Chapter 8

Inventory Valuation

236

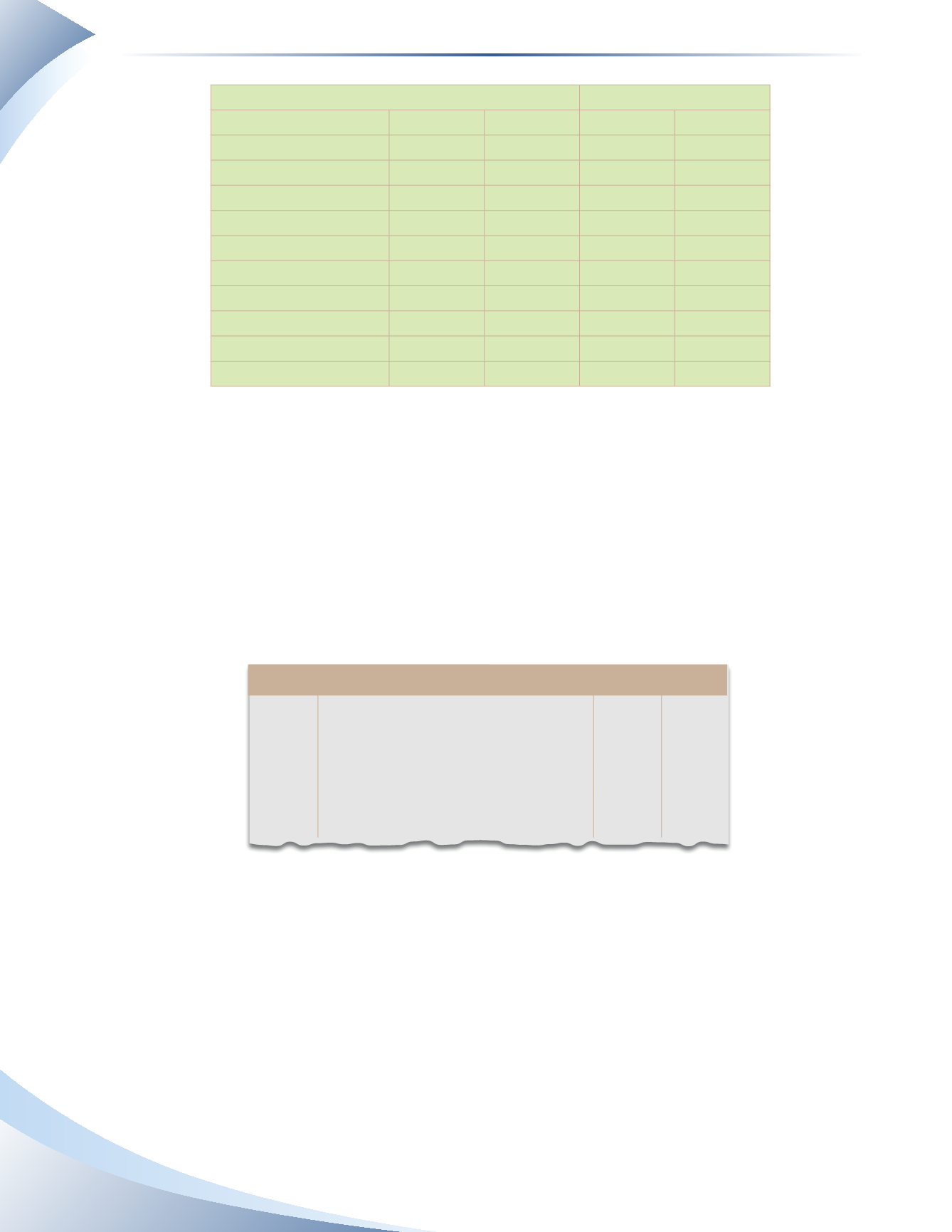

LCRNV

Cost

NRV Individual

Category

Point-and-Shoot

Camera 1

40,000

12,000

12,000

Camera 2

35,000

45,000

35,000

Total Point-and-Shoot

75,000

57,000

57,000

DSLR

Camera A

80,000

110,000

80,000

Camera B

90,000

130,000

90,000

Total DSLR

170,000

240,000

170,000

Camera Bags

15,000

20,000

15,000

Total

$260,000 $317,000

_______________

FIGURE 8.11

The total cost of $260,000 is the current balance of the inventory account and is broken down

between the various inventory items carried by the store. NRV is the net realizable value of the

different inventory items. Notice that the point-and-shoot camera 1 has an NRV significantly less

than the cost.This model may be outdated and thus difficult to sell.

Usually, LCNRV is applied to individual inventory items. In our example, only camera 1 shows an

NRV less than cost.The difference between its cost and its NRV is $28,000 ($40,000 − $12,000).

