Chapter 8

Inventory Valuation

229

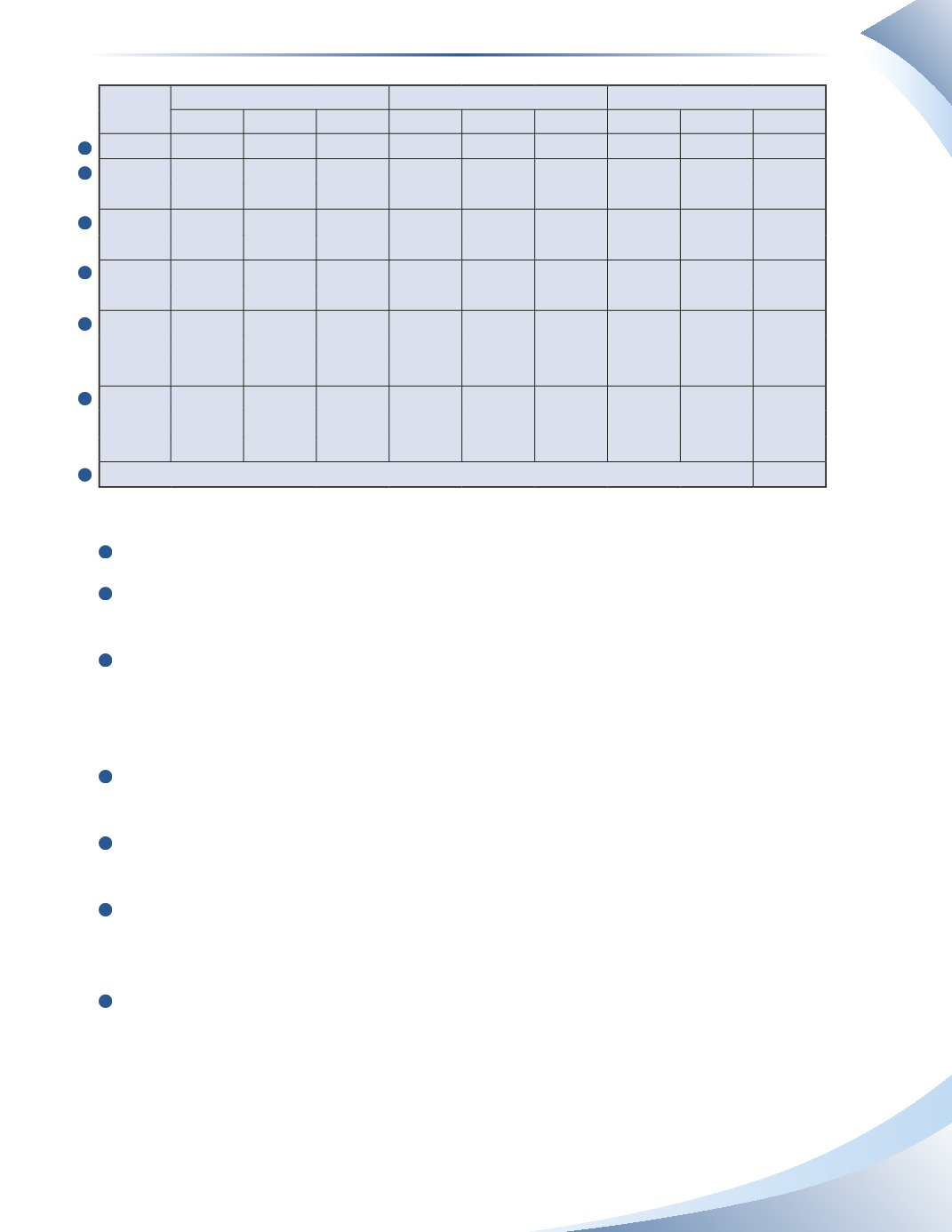

Date

Purchases

Sales

Balance

Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value

March 1

10

$10

$100

March 5

50

$12

$600

10

$10

$100

50

$12

$600

March 7

10

$10

$100

5

$12

$60

45

$12

$540

March 15

40

$14

$560

45

$12

$540

40

$14

$560

March 19

20

$16

$320

45

$12

$540

40

$14

$560

20

$16

$320

March 27

45

$12

$540

5

$14

$70

35

$14

$490

20

$16

$320

Ending Inventory

$810

______________

FIGURE 8.3

1

Record the opening balance of inventory of 10 pens at $10 each.

2

The purchase of 50 pens on March 5 is added to the value of inventory. These are listed on a

separate line from the 10 opening units because they were purchased on a different date.

3

The sale of 15 pens on March 7 must first use the costs from the opening balance. Since there

were only 10 pens in the opening balance, another five are taken from the purchase on March

5.This means that the entire opening balance inventory has been sold and only 45 units remain

from the purchase on March 5.The value of cost of goods sold for this sale is $160 ($100 + $60).

4

The purchase of 40 pens on March 15 is added to the value of inventory. Again, a new row is

used because they were purchased on a different date.

5

The purchase of 20 pens on March 19 is added to the value of inventory. Again, a new row is

used because they were purchased on a different date.

6

The sale of the 50 pens on March 27 must first use the costs from the purchase on March 5.

Since there are only 45 pens left from that purchase, another five are taken from the purchase

on March 15.The value of cost of goods sold for this sale is $610 ($540 + $70).

7

The value of ending inventory is made up of 35 pens remaining from the March 15 purchase

and 20 pens from the March 19 purchase. Total value of inventory is $810 ($490 + $320).

Weighted-Average Cost Method

The weighted-average cost method is used when inventory items are identical and the order they

are sold in is irrelevant. For example, a gas station has its gasoline tank filled, and the new product

is mixed with the old product.

1

2

3

4

5

6

7