Chapter 8

Inventory Valuation

231

7

The value of ending inventory is 55 pens at the average unit cost of approximately $13.38.Total

value of inventory is $735.95.

The Effect of Different Valuation Methods

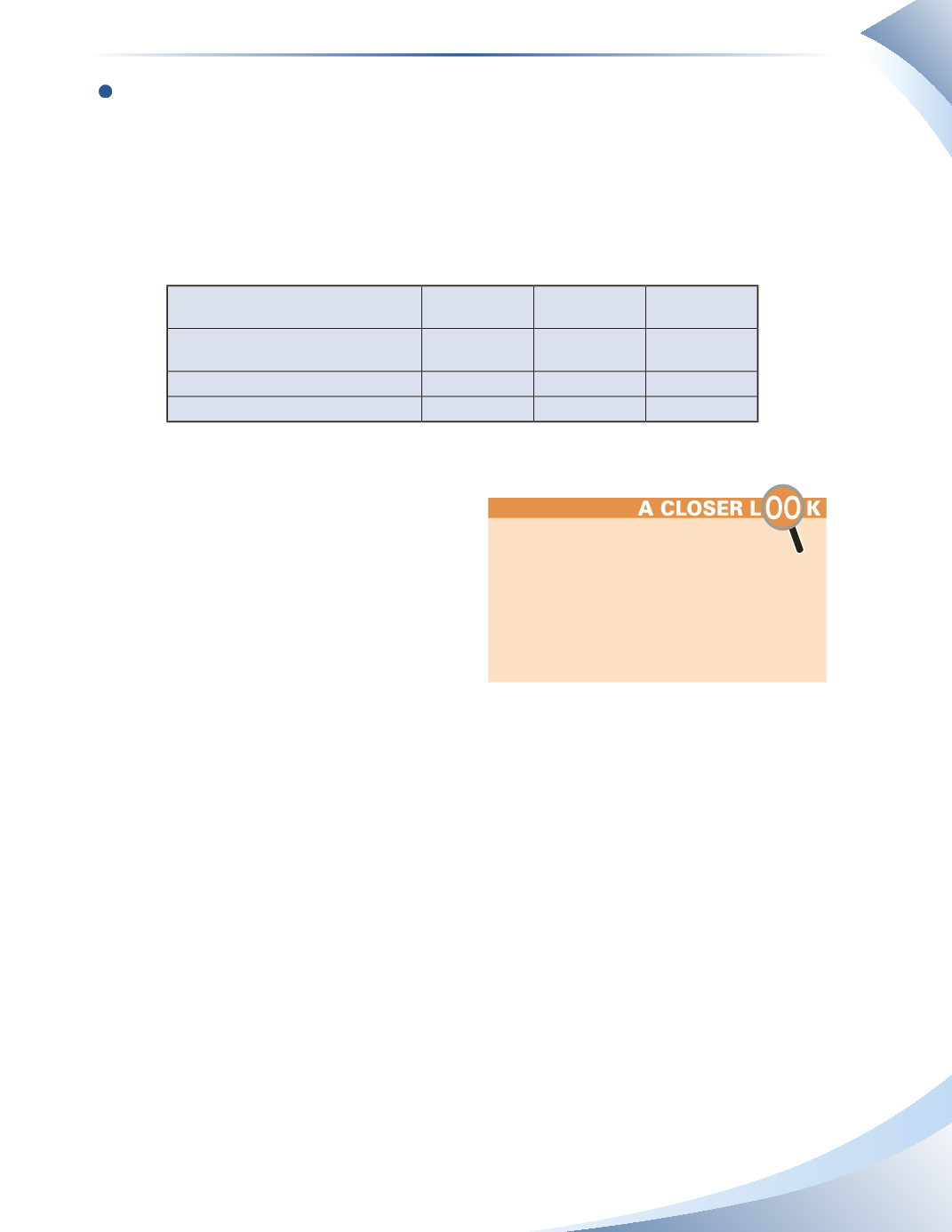

As the previous example with Cool Ink Company demonstrates, different ending inventory figures

are produced using different valuation methods. The chart in Figure 8.5 summarizes these

differences for the Cool Ink example.

Specific

Identification

FIFO

Weighted-

Average Cost

Inventory Available for Sale

(beginning inventory + purchases)

$1,580

$1,580

$1,580

Ending Inventory

790

810

735.95

Value of COGS

790

770

844.05

______________

FIGURE 8.5

The above example illustrates an important point.

In cases where the unit cost of inventory increases

over a period of time, the FIFO method results

in the highest value of ending inventory and the

lowest value of COGS. This also results in the

highest profit for the period. Similarly, in cases

where the unit cost of inventory decreases over a

period of time, the FIFO method results in the

lowest value of ending inventory and the highest

value of COGS. Therefore, two identical companies using different inventory valuation methods

will show different financial results.

Determining the Actual Quantity of Inventory

Goods are moved in and out of inventory all the time, which is why recording the amount and

quantities bought and sold is so important. This is done when the goods enter the premises at

purchase and when they leave the premises at sale. The reliability of the information recorded at

these points must be assured.

For example, the items must be counted when they are received, and these amounts should be

compared to the amounts listed on the original purchase order. Any discrepancies must be noted

and followed up. Once the inventory count is complete, the company’s records should be updated

immediately.

Before goods can leave the premises, a release order, such as a packing slip, must be written up and

authorized. Just as goods coming in have to be recorded, goods moving out must also be recorded.

The shipper should note which goods are leaving and forward the documents to the accounting

department to ensure the information is entered into the system.

Accounting software will usually allow you to

select which inventory method you wish to

use. In addition to using specific identification,

FIFO or weighted average, software may also

allow for the last-in, first-out (LIFO) valuation

method. This method is not allowed under

ASPE or IFRS, but is allowed in the United

States.