Chapter 5

The Accounting Cycle: Adjustments

126

Review Exercise

Catherine Gordon is running her own proprietary business called CG Accounting. CG

Accounting provides bookkeeping services to small and mid-sized companies.The company

prepares financial statements on a monthly basis and was introduced in the review exercise in

chapter 4. Before you begin this exercise, familiarize yourself with the review exercise in chapter 4

because this is a continuation.

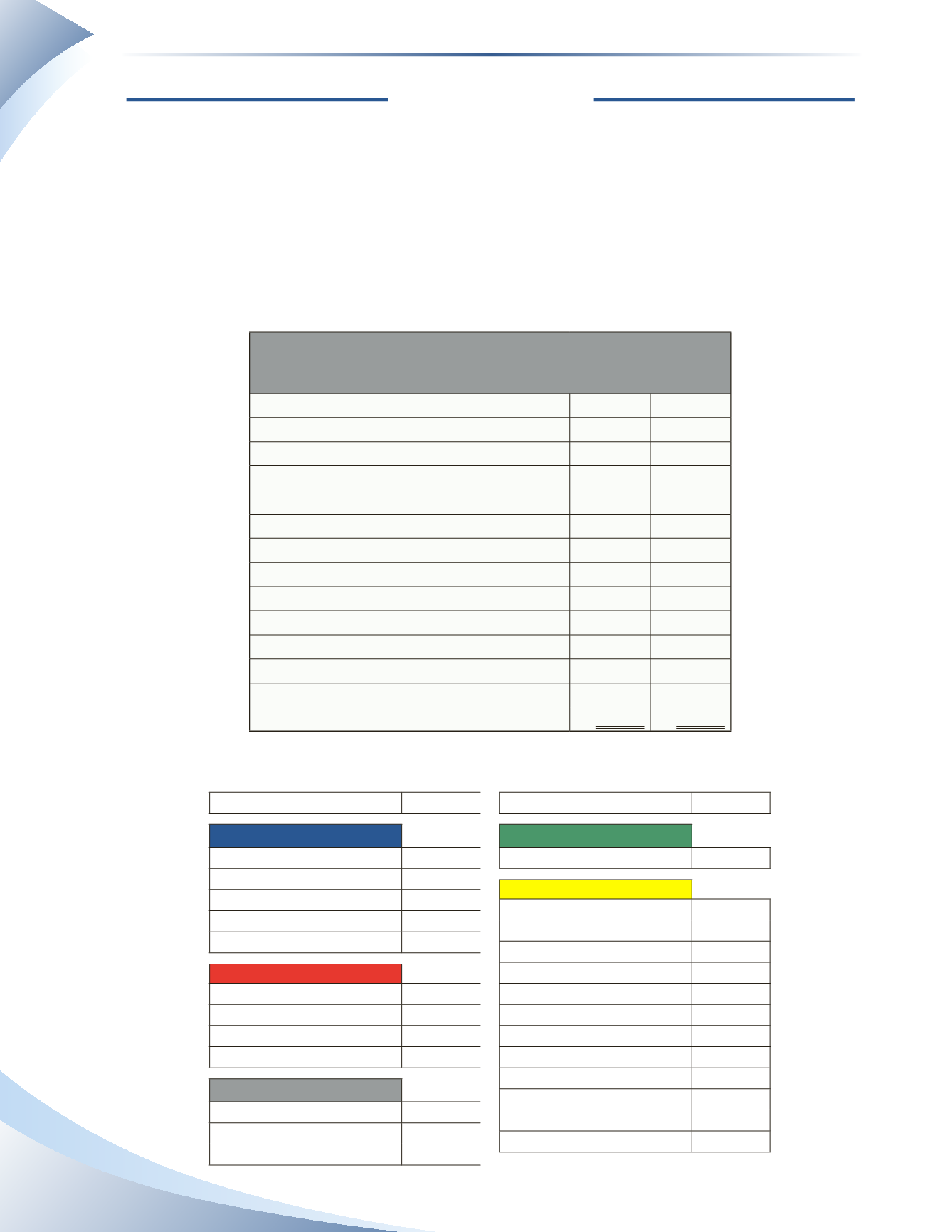

The journal entries for the month of June have already been entered in the journal and posted to

the ledger.The trial balance, before adjustments, is presented below.

