219

Review Exercise

Part 1

The following transactions occurred between George’s Gardening Supplies and Michael’s

Distributing during the month of December 2016.

Dec 3 George’s Gardening Supplies purchased $50,000 worth of inventory on account from

Michael’s Distributing. The purchase terms were 2/10 n/30. The cost of the goods to

Michael’s Distributing was $35,000.

Dec 6 Freight charges of $200 were paid in cash by the company which incurred them.

Dec 8 George’s Gardening Supplies returned $2,000 of incorrect inventory from the purchase

on December 3. Michael’s Distributing put the merchandise back into inventory. The

cost of the goods to Michael’s Distributing was originally $700.

Dec 11 George’s Gardening Supplies paid the balance owing to Michael’s Distributing.

Assuming that both companies use the perpetual inventory system, complete the following

exercise.

a) Journalize the December transactions for George’s Gardening Supplies. Assume the goods

from December 3 were shipped FOB shipping point.

b) Journalize the December transactions for Michael’s Distributing. Assume the goods from

December 3 were shipped FOB destination.

See Appendix I for solutions.

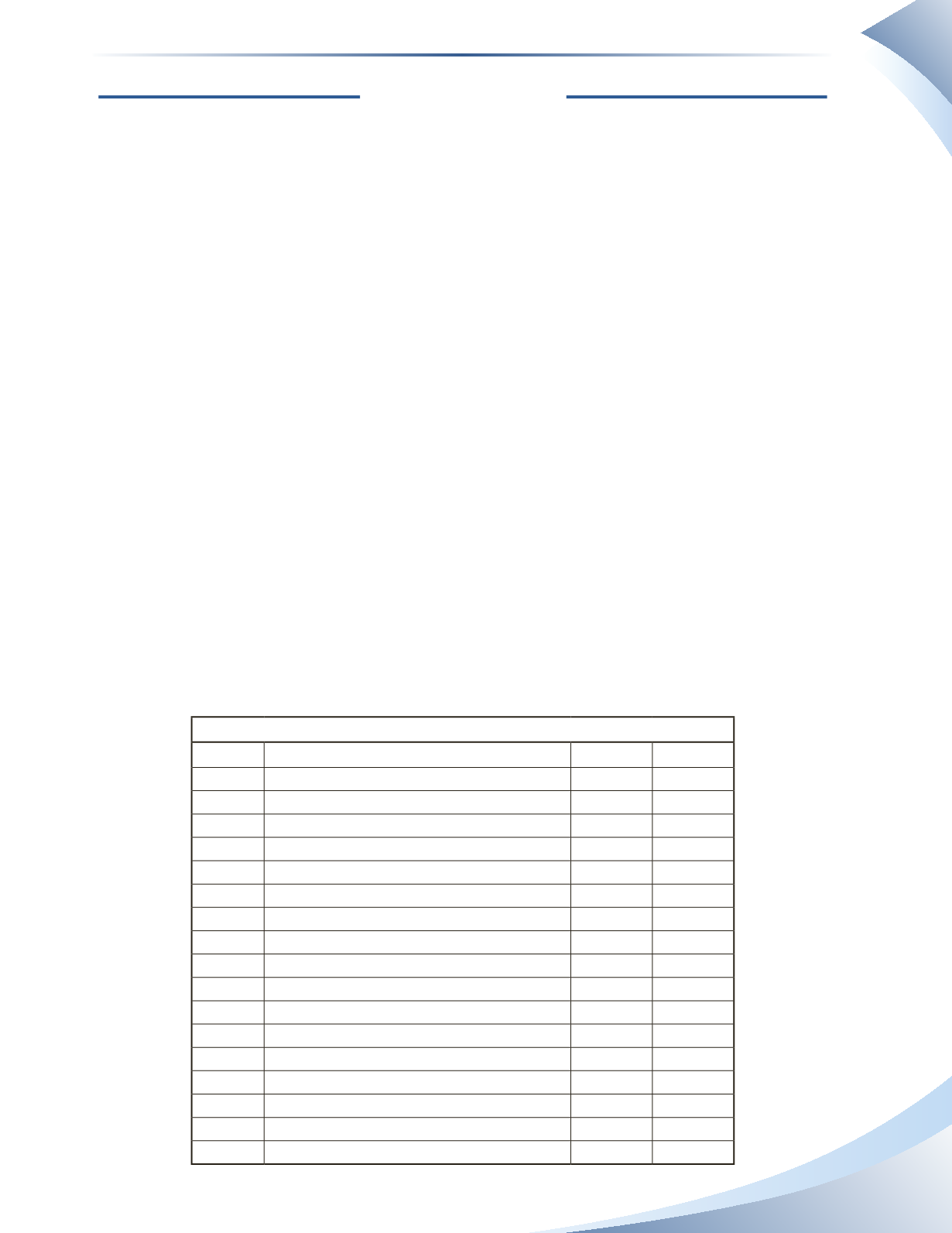

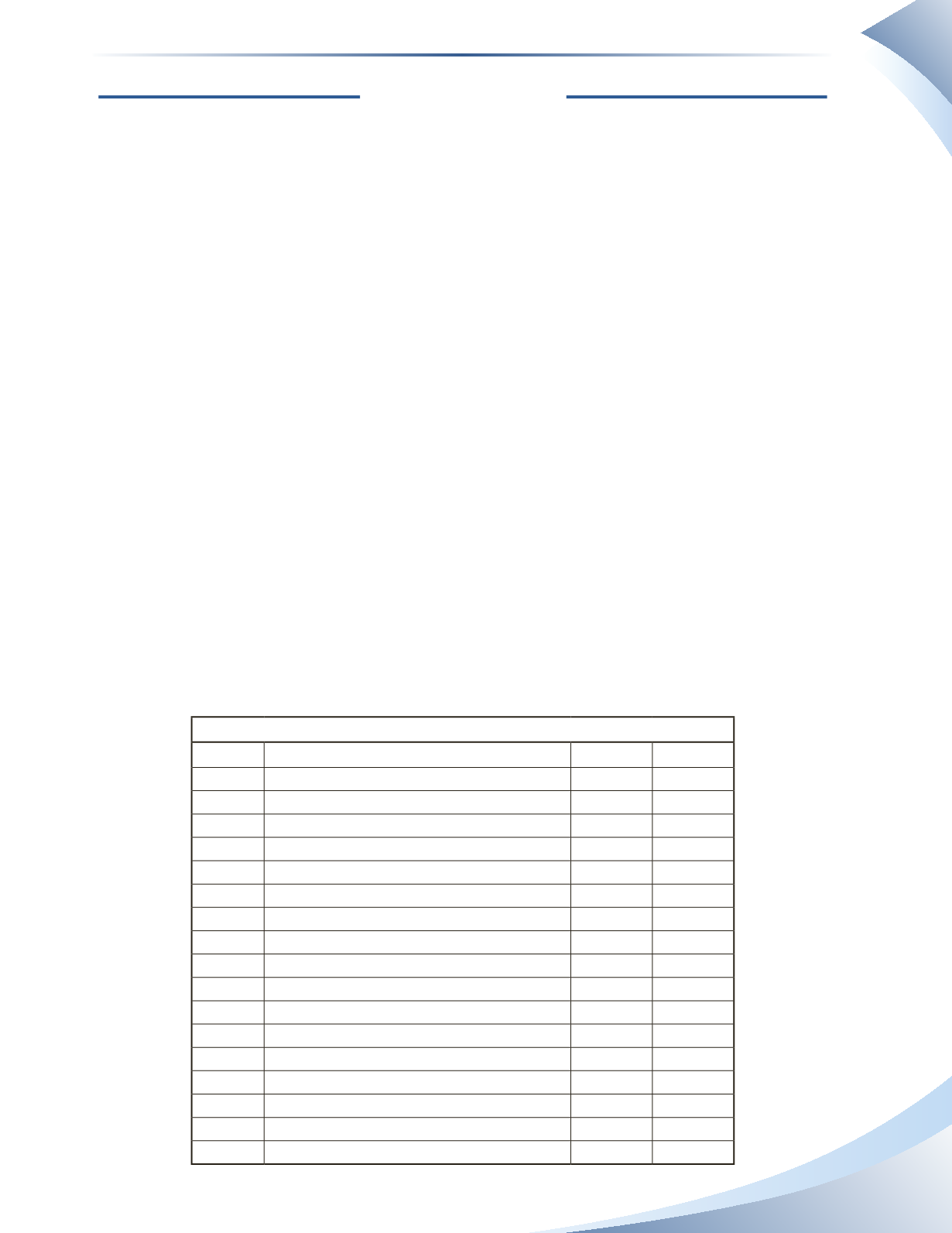

a) December transactions for George’s Gardening Supplies

Journal

Page 1

Date

Account Titles and Explanation

Debit

Credit

Inventory: Merchandising Transactions

Chapter 7 Appendix