Chapter 8

Inventory Valuation

234

When closing inventory is correctly valued at $9,000, a COGS value of $71,000 is produced. As a

result, the gross profit for the year is $29,000.The gross margin for the reporting period is 29,000

÷ 100,000 = 29%

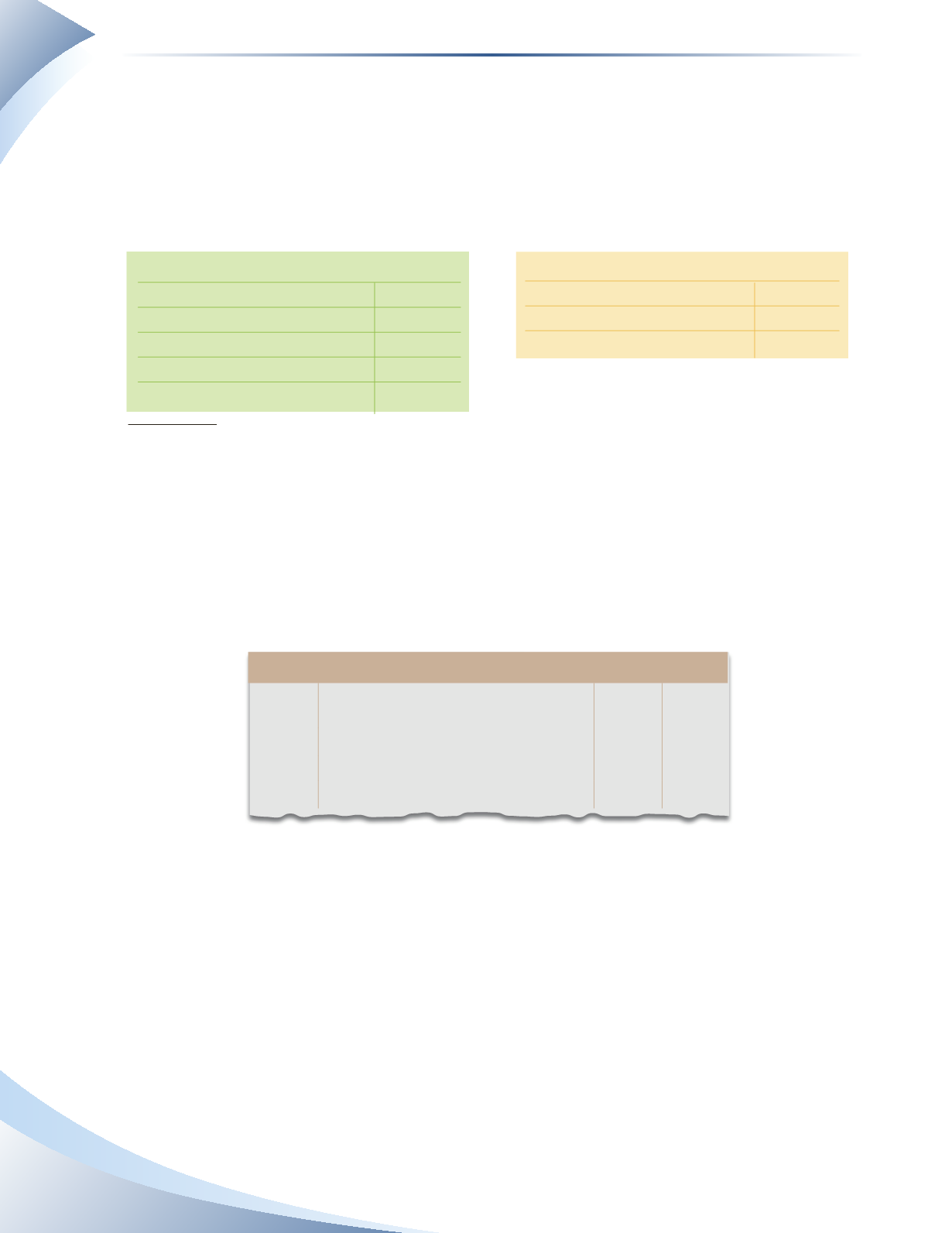

What happens if we overstate closing inventory by $1,000? This is shown in Figure 8.9.

Gross profit for the year is $30,000. Gross margin is then 30,000 ÷ 100,000 = 30%

Inventory Calculation

Opening Inventory

5,000

Plus: Purchases

75,000

Cost of Goods Available for Sale

80,000

Less: Closing Inventory

10,000

Cost of Goods Sold

70,000

Income Statement Year 1

Sales

$100,000

Less: Cost of Goods Sold

70,000

Gross Profit

$30,000

FIGURE 8.9

As a result, COGS is understated by $1,000, gross profit is overstated by $1,000, and gross margin

is overstated by 1%. The same error while performing a physical account for a company that uses

the perpetual inventory system will lead to the same problem.

