Chapter 11

Payroll

334

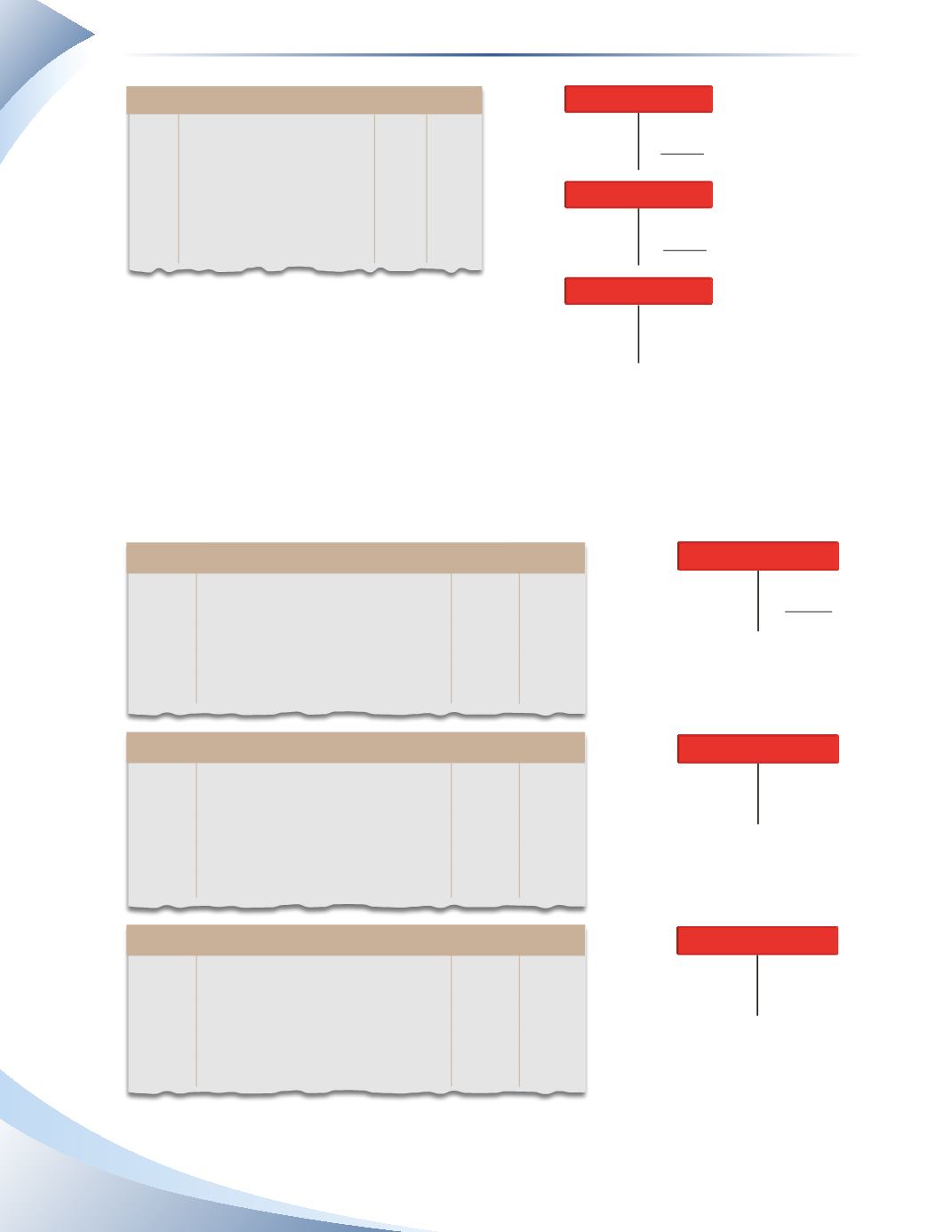

CPP PAYABLE

EI PAYABLE

INCOME TAXES PAYABLE

-

-

-

+

+

+

Employee deduction

Employer contribution

Employee deduction

Employer contribution

Remittance

Remittance

Remittance

84.60

118.44

203.04

208.31

208.31

416.62

416.62

203.04

802.90 802.90

Journal Page 1

Date

2015

account title and explanation Debit credit

Jan 31 CPP Payable

416.62

EI Payable

203.04

Income Taxes Payable

802.90

Cash

1,422.56

To remit deductions to the CRA

______________

FIGURE 11.7

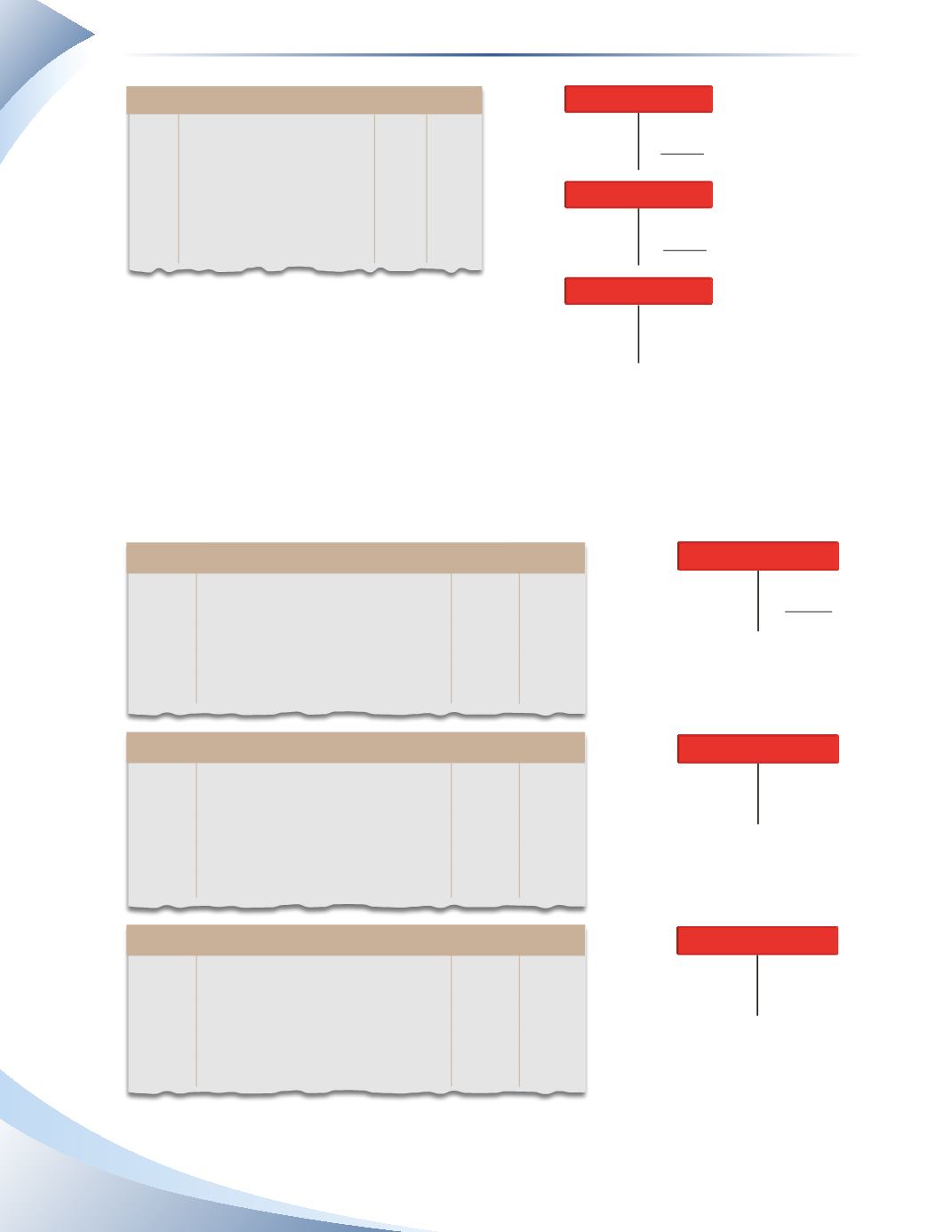

Lastly, any amount owing to other institutions must be paid. The institution will have a schedule

for when payments must be sent in. In our example, the employer has a liability to pay union dues,

health insurance premiums and workers’ compensation premiums. Each of these liabilities will be

cleared out and payment will be sent to the union, the health insurance company and the workers’

compensation board.These transactions are shown in Figure 11.8.

Journal Page 1

Date

2015

account title and explanation Debit credit

Feb 28 Health Insurance Payable

30

Cash

30

To pay health insurance premiums

HEALTH INSURANCE PAYABLE

-

+

Remittance

15.00

15.00

30.00

30.00

Journal Page 1

Date

2015

account title and explanation Debit credit

Feb 28 Union Dues Payable

50

Cash

50

To pay union dues

UNION DUES PAYABLE

-

+

Remittance

50.00

50.00

Journal Page 1

Date

2015

account title and explanation Debit credit

Feb 28 Workers' Compensation Payable

22.50

Cash

22.50

To pay workers' compensation

WORKERS’COMPENSATION PAYABLE

-

+

Remittance

22.50

22.50

______________

FIGURE 11.8