Chapter 7

Inventory: Merchandising Transactions

178

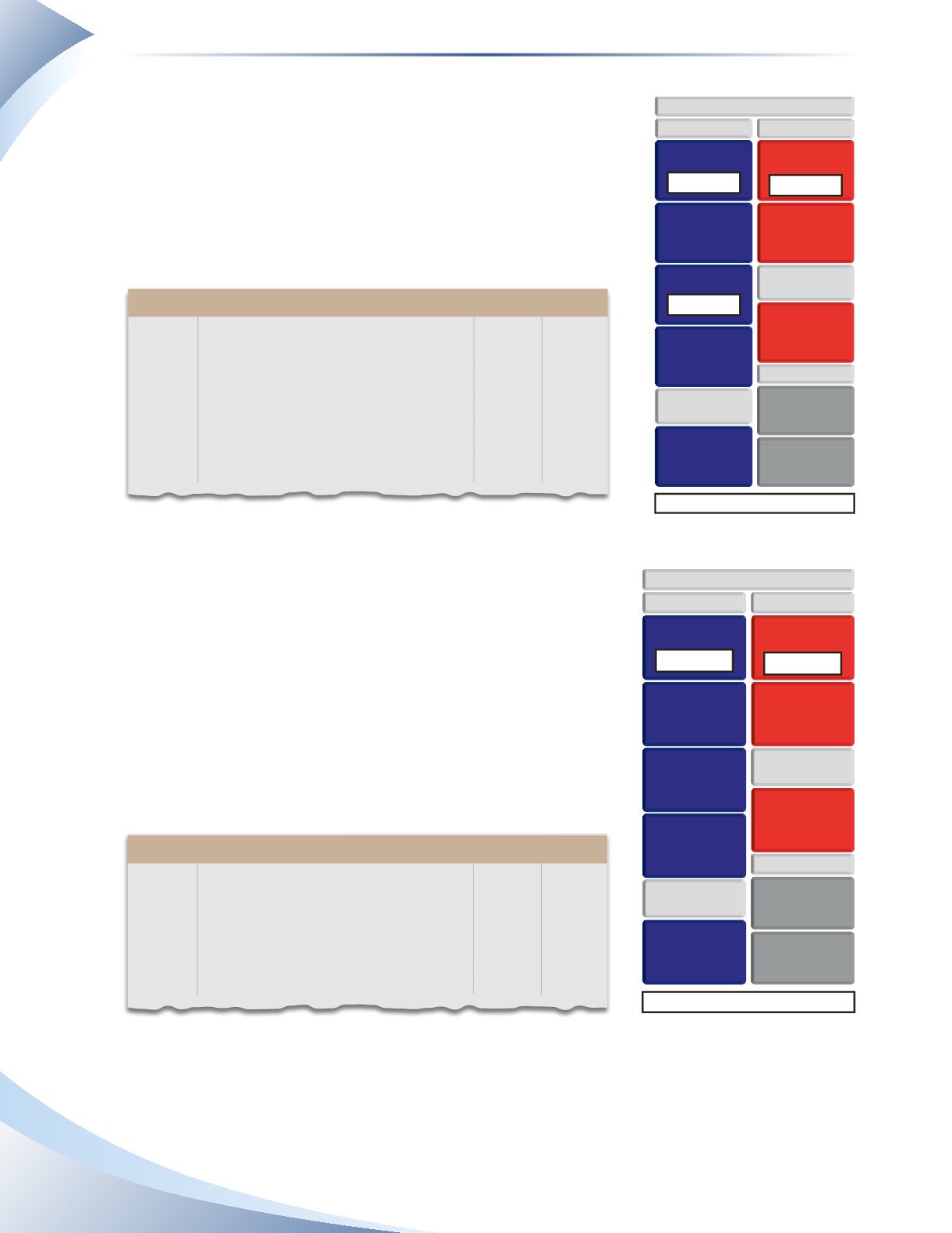

Assume Tools 4U made the payment on January 10, the amount for

the bill will be $4,200 less the $84 discount ($4,200 × 2%). Since

the business is paying less for the inventory, the value of the

inventory needs to decrease by the value of the discount.The entry

to record the payment is shown in Figure 7.9.

The discount of $84 is credited to inventory because the adjustment

is made to reflect the true cost of the goods.

