Chapter 11

Payroll

333

At this point, payroll for the employee is complete. It is now time for the employer to pay the

payroll liabilities that have been created.

Paying the Payroll liabilities

Amounts deducted from payroll are owed to the government and other institutions.After recording

the journal entries for the employee payroll and the employer contributions, the employer has a

number of liability accounts that must be paid.

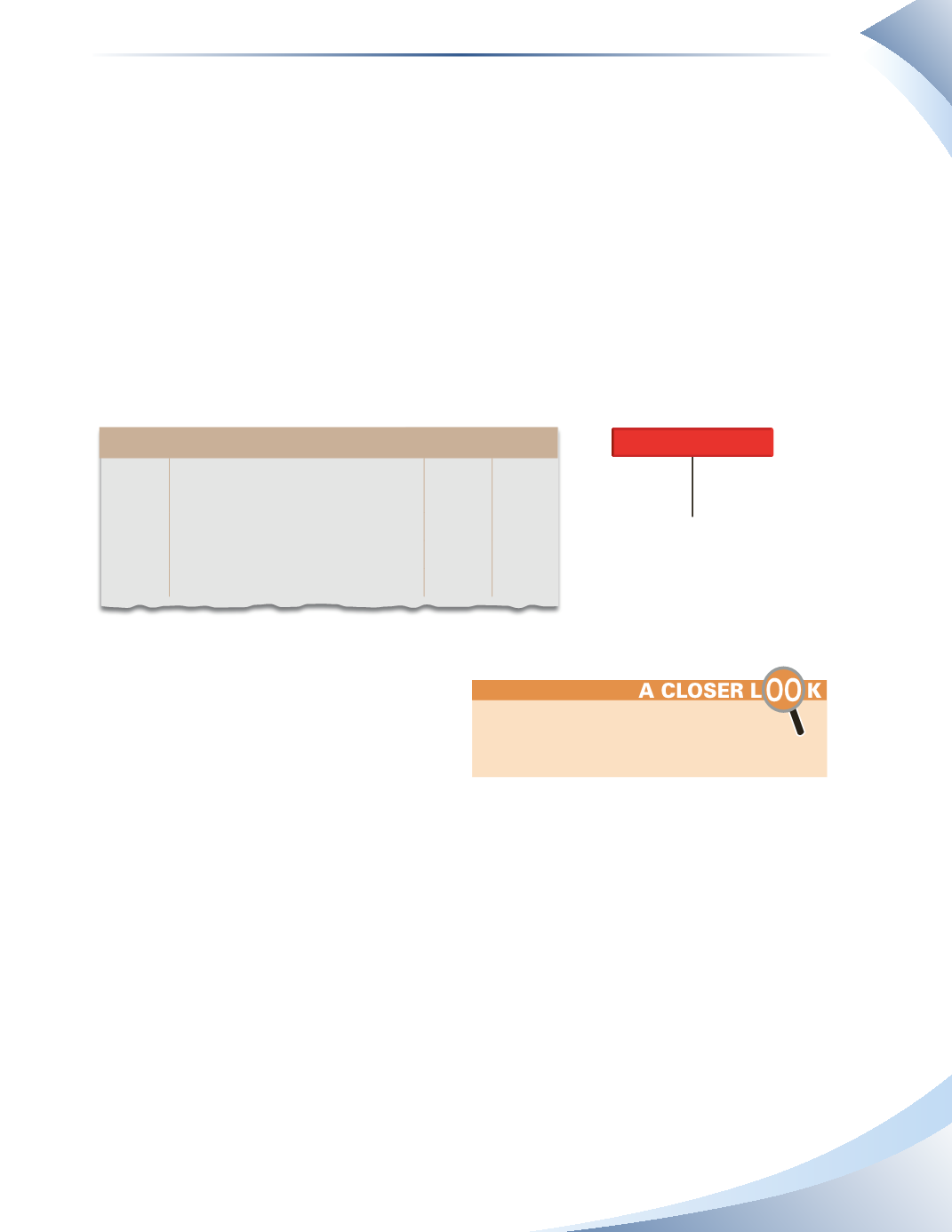

First, the employer must actually pay the employee. Initially the net pay was recorded in salaries

payable because the actual pay is going to be paid on a different day. Thus, to pay the employee,

decrease cash and decrease the liability, shown in Figure 11.6. Remember, if the employee was

paid on the same day as the payroll entry, cash would have been credited in Figure 11.3 instead of

salaries payable and this entry on February 1 would not be needed.

SALARIES PAYABLE

-

+

3,339.19 Jan 31

Feb 1 3,339.19

Journal Page 1

Date

2015

account title and explanation Debit credit

Feb 1 Salaries Payable

3,339.19

Cash

3,339.19

To pay employee

______________

FIGURE 11.6

Next, because our example is not in the prov-

ince of Quebec, all the statutory deductions

must be sent to the CRA. This is called a

payroll remittance. This remittance includes

the employee and employer portion of CPP,

the employee and employer portion of EI and the income tax.The business will have a schedule to

follow to make the remittance to the CRA.Most moderate-sized businesses must send the amount

by the 15

th

of the following month. If the employer fails to make the remittance on time, it will pay

penalties and interest on the amount owing.

Since the payroll in our example is for January, the remittance must be made by February 15, 2015.

The journal entry to make the payment is shown in Figure 11.7. All the liability accounts are

debited by their balance to clear them, and the total amount is cash sent to the CRA.

In Quebec, QPP, QPIP and provincial income

tax are sent to Revenu Quebec and the EI and

federal income tax is sent to the CRA.