Chapter 11

Payroll

326

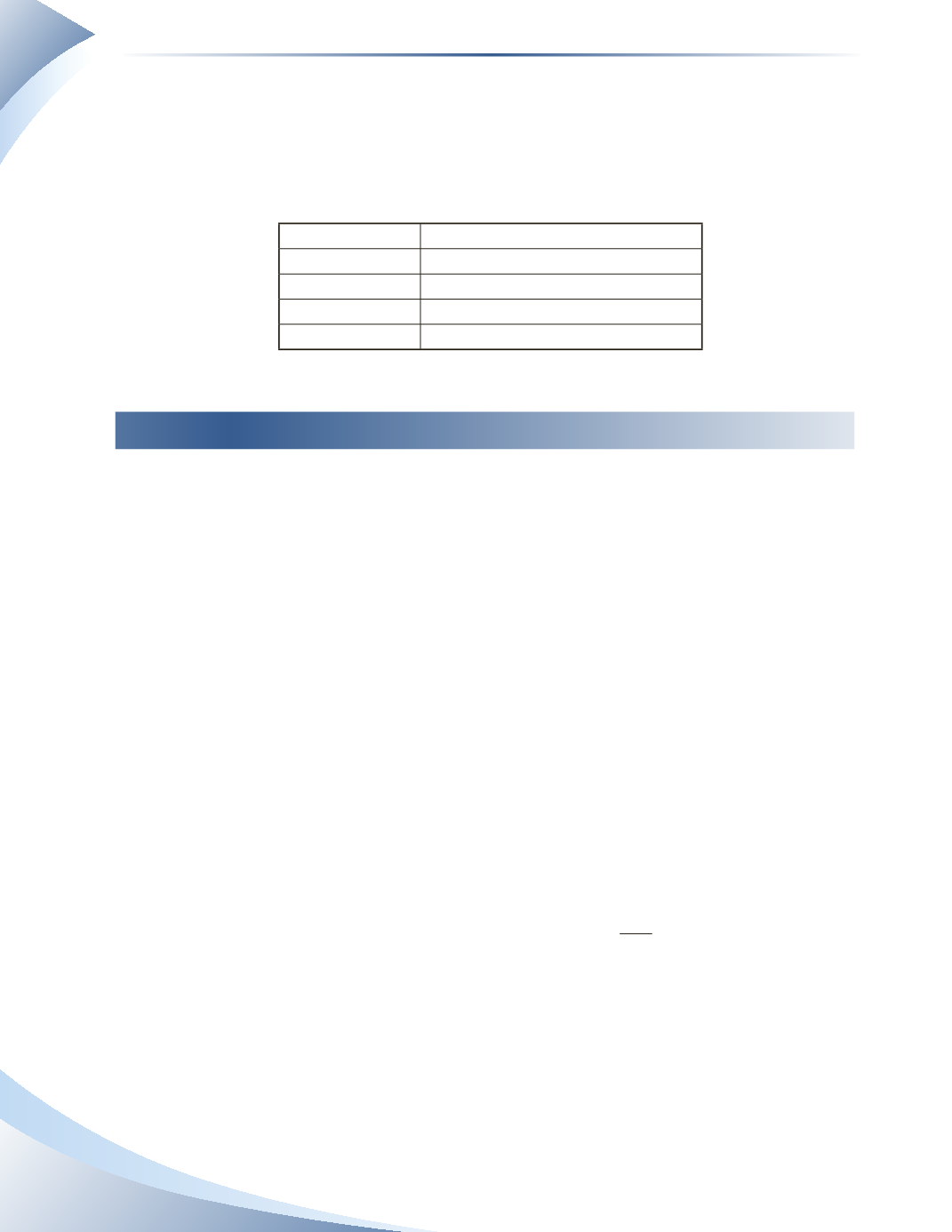

Before discussing how to calculate gross pay and how to determine which deductions must be

subtracted from gross pay, it is important to determine the pay frequency when dealing with

payroll.The amount of gross pay and deductions on each paycheque are affected by the pay period

(pay frequency). Pay period refers to the number of times an employee is paid during one year.The

table below shows how many pay periods there are in a year for the most common pay frequencies.

Pay Frequency

Number of Pay Periods in a Year

Weekly

52

Bi-weekly

26

Semi-monthly

24

Monthly

12

______________

FIGURE 11.1

Gross Pay

When an employee is paid, employers generally pay either with a salary or an hourly rate. A salary

is a set annual amount that is then divided by the number of pay periods to determine the gross

pay for each period. A sales manager who is paid $52,000 per year would earn $1,000 per week. If

he was paid on a bi-weekly basis, his gross pay would be $2,000 for each pay period.

An hourly rate is a set dollar amount for each hour worked and is multiplied by the hours

worked in a period to determine the gross pay for the period. If a factory worker is paid $17.00

per hour and he works for 65 hours in a two-week period, his gross pay would be $1,105

(65 hours x $17.00 per hour = $1,105).

In addition to regular pay, employers must also pay for statutory holidays and overtime. Overtime

pay is owed for any hours worked beyond a certain number of hours per period. Employment

standards in each jurisdiction specify what is considered overtime and how much should be paid

for each overtime hour. In many cases, overtime hours are paid at 1.5 times the regular hourly rate.

Suppose a person works 48 hours in a week, and any hours over 40 must be paid at 1.5 times the

regular hourly rate. Assuming the hourly rate is $15 per hour, the overtime rate would be $22.50

per hour ($15 x 1.5). Gross pay would be calculated as shown below.

Regular pay

40 hours × $15/hour =

$600

Overtime pay 8 hours × ($15 x 1.5) =

$180

Gross pay

$780

Employees are also generally paid their regular wages for statutory holidays (such as Christmas

day), even though they do not work on those days. If an employee does work on a statutory holiday,

they are typically paid their regular wages for the statutory holiday, plus 1.5 times their regular

hourly rate for the hours they actually work. Again, this may vary slightly in different jurisdictions.

Vacation pay is also an amount that must be paid to employees. Generally, employers must provide

two weeks or 4% of the employee’s gross pay as vacation amounts.This can vary from jurisdiction to