Chapter 7

Inventory: Merchandising Transactions

188

An actual company’s balance sheet and income statement will usually look similar to what we have

seen up to this point. However, most companies’ financial statements will also have an additional

column to show amounts from the previous fiscal year. for instance, a company reporting for fiscal

year 2016 will have a column with the header

“

2016

”

in each of the balance sheet and income statement

to report financial information for the most recent fiscal year. There may also be an additional column with

the header

“

2015

”

to show amounts from the previous fiscal year. This form of financial reports is referred

to as comparative financial statements. This allows users to easily compare the financial performance and

position of a company to that of the previous year.

Some companies go beyond the two-year comparison. This allows users, such as investors, to identify both

short-term and long-term trends in the financial data. The investors can then assess whether or not the

business is growing at a rate they anticipated.

INTHE REAL WORLD

Closing entries

When using a perpetual inventory system, inventory is immediately updated after each purchase

and sale transaction. However, the value of inventory on the balance sheet may not accurately

represent the value of inventory actually on hand. To verify the accuracy of the accounting records,

a physical inventory count should be performed at the end of the reporting period. If the count

does not match the records, an adjustment must be made to bring the inventory to its correct

balance.This difference is often referred to as “inventory shrinkage,” resulting either from an error

in recording transactions, theft or breakage. If the amount is considered immaterial, the following

entry would be made where the balance in the inventory account was more than the physical count.

Assuming that the amount of shrinkage is $200, the journal entry for this transaction is shown in

Figure 7.22.

Journal

Page 1

date account title and explanation debit Credit

2016

Dec 31 Cost of Goods Sold

200

Inventory

200

Adjust inventory to physical count

______________

fIGuRe 7.22

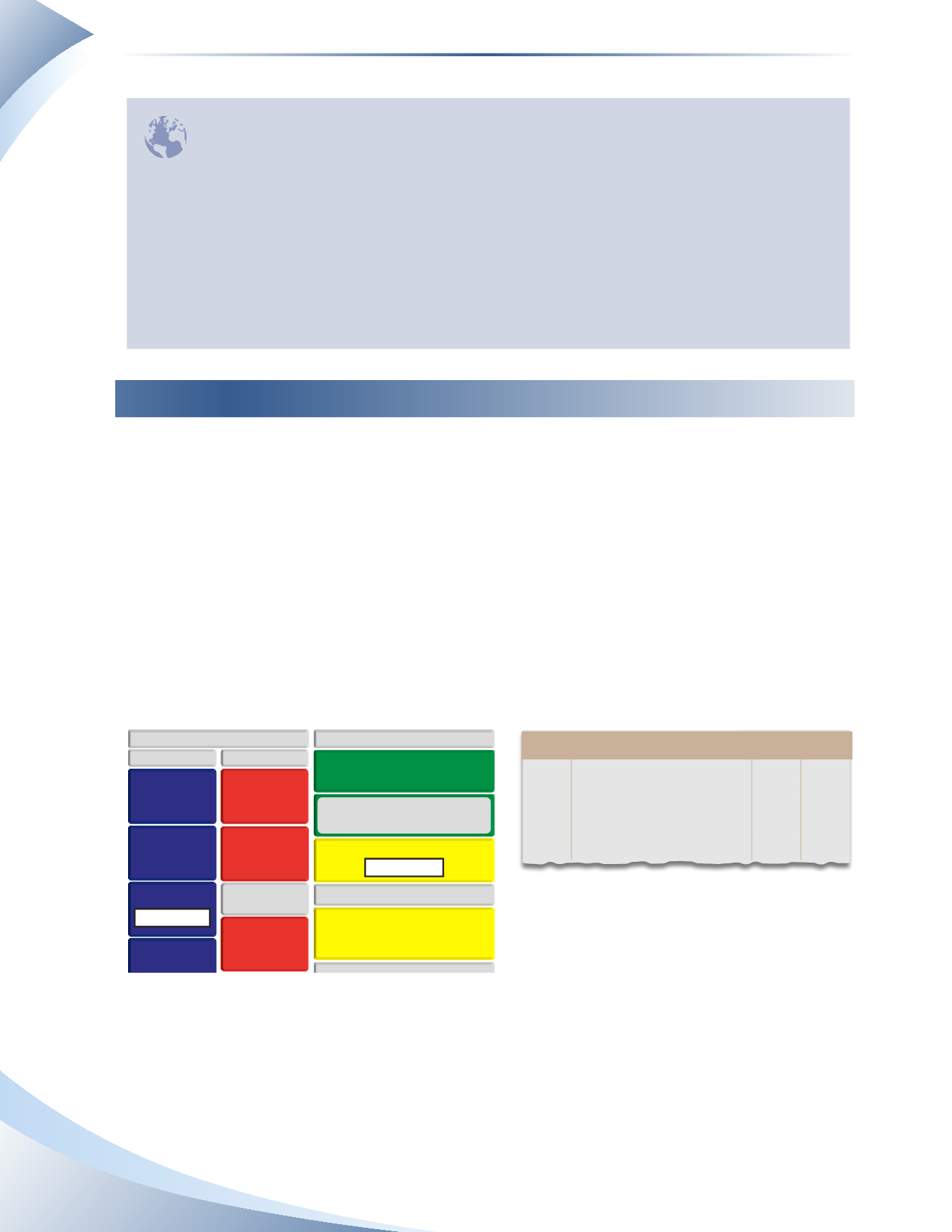

SALES RETURNS & ALLOWANCES

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

CURRENT ASSETS

CASH

INVENTORY

ACCOUNTS

RECEIVABLE

ACCOUNTS

PAYABLE

BANK LOAN

CURRENT LIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

+ $200 DR

– $200 CR

After this adjustment and all other adjustments have been made, assume Tools 4U has the adjusted

trial balance shown in Figure 7.23.