Chapter 11

Payroll

335

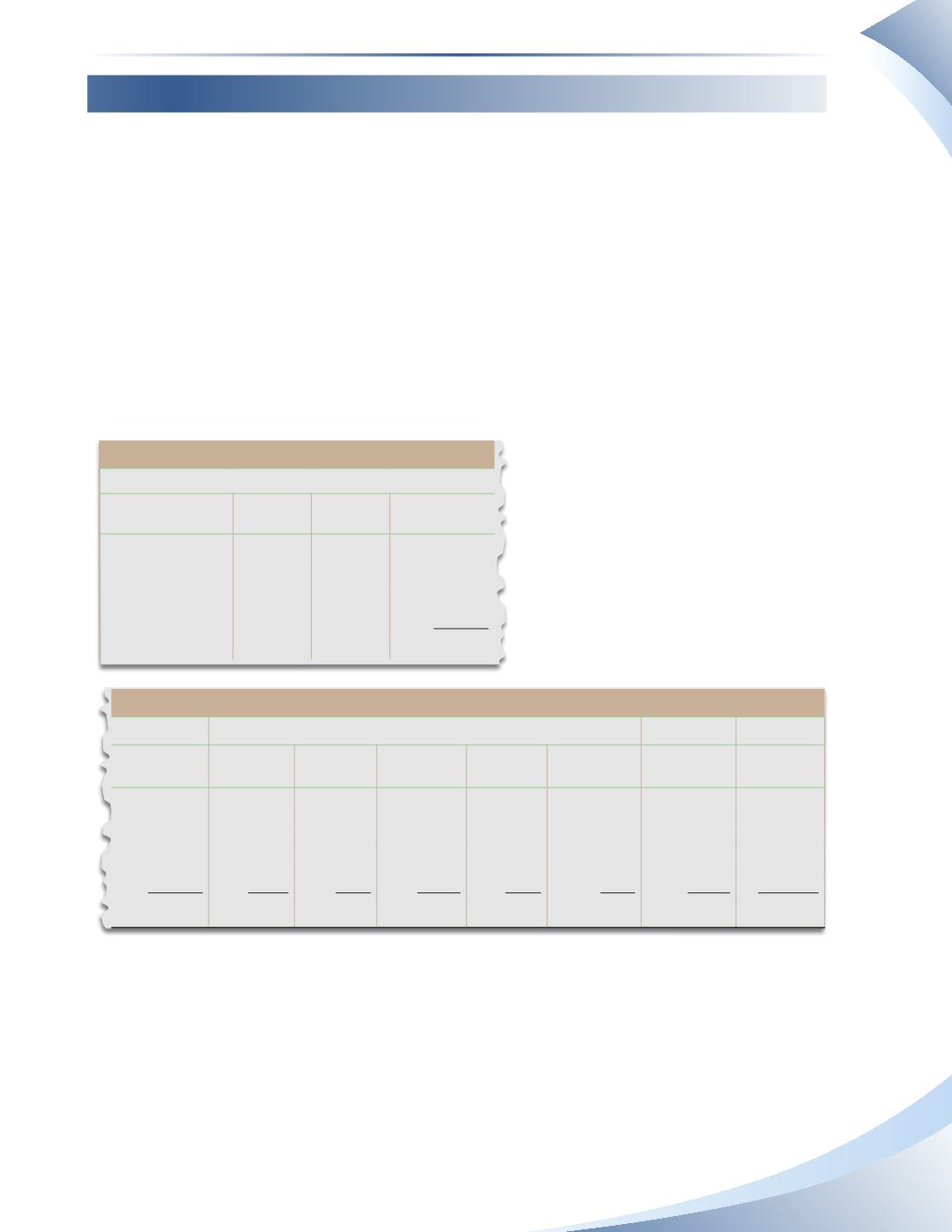

Payroll register

Since businesses usually have multiple employees, a payroll register is often used rather than

preparing individual entries. A payroll register will list every employee along with their gross pay,

deductions and net pay.The bottom of the payroll register will calculate totals that can be used to

complete the journal entries. Computer software will have a similar tool for creating paycheques

for multiple employees at one time.

