Chapter 8

Inventory Valuation

233

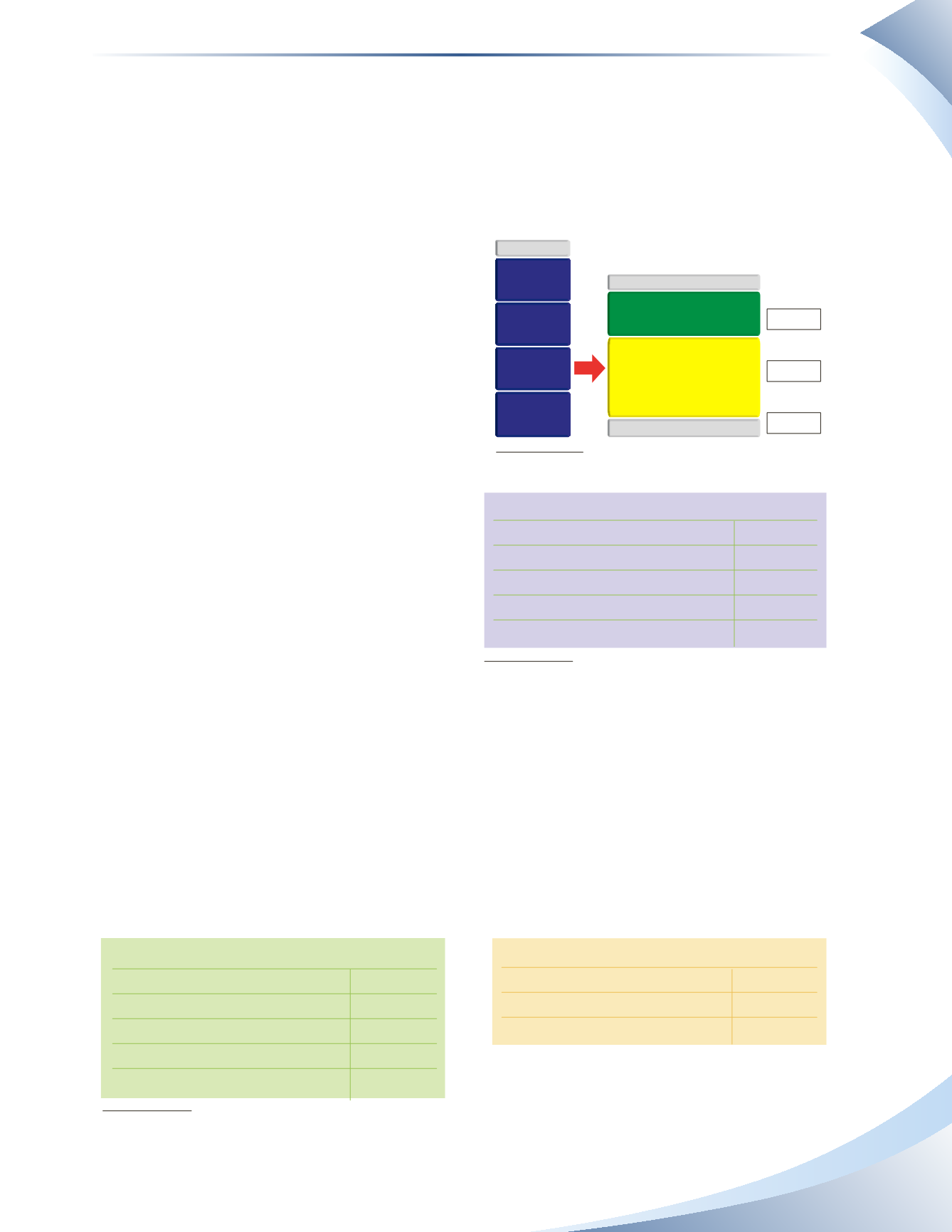

The Impact of Cost of Goods Sold on Gross Profit

Although inventory is a balance sheet account, it can have an immediate impact on the income

statement because the cost of goods sold is used to calculate gross profit. Gross profit in turn is used

to calculate the gross margin percentage.The gross margin percentage represents the percentage of

sales left to pay the remaining operating expenses of the company.

This relationship between inventory and gross

profit is demonstrated in Figure 8.6.

It should become clear that the cost of goods sold

is a focal point when dealing with inventory on a

company’s financial statements.

