Chapter 11

Payroll

332

amount is paid to the employee during his time off. When the vacation pay is paid out, statutory

deductions and any other deductions must be withheld.

The last portion of a payroll journal entry is to record the employer's portion of the statutory

deductions, plus any other contributions it makes for its employees. In this example, the employer

will pay the following

• match the employees' CPP deduction of $208.31

• pay 1.4 times the amount of the employees' EI deduction of $118.44

• the health insurance plan costs $30 per month, however the employer pays for half of it

• workers’ compensation is assumed to be 0.5% of gross pay

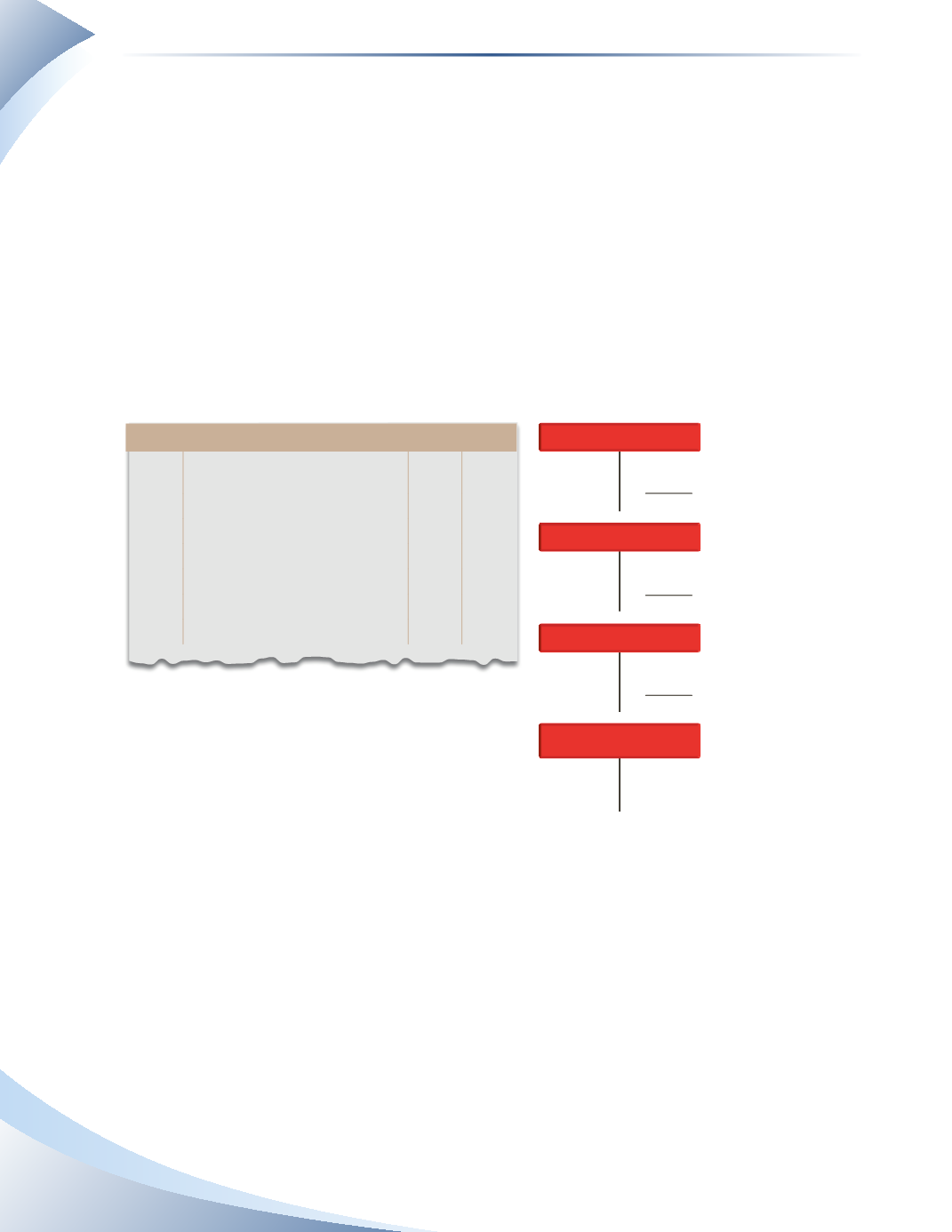

On January 31, 2015, the journal entry to record the employer contributions is shown in Figure

11.5.

