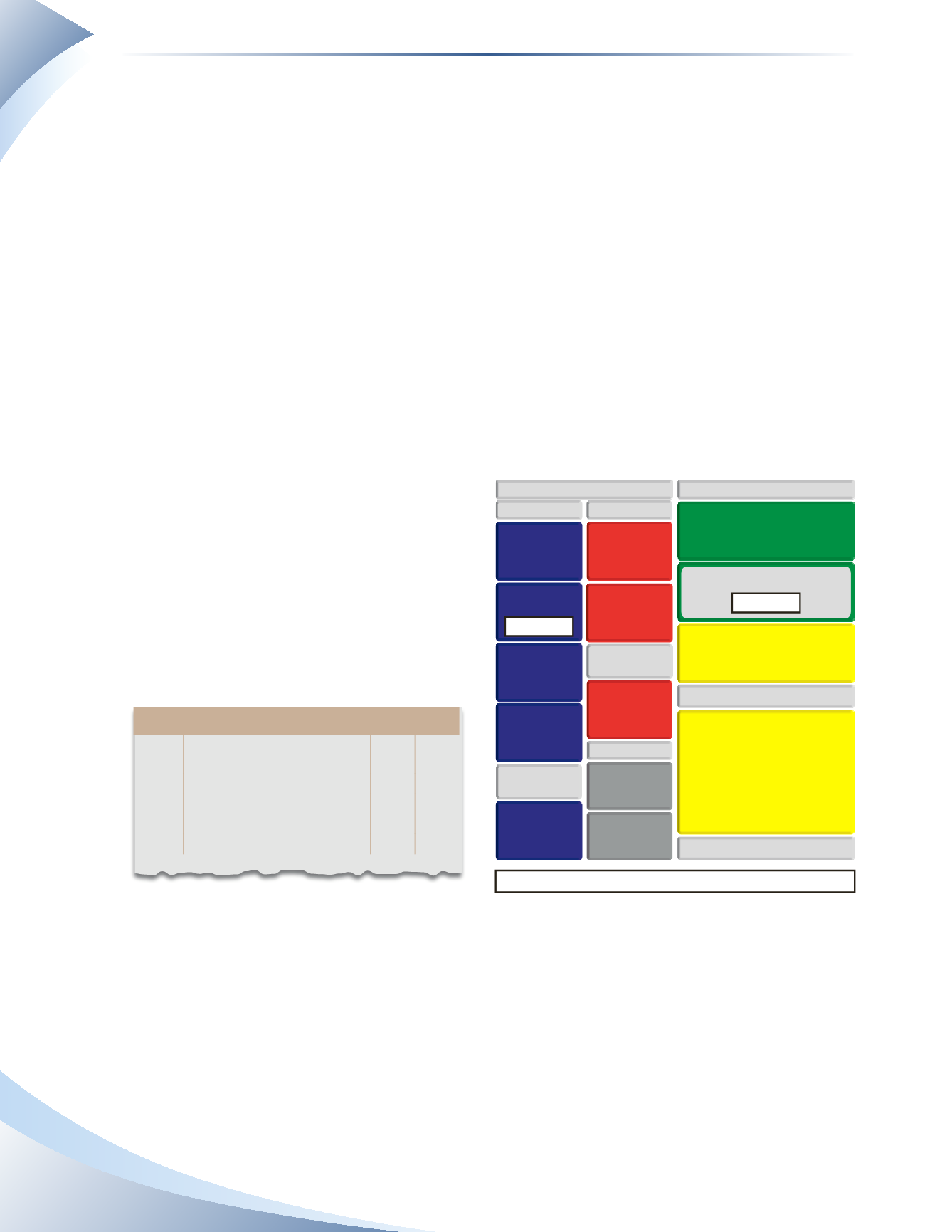

The journal entry is shown in Figure 7.16.

The amount is recorded as a debit to sales

returns and allowances and a credit to

accounts receivable.The transaction decreases

equity by $550.

A balance of $10,450 ($15,000 − $4,000 −

$550) is still owed by Tools 4U’s customer.

Sales Discounts

When selling products or services, it is common to offer sales discounts to customers for early

payment. The concept works in the same way as the purchase discount. Assume that Tools 4U

offered its customer from January 15 terms of 2/10, n/30 in the invoice. If the customer pays by

January 25, a 2% discount will be applied on the amount owing of $10,450.

Assume the customer made the payment on January 20; the amount is $10,241 ($10,450 less the

2% discount).The journal entry to record this transaction is shown in Figure 7.17.

Owner’s equity decreases by $550

SALES RETURNS & ALLOWANCES

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

OPERATING INCOME (LOSS)

CURRENT ASSETS

CASH

INVENTORY

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

OWNER’S EQUITY

CURRENT LIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

– $550 CR

+ $550 DR

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 18 Sales Returns & Allowances

550

Accounts Receivable

550

Sale allowance for damaged

goods

______________

fIGuRe 7.16