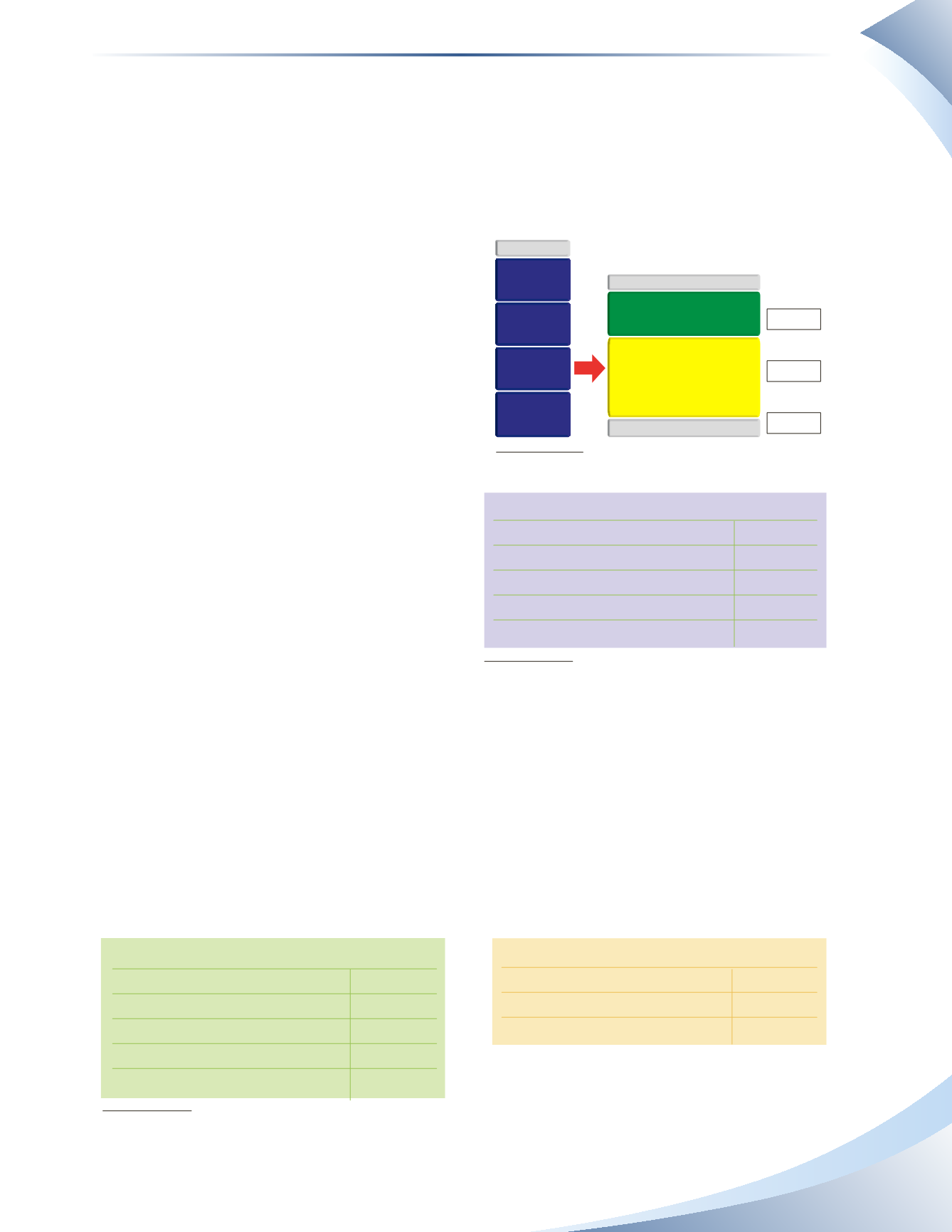

In a periodic inventory system,COGS is calculated

by adding total inventory purchases to the value of

inventory on hand at the beginning of the period,

then deducting the closing value of inventory at

the end of the period. The closing value of

inventory is determined by a physical count. An

example of the calculation is shown in Figure

8.7.

In other words, a company’s COGS represents

the amount of inventory that is used/sold in a

period.

Errors in valuing closing inventory can affect COGS and, as a result, gross profit. Beyond affecting

COGS and gross profit, an incorrect inventory value affects opening inventory for the next period.

We will examine the impact on gross profit while ignoring the effects on net income for the year.

The Effect of Overstating Inventory

We will use two examples. One set of charts will include the correct amount for closing inventory;

the other set of charts will include an incorrect amount for closing inventory.

We will then look at how this error affects the other important figures on the company’s financial

statements. Figure 8.8 shows the correct numbers.

Inventory Calculation

Opening Inventory

5,000

Plus: Purchases

75,000

Cost of Goods Available for Sale

80,000

Less: Closing Inventory

9,000

Cost of Goods Sold

71,000

Income Statement Year 1

Sales

$100,000

Less: Cost of Goods Sold

71,000

Gross Profit

$29,000

FIGURE 8.8

CURRENT ASSETS

CASH

OTHER CURRENT

ASSETS

ACCOUNTS

RECEIVABLE

INVENTORY

INCOME STATEMENT

GROSS PROFIT

REVENUE

COST OF GOODS SOLD

$10,000

$6,000

$4,000

minus

equals

= 40%

Gross Margin

FIGURE 8.6

Inventory Calculation

Opening Inventory

10,000

Plus: Purchases

60,000

Cost of Goods Available for Sale

70,000

Less: Closing Inventory

20,000

Cost of Goods Sold

50,000

FIGURE 8.7