Chapter 7

Inventory: Merchandising Transactions

183

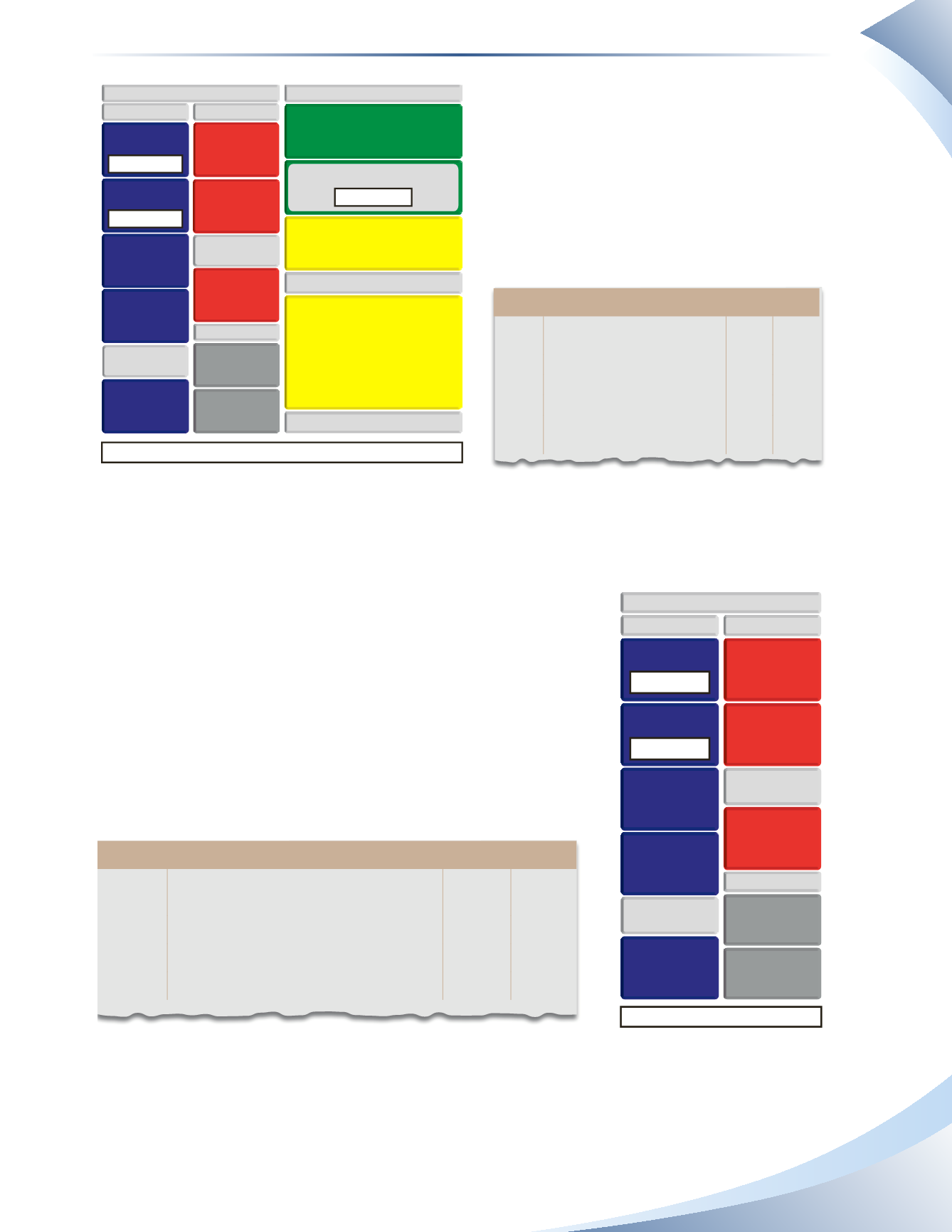

Owner’s equity decreases by $209

SALES RETURNS & ALLOWANCES

INCOME STATEMENT

GROSS PROFIT

OPERATING EXPENSES

SALES REVENUE

COST OF GOODS SOLD

BALANCE SHEET

OPERATING INCOME (LOSS)

CURRENT ASSETS

CASH

INVENTORY

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

BANK LOAN

OWNER’S EQUITY

CURRENT LIABILITIES

UNEARNED

REVENUE

LONG-TERM

LIABILITIES

– $10,450 CR

+ $209 DR

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

+ $10,241 DR

Journal

Page 1

date

2016

account title and explanation debit Credit

Jan 20 Cash

10,241

Sales Discounts

209

Accounts Receivable

10,450

Payments received from customer

less discount

______________

fIGuRe 7.17

The $209 discount is recorded as a debit in the

sales discounts

account. Sales discounts is another

contra-revenue account which increases with a debit and decreases with a credit.