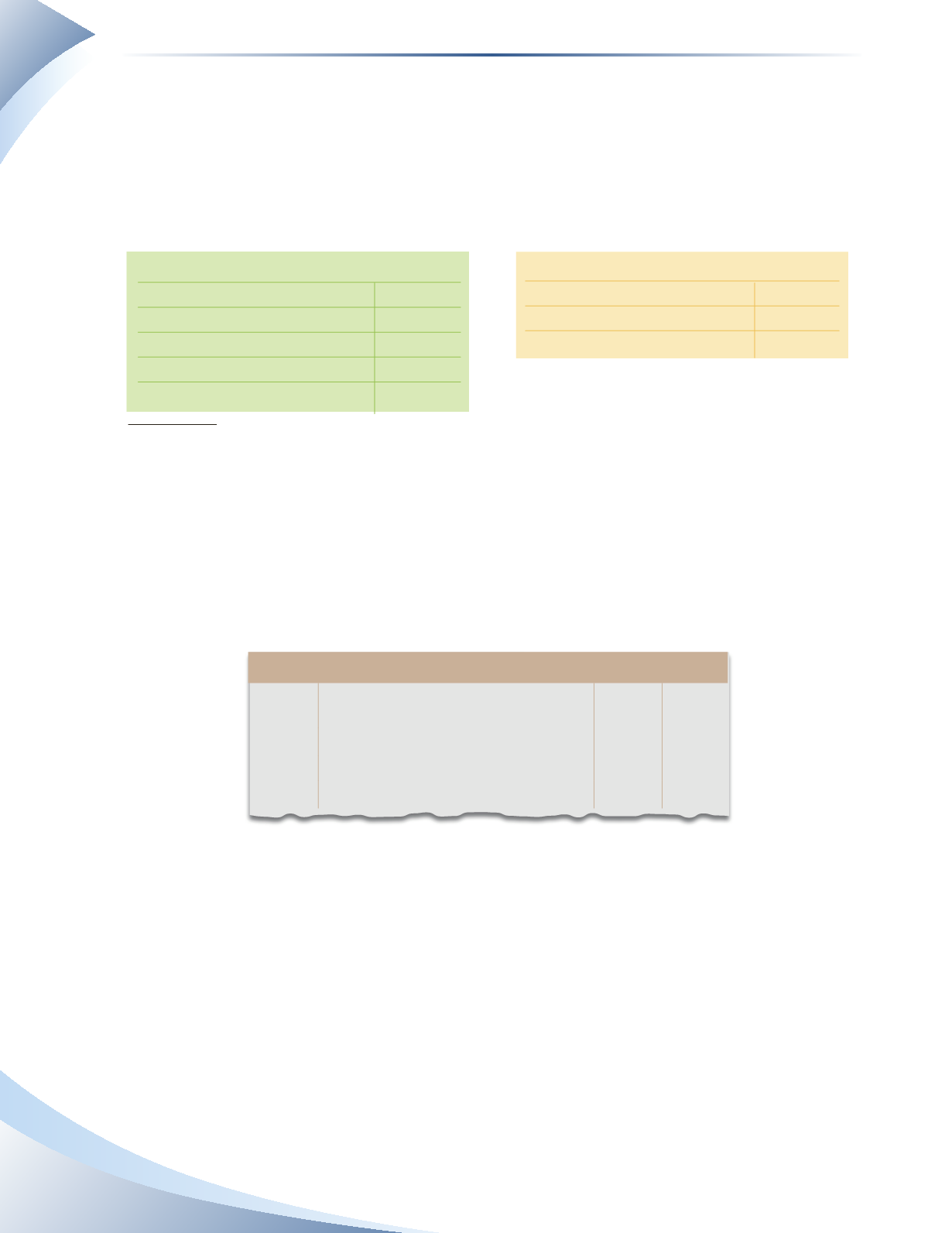

If this error is found and corrected before the end of the period, then a journal entry must be

recorded to correct the balances of inventory and COGS. In this example, the correct journal entry

is shown in Figure 8.10. If inventory was instead understated by $1,000, the journal entry would

debit inventory and credit cost of goods sold.

JOURNAL

Page 1

Date

2016

Account Title and Explanation

Debit Credit

Dec 31 Cost of Goods Sold

1,000

Inventory

1,000

Corrected overstated inventory

_______________

FIGURE 8.10

If the error is made after the financial reporting period is over, then an assessment of the materiality

of the error must be made.

If the error is considered material, then the company’s financial statements must be reissued with

the amended figures. It is obviously a scenario that companies want to avoid. Such a high profile

mistake can only cast doubt on how the company is being run. Nevertheless, if such material

errors are found, they must be reported—regardless of any negative impact they may have on the

company's reputation.

This is just a snapshot of what errors in valuing inventory can do to a company’s financial statements.

Both internal and external stakeholders are affected by inventory errors. Such errors can affect

business decision-making, tax reporting and adherence to accounting procedures.