Chapter 6

The Accounting Cycle: Statements and Closing Entries

136

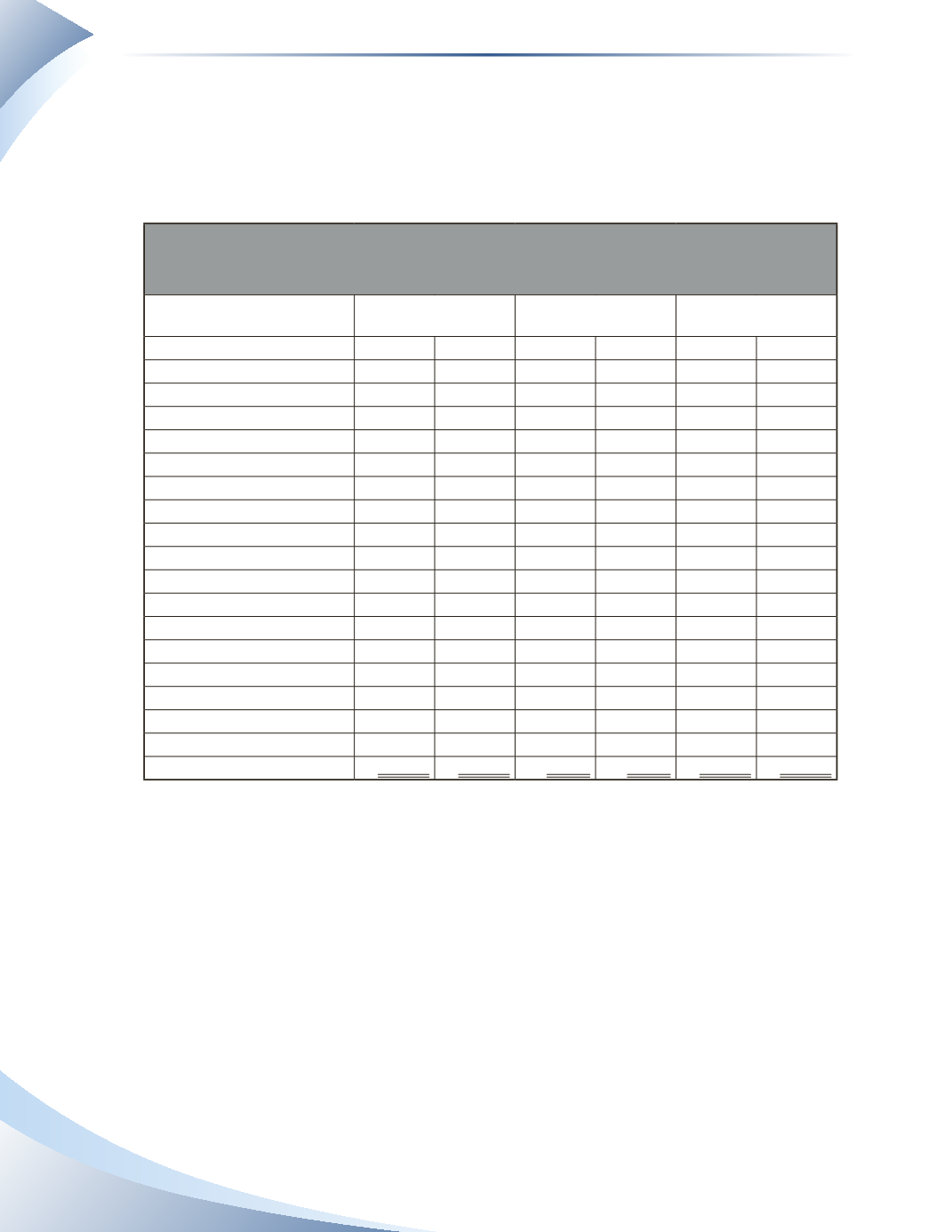

The final steps of the accounting cycle are illustrated using the MP Consulting example from the

previous chapter. At the end of the previous chapter, we prepared a worksheet which shows the

unadjusted trial balance, the adjustments made and the adjusted trial balance. This is shown in

Figure 6.2.The adjusted trial balance shows the balance of the accounts after the adjustments have

been made. At this point, the accounts are ready to be compiled into the financial statements.