Figure 11.9 shows a sample payroll register.The first person listed is our example of earning $4,500

gross pay per month as a salary.The rest of the employees are paid various hourly wages and work

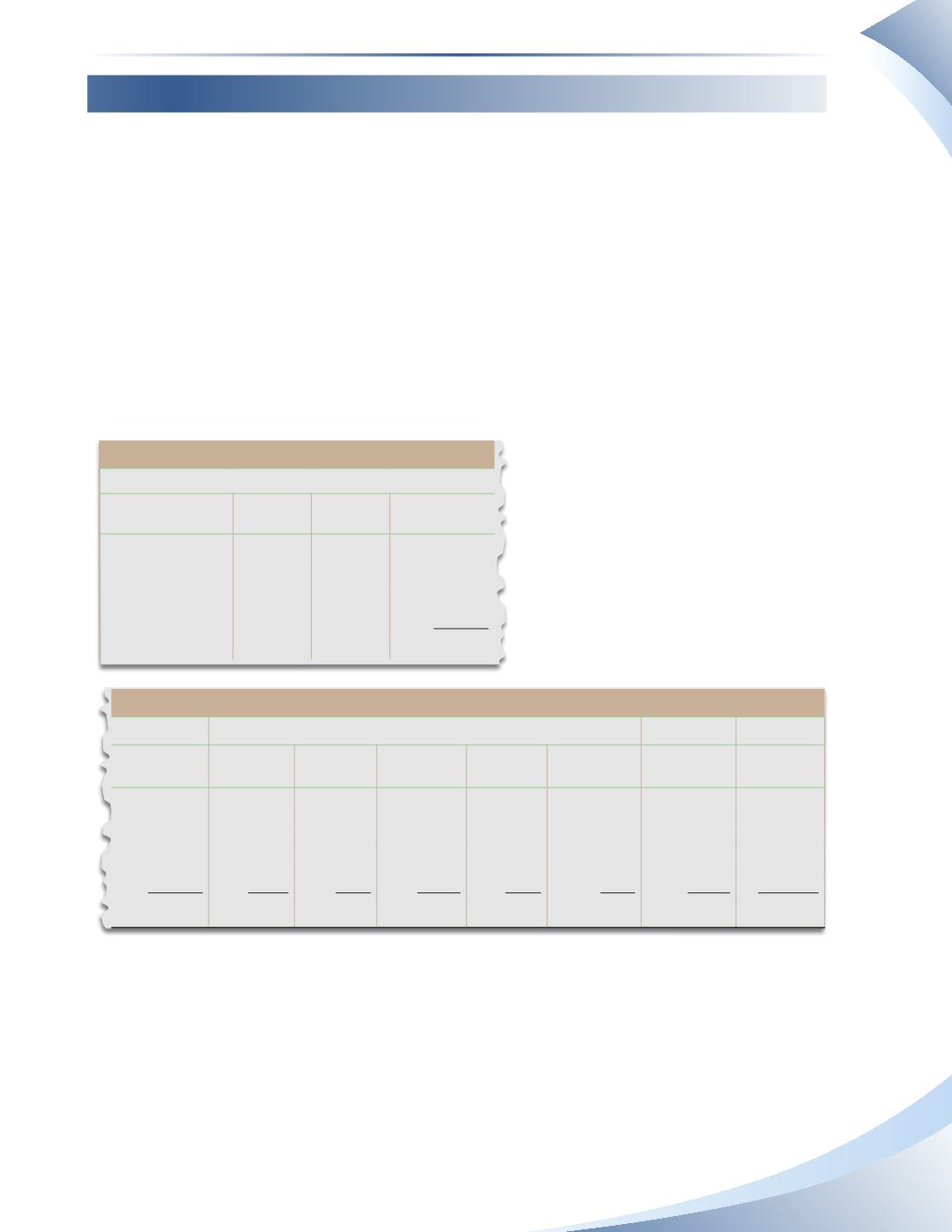

a different number of hours. We will assume all employees must pay monthly union dues of $50

and monthly health insurance of $15. The monthly health insurance premiums are actually $30

per person, but the business pays half. By completing the rest of the payroll information for all the

employees, we can use the totals to create our journal entries.

Payroll PerioD January 1 to January 31, 2015

name

Hourly

Wage Hours

gross

earnings

Booth, Glen

160

4,500.00

Dickens, Charlie

$18.00

170

3,060.00

Smith, Adam

$18.56

160

2,969.60

Wood, Amy

$19.23

175

3,365.25

Totals

$13,894.85

Payroll register

Deductions

gross

earnings

cPP

ei

income

tax

union

Dues

Health

insurance

total

Deductions net Pay

4,500.00

208.31

84.60

802.90

50.00

15.00

1,160.81 $3,339.19

3,060.00

137.03

57.53

403.25

50.00

15.00

662.81 $2,397.19

2,969.60

132.56

55.83

387.55

50.00

15.00

640.94 $2,328.66

3,365.25

152.14

63.27

469.90

50.00

15.00

750.31 $2,614.94

$13,894.85 $630.04 $261.23 $2,063.60 $200.00

$60.00 $3,214.81 $10,679.98

______________

FIGURE 11.9