Chapter 7

Inventory: Merchandising Transactions

185

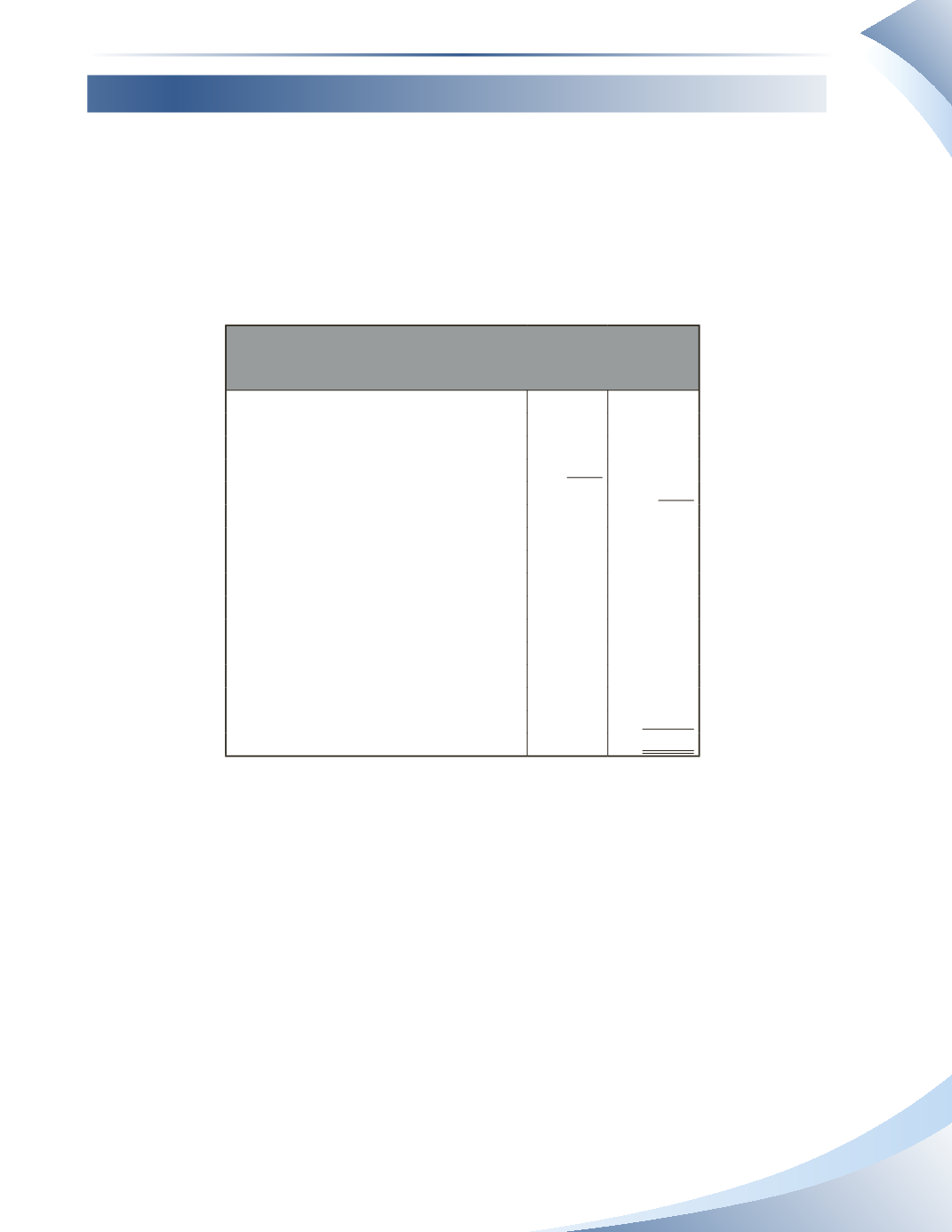

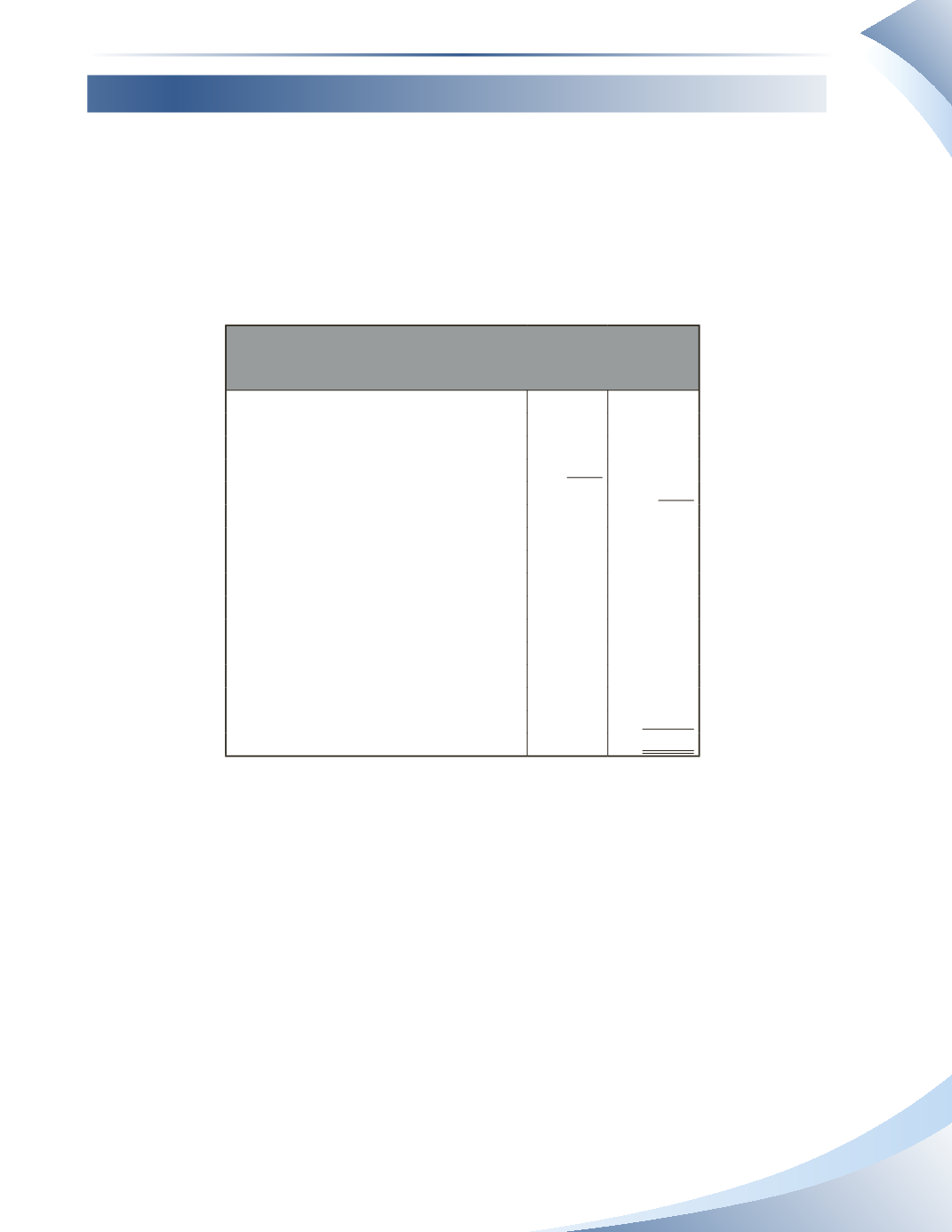

Multistep Income Statement

The income statement of a merchandising business follows the same principles as those of a service

business. Until now, we have been grouping revenue accounts together and listing all expenses

together, without further categorizing. A merchandising business must include the contra-revenue

accounts on the income statement. Sales returns and allowances and sales discounts are subtracted

from sales revenue. This is shown in Figure 7.19. This format of the income statement classifies

expenses by their

nature

.This simply means that expenses are presented together, without further

categorizing them by function.

Tools 4U

Income Statement

For the Year Ended December 31, 2016

Revenue

Sales Revenue

$200,000

Less: Sales Returns and Allowances

$4,000

Sales Discounts

2,000

(6,000)

Interest Revenue

8,000

Total Revenue

202,000

Expenses

Cost of Goods Sold

100,000

Depreciation Expense

5,000

Interest Expense

4,000

Rent Expense

10,000

Salaries Expense

40,000

Supplies Expense

7,000

Utilities Expense

6,000

Total Operating Expenses

172,000

Net Income

$30,000

________________

figure 7.19