MP Consulting

Worksheet

January 31, 2016

Unadjusted Trial

Balance

Adjustments

Adjusted Trial

Balance

Account Titles

DR

CR

DR

CR

DR

CR

Cash

$3,800

$3,800

Accounts Receivable

3,000

$1,000

4,000

Prepaid Insurance

1,200

$100

1,100

Equipment

8,300

8,300

Accumulated Depreciation

$0

150

$150

Accounts Payable

1,250

1,250

Interest Payable

0

25

25

Unearned Revenue

2,000

200

1,800

Bank Loan

2,500

2,500

Parish, Capital

10,300

10,300

Parish, Drawings

2,000

2,000

Service Revenue

3,300

1,200

4,500

Depreciation Expense

0

150

150

Insurance Expense

0

100

100

Interest Expense

0

25

25

Rent Expense

800

800

Telephone Expense

250

250

Total

$19,350 $19,350 $1,475 $1,475 $20,525 $20,525

________________

Figure 6.2

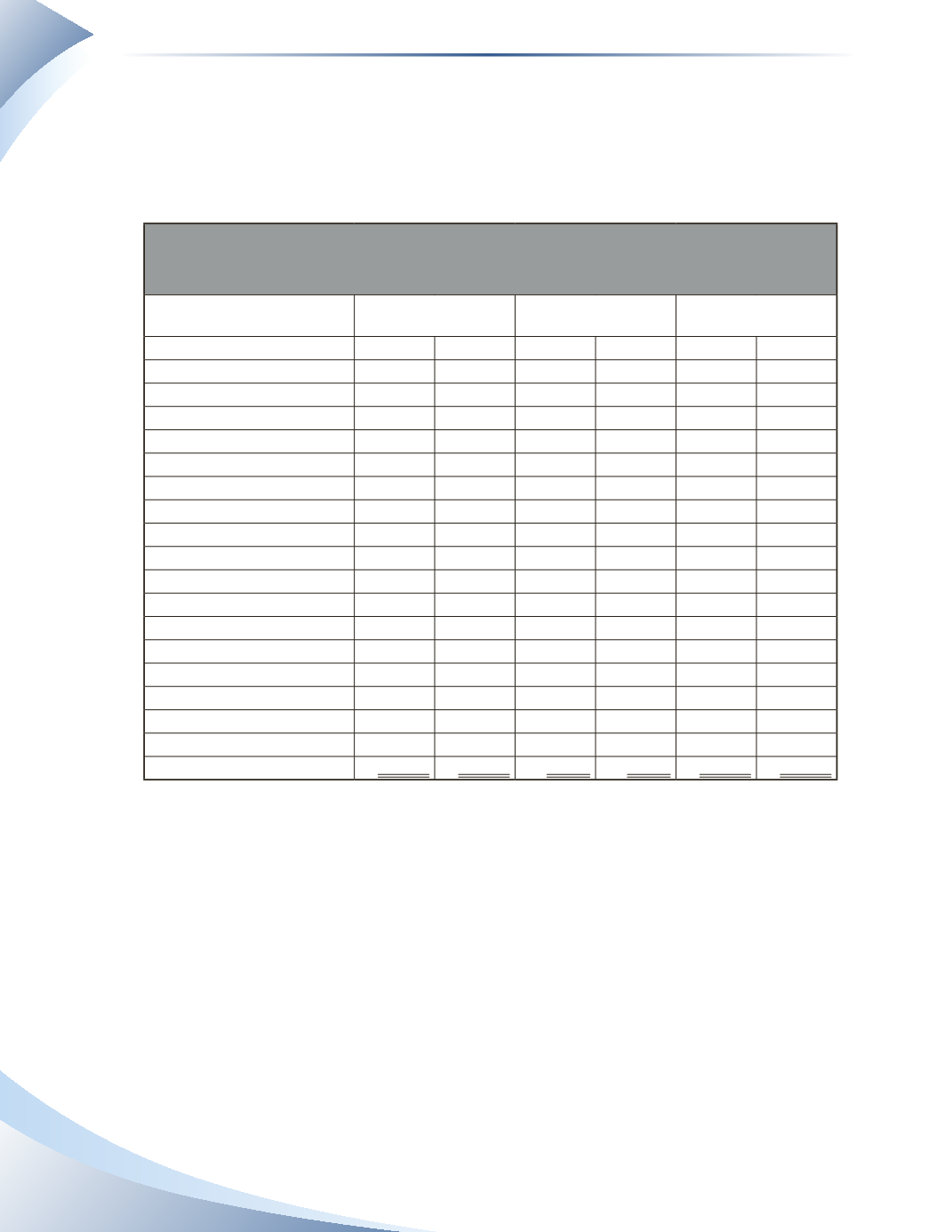

The worksheet is only a working paper for accountants, it is not meant to be read by external users

of financial information. It is therefore important to create formal documents in the form of an

income statement, a statement of owner’s equity and a balance sheet.

The Income Statement

The income statement takes the values from the adjusted trial balance columns of the worksheet

and organizes them into a format that shows the net income or loss.To illustrate the importance of

preparing the adjustments, first look at the income statement in Figure 6.3.This income statement

was prepared before any adjustments were made. Net income shows $2,250.