CG Accounting

Trial Balance

June 30, 2016

Account Titles

DR

CR

Cash

$5,550

Accounts Receivable

4,600

Prepaid Insurance

1,200

Equipment

6,000

Accounts Payable

$2,750

Unearned Revenue

900

Bank Loan

3,050

Gordon, Capital

9,400

Gordon, Drawings

1,000

Service Revenue

3,600

Advertising Expense

450

Professional Fees Expense

900

Total

$19,700

$19,700

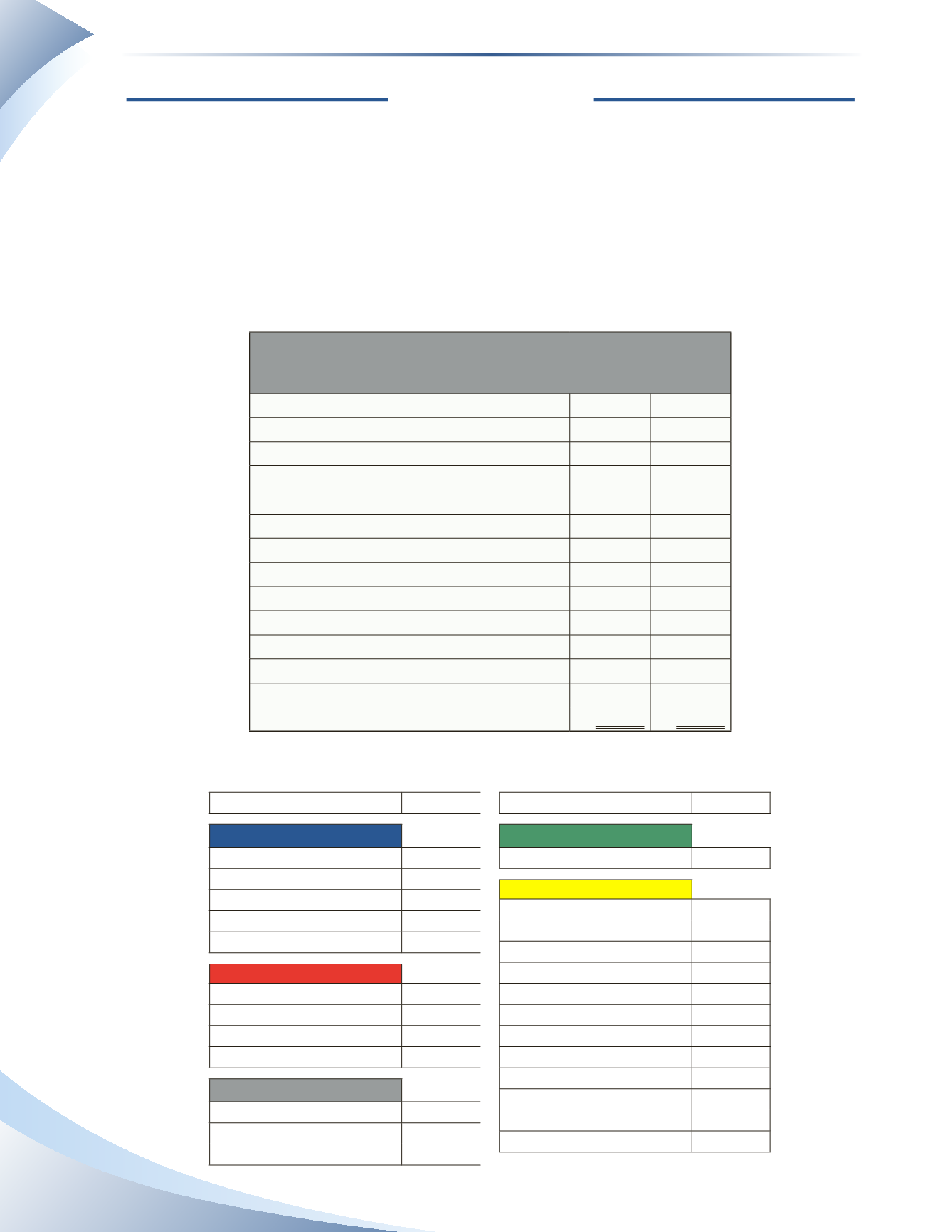

CG Accounting uses the following accounts and accounting numbers in its accounting records.

Account Description

Account #

ASSETS

Cash

101

Accounts Receivable

105

Prepaid Insurance

110

Equipment

120

Accumulated Depreciation

125

LIABILITIES

Accounts Payable

200

Interest Payable

205

Unearned Revenue

210

Bank Loan

215

OWNER’S EQUITY

Gordon, Capital

300

Gordon, Drawings

310

Income Summary

315

Account Description

Account #

REVENUE

Service Revenue

400

EXPENSES

Advertising Expense

500

Bad Debt Expense

505

Depreciation Expense

510

Insurance Expense

515

Interest Expense

520

Maintenance Expense

525

Office Supplies Expense

530

Professional Fees Expense

535

Rent Expense

540

Salaries Expense

545

Telephone Expense

550

Travel Expense

555