Chapter 11

Payroll

331

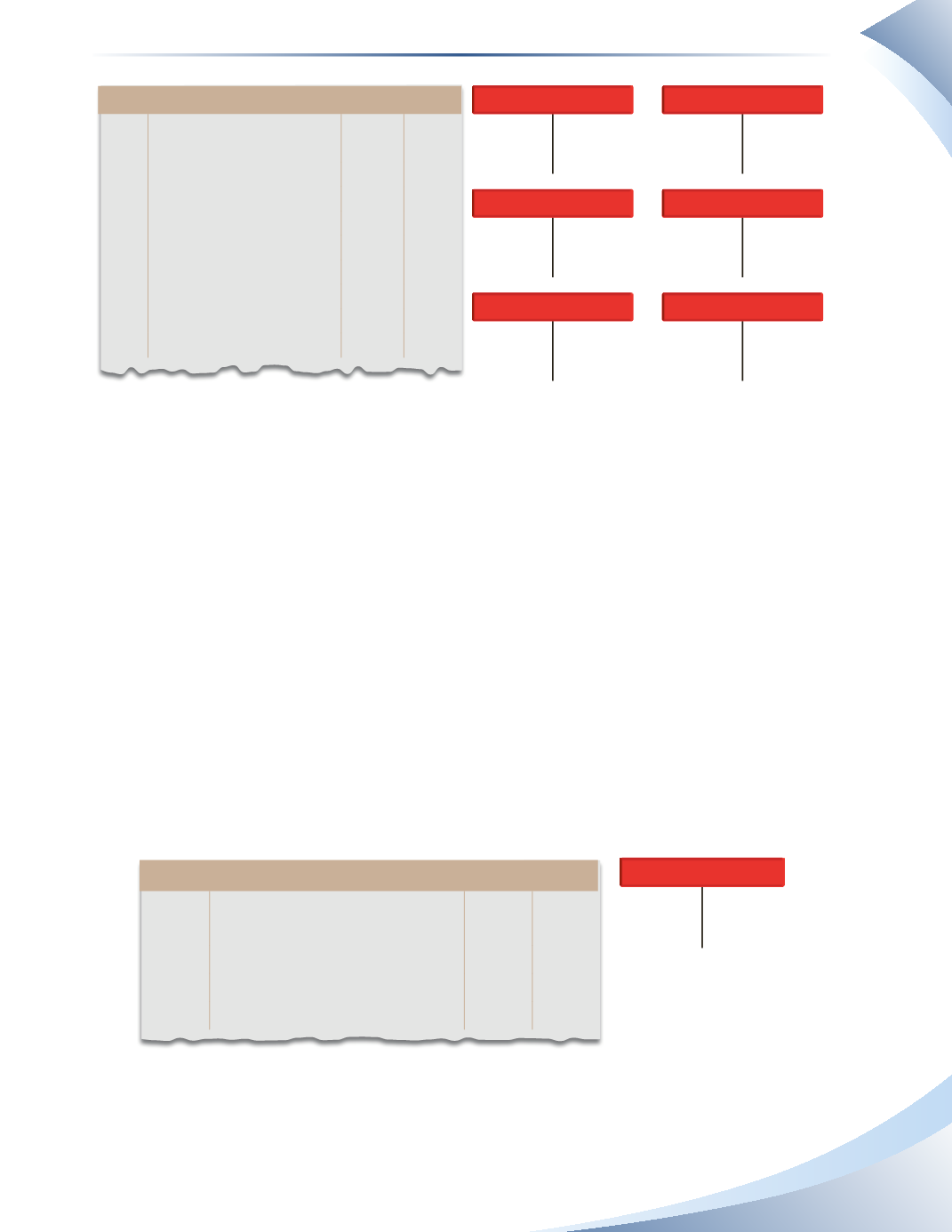

Journal Page 1

Date

2015

account title and explanation Debit credit

Jan 31 Salaries Expense

4,500.00

CPP Payable

208.31

EI Payable

84.60

Income Tax Payable

802.90

Union Dues Payable

50.00

Health Insurance Payable

15.00

Salaries Payable

3,339.19

To record employee payroll

CPP PAYABLE

INCOME TAXES PAYABLE

HEALTH INSURANCE PAYABLE

EI PAYABLE

UNION DUES PAYABLE

SALARIES PAYABLE

-

-

-

-

-

-

+

+

+

+

+

+

208.31

802.90

15.00

84.60

50.00

3,339.19

______________

FIGURE 11.3

The transaction shows the salaries expense broken down into various liability amounts. All the

deductions will be recorded in liability accounts until it is time to send these amounts to the insti-

tutions to which they are owed. In a perfect world with no liabilities, all the amounts withheld from

the employee’s paycheque would immediately be paid to the CRA and others with cash. In reality,

there is usually a difference in timing from withholding the deductions to actually sending them to

the CRA and others. Businesses act as an intermediary taking the money from the employee and

sending it to the institutions at a later date.The business effectively has a debt (liability) for a short

period of time until it sends the money where it is supposed to go.