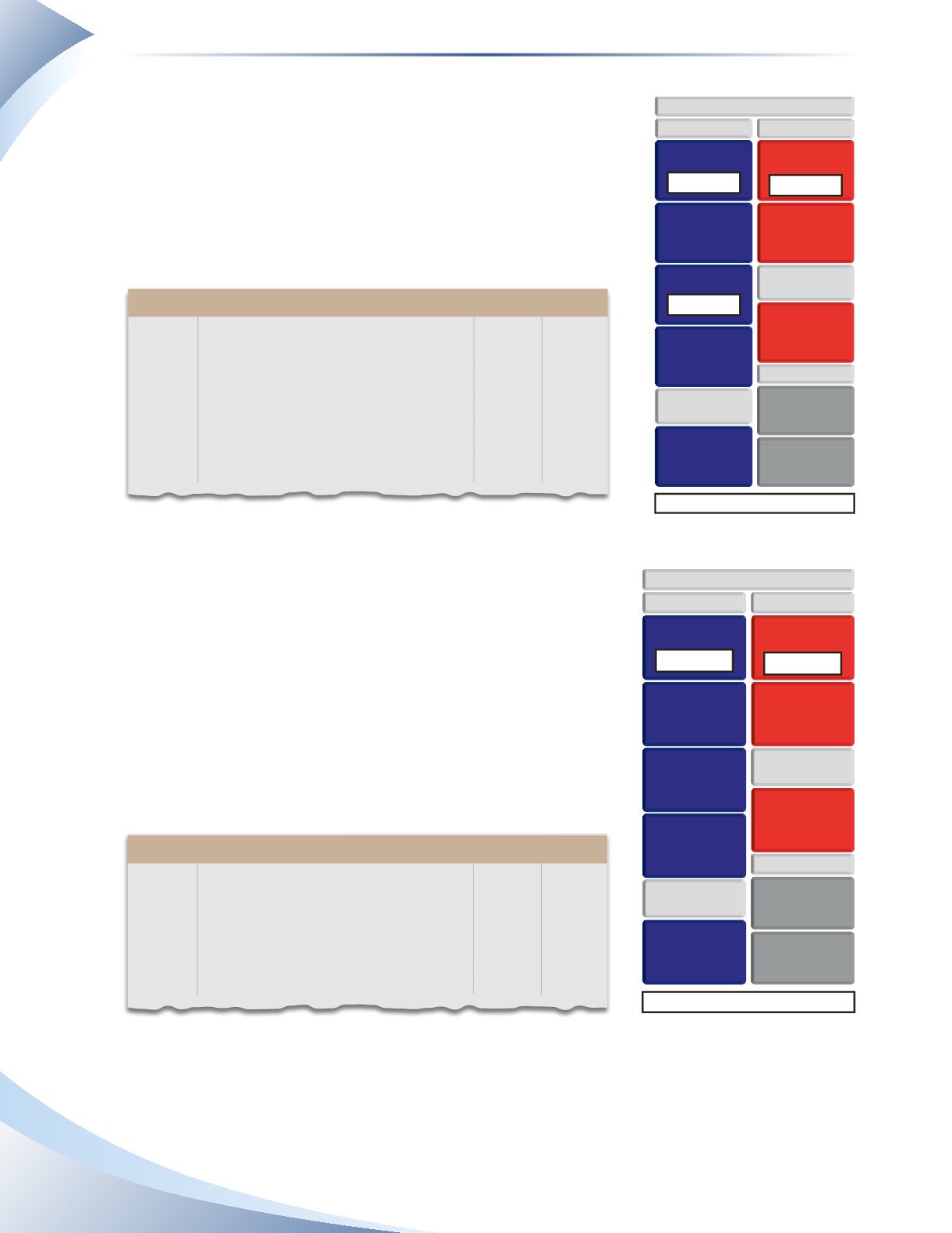

If Tools 4U decides not to pay the amount owing within 10

days, then it is not entitled to take the discount. It must pay the

full amount of $4,200 within 30 days of the invoice date. This

payment is just like paying any other amount that is owed to a

supplier. Cash will decrease and accounts payable will decrease by

the amount owed. The entry is shown in Figure 7.10. Notice the

date is more than 10 days past the invoice date.

No change in owner’s equity

BALANCE SHEET

INVENTORY

– $84 CR

CURRENT ASSETS

CASH

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

– $4,200 DR

– $4,116 CR

CURRENT LIABILITIES

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

LONG-TERM

LIABILITIES

Journal Page 1

date

2016

account title and explanation

debit Credit

Jan 10 Accounts Payable

4,200

Cash

4,116

Inventory

84

Paid invoice and took purchase discount

______________

fIGuRe 7.9

No change in owner’s equity

BALANCE SHEET

INVENTORY

CURRENT ASSETS

CASH

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

– $4,200 DR

– $4,200 CR

CURRENT LIABILITIES

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

LONG-TERM

LIABILITIES

Journal Page 1

date

2016

account title and explanation

debit Credit

Jan 24 Accounts Payable

4,200

Cash

4,200

Paid amount owing to Roofs and More

______________

fIGuRe 7.10