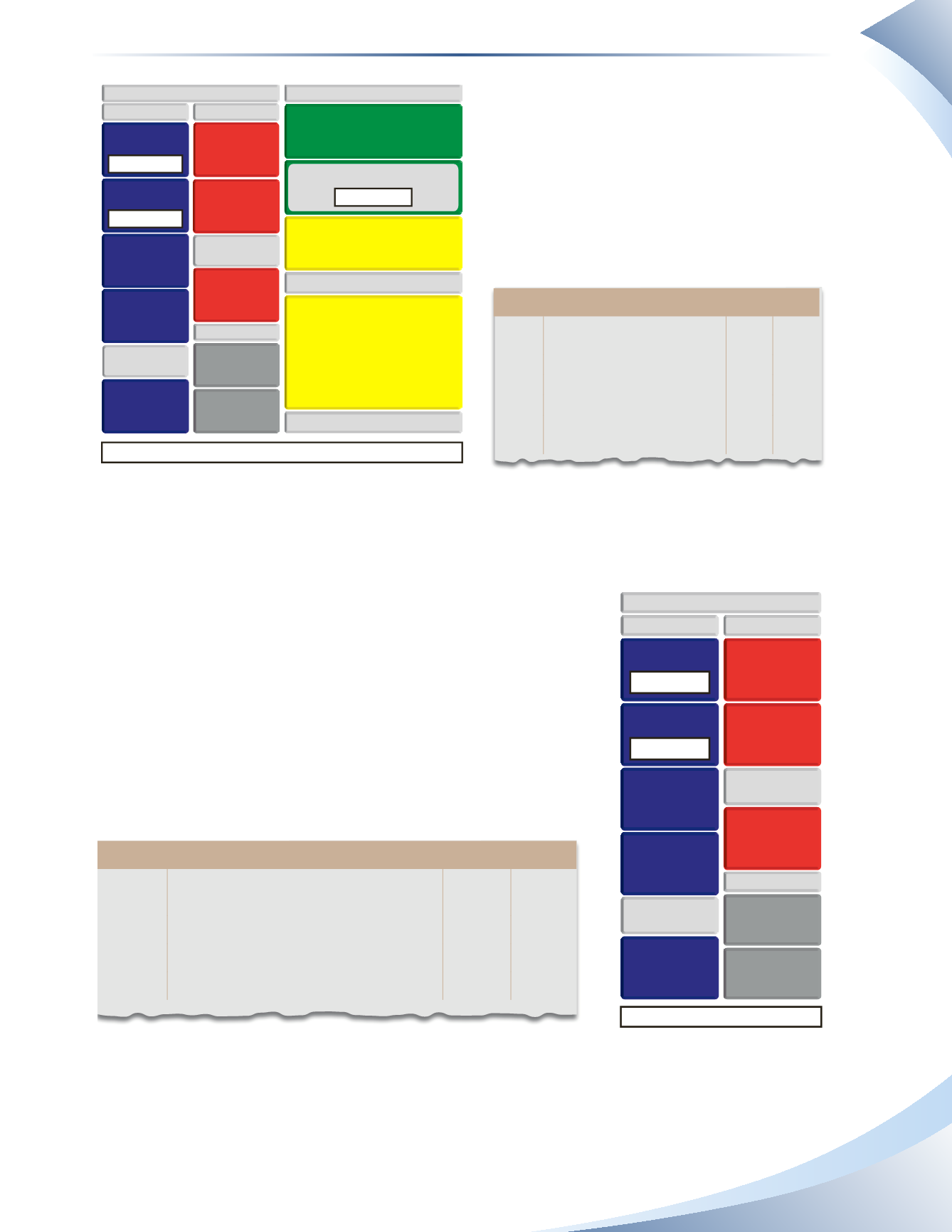

If the customer decides not to pay the amount owing within the

discount period, then it is not entitled to take the discount that

Tools 4U offers. Instead, the customer must pay the full amount

of $10,450 within 30 days of the sale. The receipt of cash from

the customer is just like receiving cash from any customer that

owes the company money. Cash increases and accounts receivable

decreases.The entry is shown in Figure 7.18. Notice that the date

is more than 10 days past the date of the sale.

No change in owner’s equity

BALANCE SHEET

INVENTORY

CURRENT ASSETS

CASH

PREPAID

EXPENSES

PROPERTY, PLANT

& EQUIPMENT

ACCOUNTS

RECEIVABLE

LONG-TERM

ASSETS

ACCOUNTS

PAYABLE

+ $10,450 DR

– $10,450 CR

CURRENT LIABILITIES

UNEARNED

REVENUE

BANK LOAN

OWNER’S EQUITY

OWNER’S

CAPITAL

OWNER’S

DRAWINGS

LONG-TERM

LIABILITIES

Journal Page 1

date

2016

account title and explanation

debit Credit

feb 2 Cash

10,450

Accounts Receivable

10,450

Payment received from customer

______________

fIGuRe 7.18