The net pay may be recorded as a liability (salaries payable) if the actual cash payment will happen

a few days later. If however the employee is paid immediately, cash would be credited for the net

pay amount instead of salaries payable.

Vacation pay must also be accounted for. We will assume the business must pay 4% of the gross

pay as vacation pay and the business accrues the vacation pay for its employees. This means $180

($4,500 x 4%) will be accrued for Glen Booth.The journal entry for this accrual is shown in Figure

11.4.

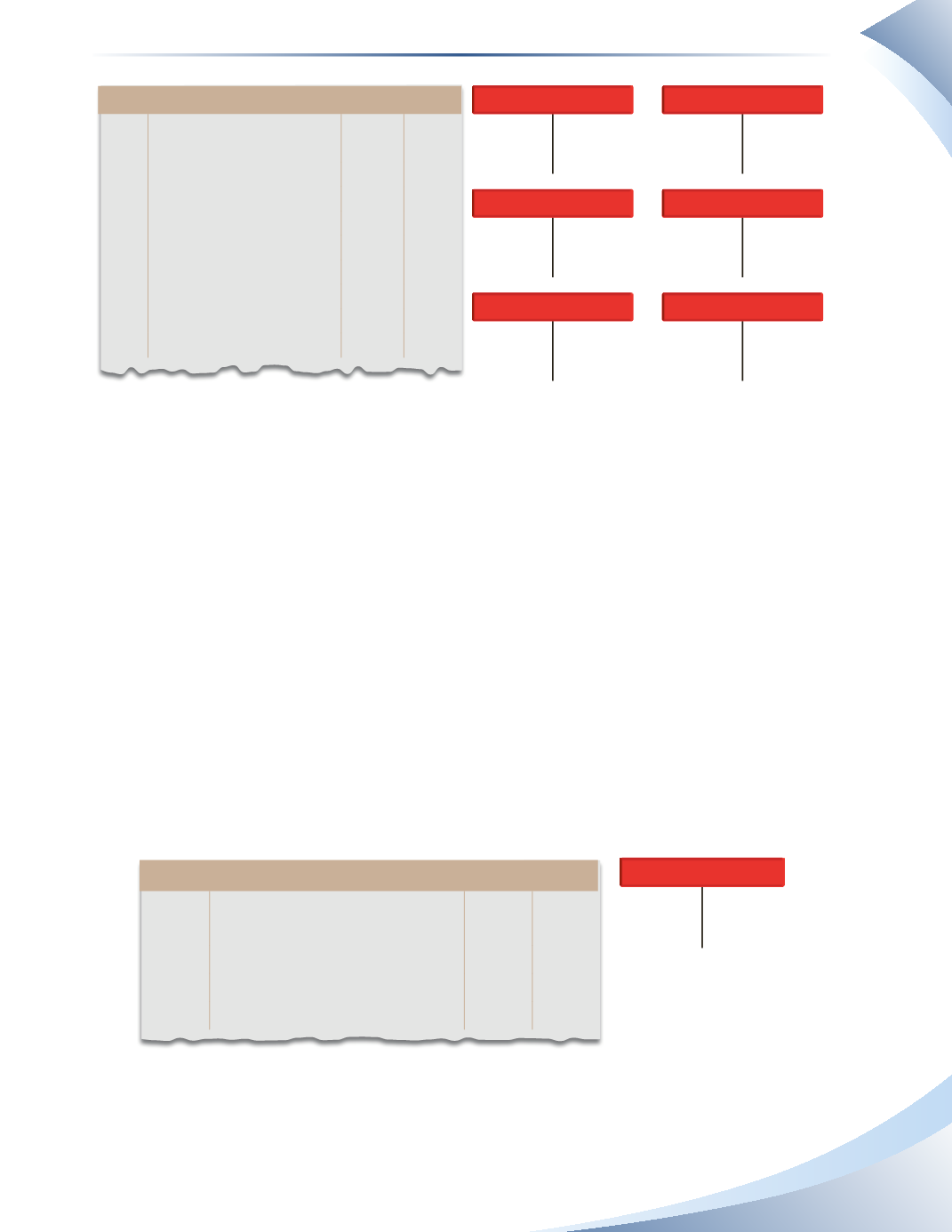

Journal Page 1

Date

2015

account title and explanation Debit credit

Jan 31 Vacation Pay Expense

180

Vacation Pay Payable

180

To accrue vacation pay

VACATION PAY PAYABLE

-

+

180

______________

FIGURE 11.4

The amount recorded as vacation pay will accrue over time.The amount in the liability account will

grow until the employee takes time off. At that point, the vacation pay liability will decrease as the