Chapter 11

Payroll

330

Employers may also voluntarily contribute towards other plans on behalf of the employee. For

example, an employer may provide health benefits or savings plans for their employees.An employer

may decide to pay for all of the health benefits, or split the payment with the employees through

a voluntary deduction. Or, an employer may make a contribution to an employee’s savings if the

employee decides to sign up for the savings plan voluntary deduction.

Payroll Example

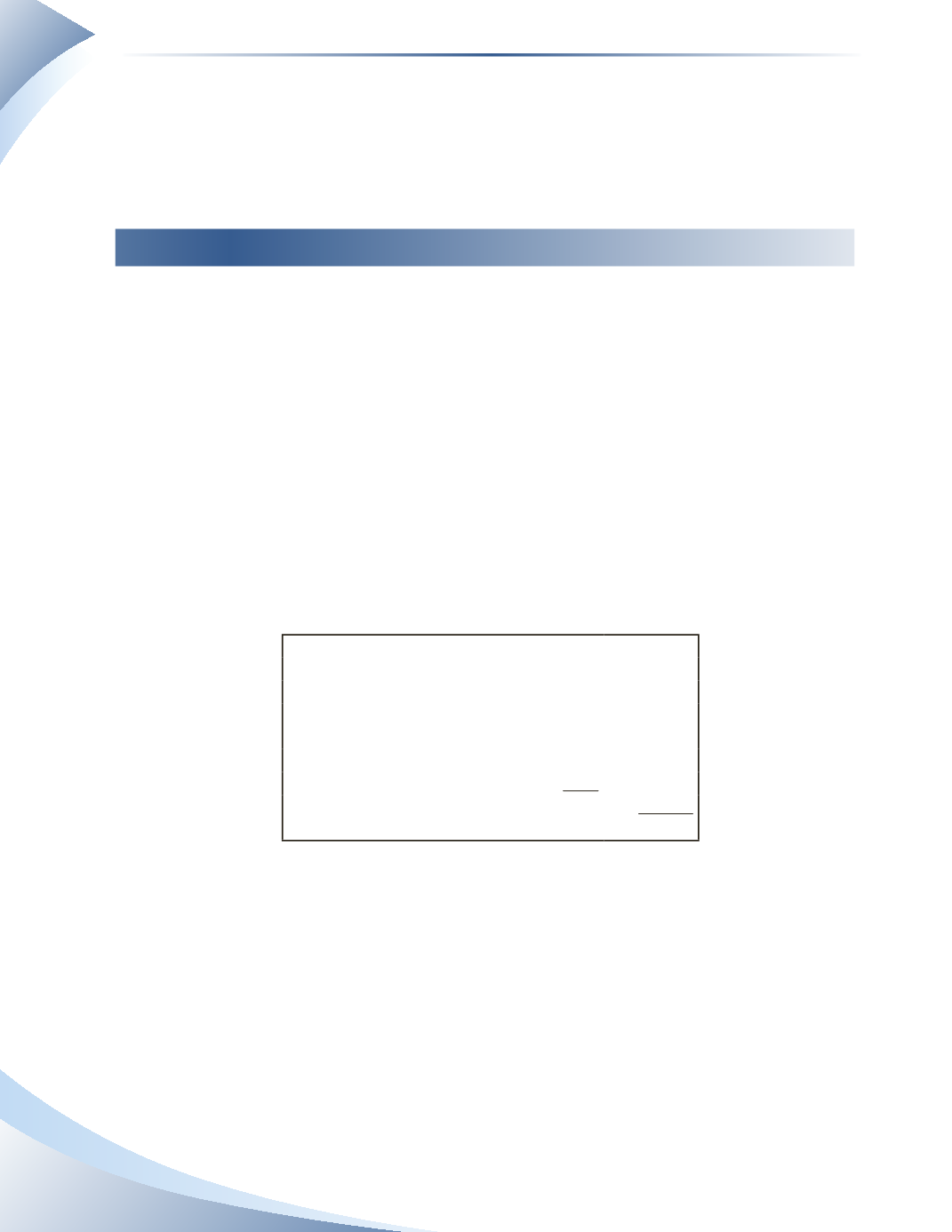

Let us examine how a basic payroll journal entry would be calculated and recorded. Assume Glen

Booth is a salaried employee who earns $54,000 per year and is paid on a monthly basis.This means

his monthly gross pay is $4,500 ($54,000 ÷ 12 months).

We will assume the following deductions are taken from his paycheque.

• Canada Pension Plan deduction is $208.31.

• Employment Insurance is $84.60.

• Federal and Provincial income tax is $802.90.

• He is a member of a union and has $50 deducted per month for his union dues.

• His employer provides a health insurance plan which costs $30 per month, however the

employer pays for half of this amount.

The calculation of Glen’s net pay is shown in Figure 11.2.

Gross Pay

$4,500.00

Deductions

CPP

$208.31

EI

84.60

Income taxes

802.90

Union dues

50.00

Heath insurance (only half )

15.00

Total deduction

1,160.81

Net pay

$3,339.19

______________

FIGURE 11.2

For all of the journal entries in this chapter, we will illustrate the impact on the liability accounts

using T-accounts. On January 31, 2015, the journal entry to record payroll expense and deductions

is shown in Figure 11.3.

For this example, we should consider categorizing based on three levels.

1. the net pay owed to an employee

2. amounts deducted from employee paycheques and owed to others

3. employer payroll expense