Therefore inventory must be written down by $28,000. The write-down decreases inventory and

increases cost of goods sold.The journal entry is shown in Figure 8.12.

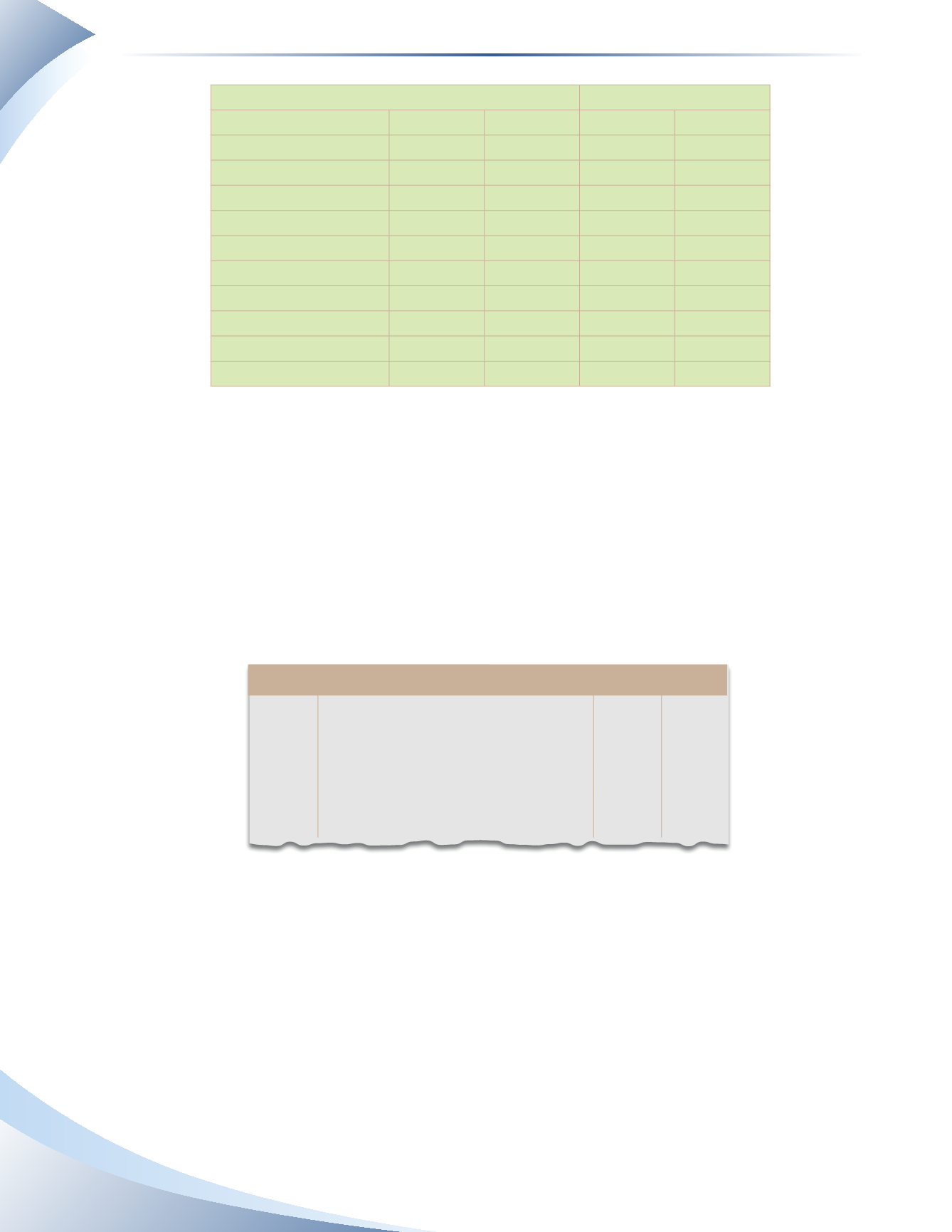

JOURNAL

Page 1

Date

2016

Account Title and Explanation

Debit Credit

Dec 31 Cost of Goods Sold

28,000

Inventory

28,000

Adjust inventory to LCNRV

_______________

FIGURE 8.12

LCRNV is generally applied to individual inventory items, but in certain circumstances can be

applied to categories of inventory. In our example, if all point-and-shoot cameras are becoming

obsolete and will no longer be sold by the store, it may be easier to write-down the entire category.

The difference between cost and NRV for the point-and-shoot category is $18,000 ($75,000 −

$57,000). If LCNRV were applied to inventory categories, the value used in the journal entry

would have been $18,000.

If the NRV of an inventory item increases after it has already been written down, a company may

reverse the write-down. However, the reversal cannot exceed the amount of the original write-

down. In other words, the value recorded for any inventory item cannot exceed its historical cost.