Chapter 8

Inventory Valuation

230

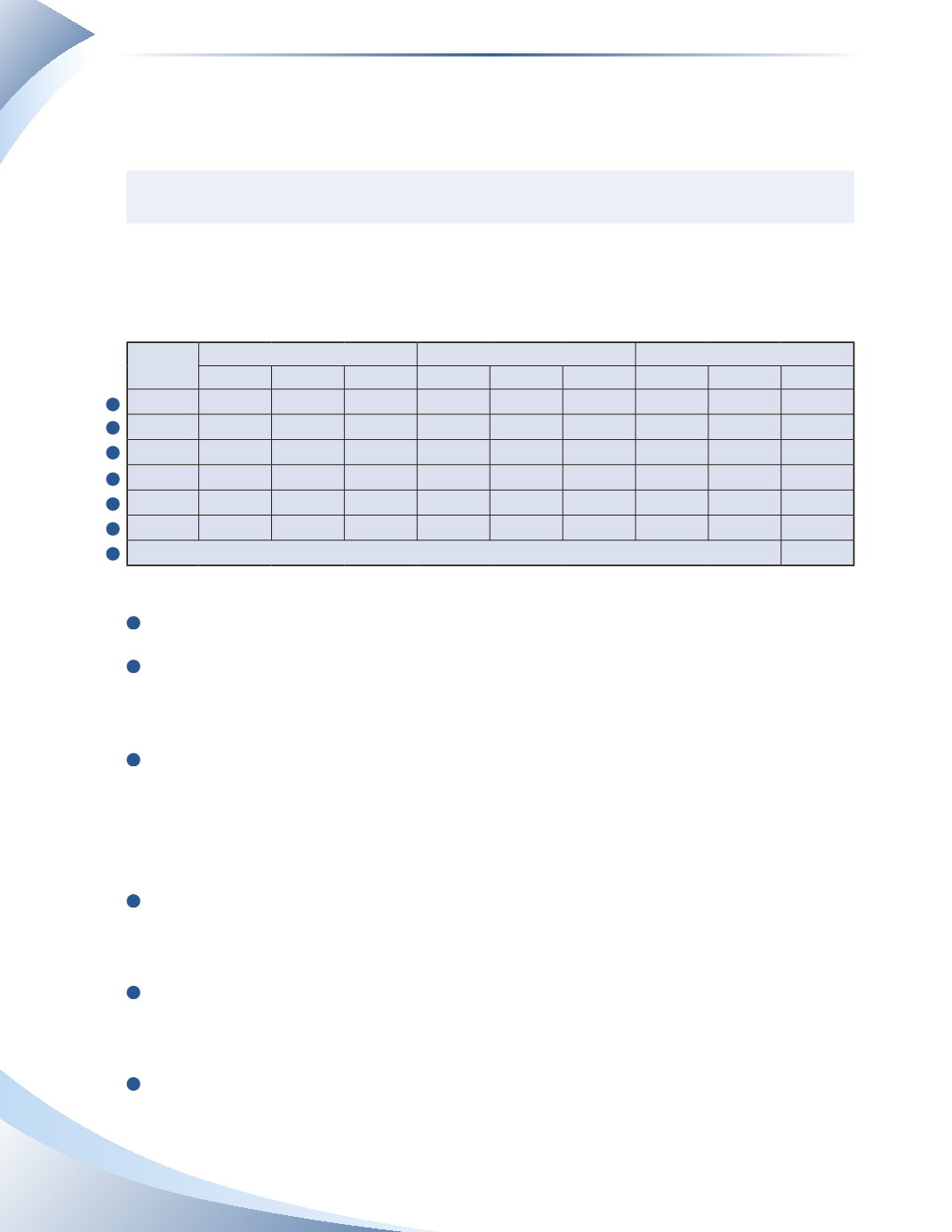

When using the weighted-average cost method, the total inventory value is divided by the total

quantity on hand to arrive at an average cost for each unit.This is done by using a table as shown

in Figure 8.4.

Average Unit Cost = Total Value ÷ Total Quantity

The opening balance and the transactions from Figure 8.1 are listed in the table.The average unit

cost changes after every purchase, but not after a sale. At the bottom of the figure is the value of

ending inventory.

Date

Purchases

Sales

Balance

Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value

March 1

10 $10.00 $100.00

March 5

50

$12

$600

60 $11.67 $700.00

March 7

15 $11.67 $175.05

45 $11.67 $524.95

March 15

40

$14

$560

85 $12.76 $1,084.95

March 19

20

$16

$320

105 $13.38 $1,404.95

March 27

50 $13.38 $669.00

55 $13.38 $735.95

Ending Inventory

$735.95

______________

FIGURE 8.4

1

Record the opening balance of inventory of 10 pens at $10 each.

2

The purchase of 50 pens on March 5 is added to the quantity on hand. The value of the 50

pens is first added to the value of the opening inventory.The average unit cost is approximately

$11.67 ($700 ÷ 60 units).

3

The sale of 15 pens on March 7 is taken from inventory. The most recent unit cost of

approximately $11.67 per unit is used to calculate the cost of goods sold of $175.05 ($11.67 x

15). Both the quantity and value of inventory decrease, and the unit cost is still approximately

$11.67 ($524.95 ÷ 45 units).The unit cost of inventory will never change after a sale; it can only

change after a purchase.

4

The purchase of 40 pens on March 15 is added to the quantity on hand.The value of the 40 pens

is added to current value of inventory.The unit cost is now approximately $12.76 ($1,084.95 ÷

85 units).

5

The purchase of 20 pens on March 19 is added to the quantity on hand.The value of the 20 pens

is added to current value of inventory.The unit cost is now approximately $13.38 ($1,404.95 ÷

105 units).

6

The sale of the 50 pens on March 27 is taken from inventory. The most recent cost of

approximately $13.38 per unit is used to calculate the cost of goods sold of $669.00 ($13.38 ×

50).

1

2

3

4

5

6

7