Journal Page 1

Date

2015

account title and explanation Debit credit

Jan 31 Employee Benefits Expense

364.25

CPP Payable

208.31

EI Payable

118.44

Health Insurance Payable

15.00

Workers’ Compensation Payable

22.50

To record employer payroll expenses

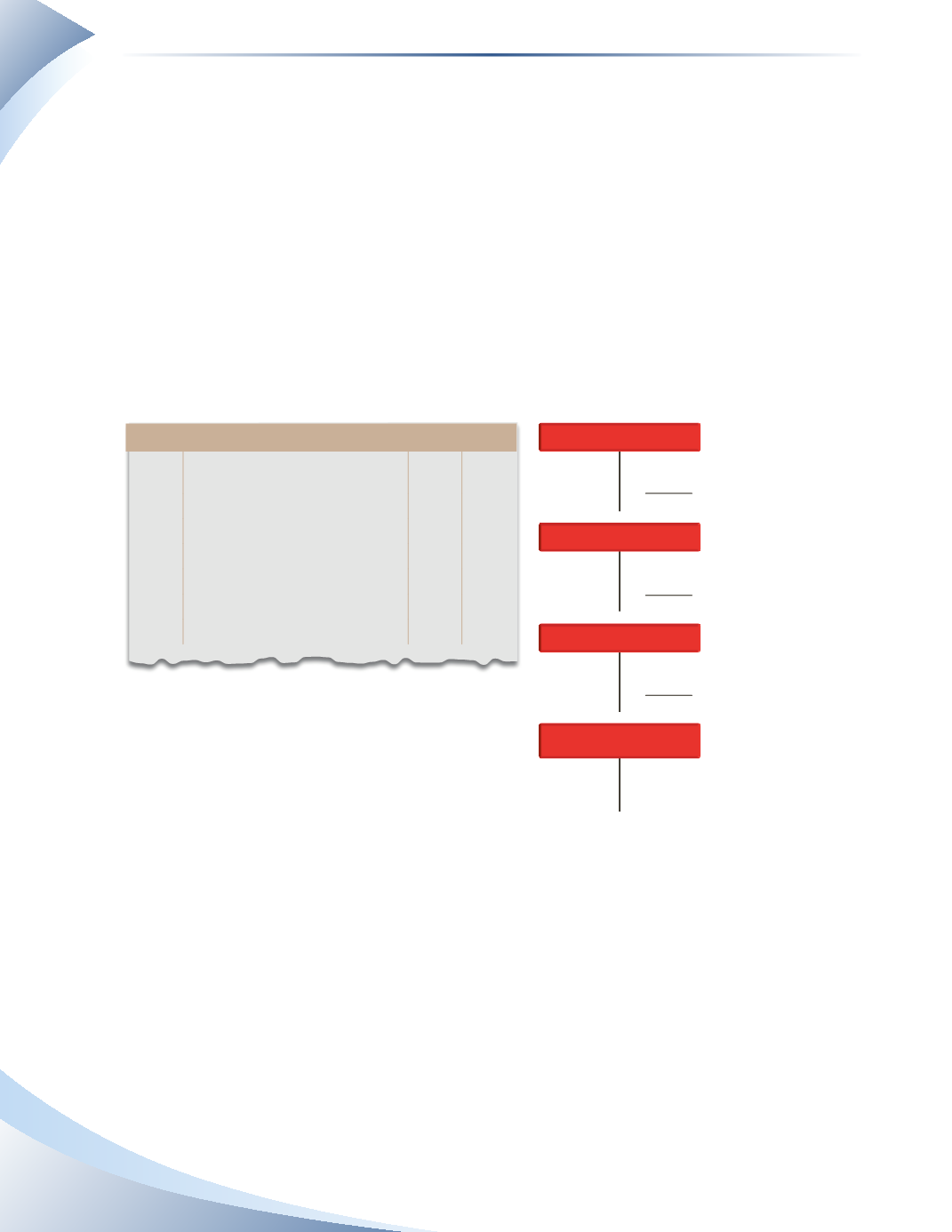

CPP PAYABLE

EI PAYABLE

HEALTH INSURANCE PAYABLE

WORKERS’

COMPENSATION PAYABLE

-

-

-

-

+

+

+

+

Employee deduction

Employer contribution

Employee deduction

Employer contribution

Employee deduction

Employer contribution

84.60

118.44

203.04

208.31

208.31

416.62

22.50

15.00

15.00

30.00

______________

FIGURE 11.5

The employer portions (CPP, EI and the health insurance plan) are added to the existing liability

accounts. These liability accounts already have the employee portions recorded in them from

Figure 11.3. Workers’ compensation is solely the responsibility of the employer. A single expense

account called employee benefits expense is used to record the extra employer expenses. Some

companies prefer to have separate expense accounts for each of the employer contributions;

however, we will only use one expense account in this textbook.

An important point is that the $4,500 of gross payroll actually incurred expenses of $5,044.25

(gross pay, vacation pay and employee benefits expenses).This means that in our example, for every

$1 of gross payroll, the actual cost to the business is approximately $1.12. Payroll can be much

more expensive to a business than the amount received by employees, depending on the types and

amounts of benefits that the business pays.