Chapter 7

Inventory: Merchandising Transactions

187

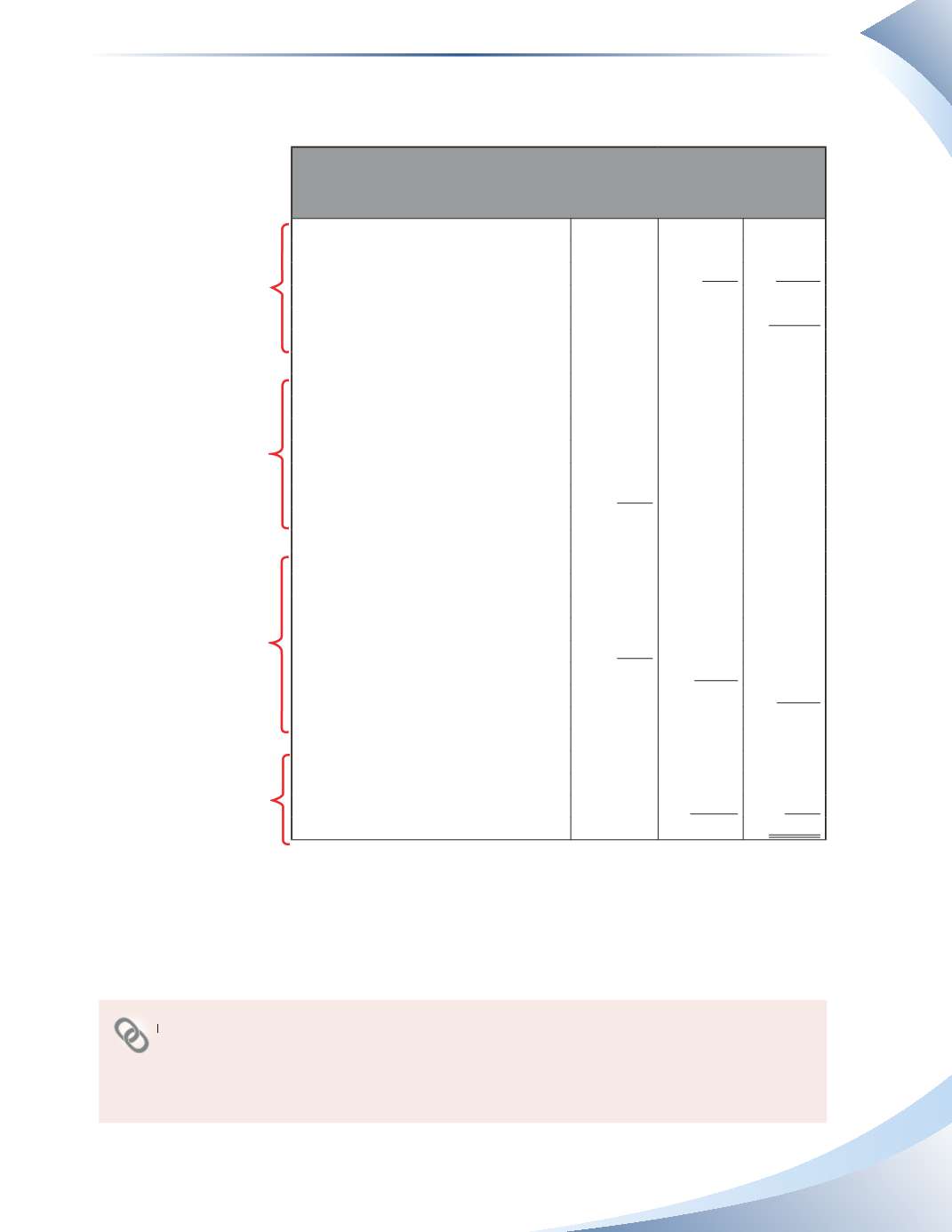

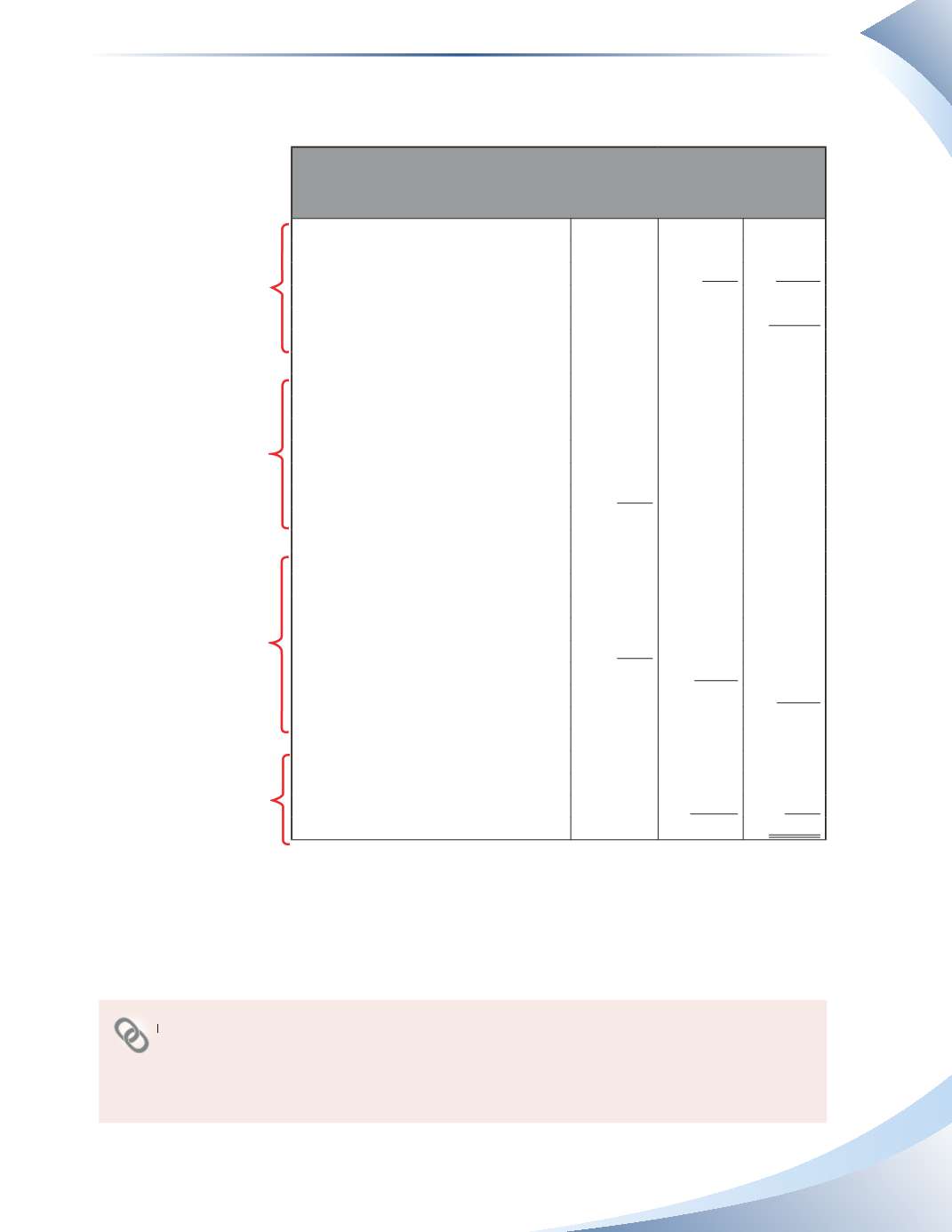

Figure 7.21, in a

classified multistep income statement

. Classified multistep income statements

further divide expenses into selling and administrative categories.

tools 4u

Income statement

For the year ended december 31, 2016

sales revenue

$200,000

Less: Sales Returns and Allowances

$4,000

Sales Discounts

2,000 (6,000)

Net Sales

194,000

Cost of Goods Sold

100,000

gross Profit

94,000

operating expenses

selling expenses

Depreciation expense

$5,000

Rent expense

8,000

Salaries expense

32,000

utilities expense

4,800

Total Selling expenses

49,800

administrative expenses

Rent expense

2,000

Salaries expense

8,000

Supplies expense

7,000

utilities expense

1,200

Total Administrative expenses

18,200

Total Operating expenses

68,000

operating Income

26,000

other revenue and expenses

Interest Revenue

8,000

Interest expense

(4,000)

4,000

net Income

$30,000

________________

fIGuRe 7.21

The classified multistep income statement is particularly useful for the company’s internal analysis.

It allows managers and executives to clearly see a detailed breakdown of costs by department and

compare performance in different areas against competitors and its own financial history.

ASPe allows a company to choose to present its expenses on an income statement by nature, by

function, or even by using a mixture of nature and function.

under IfRS, expenses can be classified either by nature or by function on an income statement. using a

mixture of nature and function is prohibited.

ASPE vs IFRS

1. Calculate Net

Sales and Gross

Profit

2. Calculate Selling

expenses

3. Calculate

Administrative

expenses and

Operating Income

4. Calculate non-

operating activities

and Net Income