Chapter 5

The Accounting Cycle: Adjustments

122

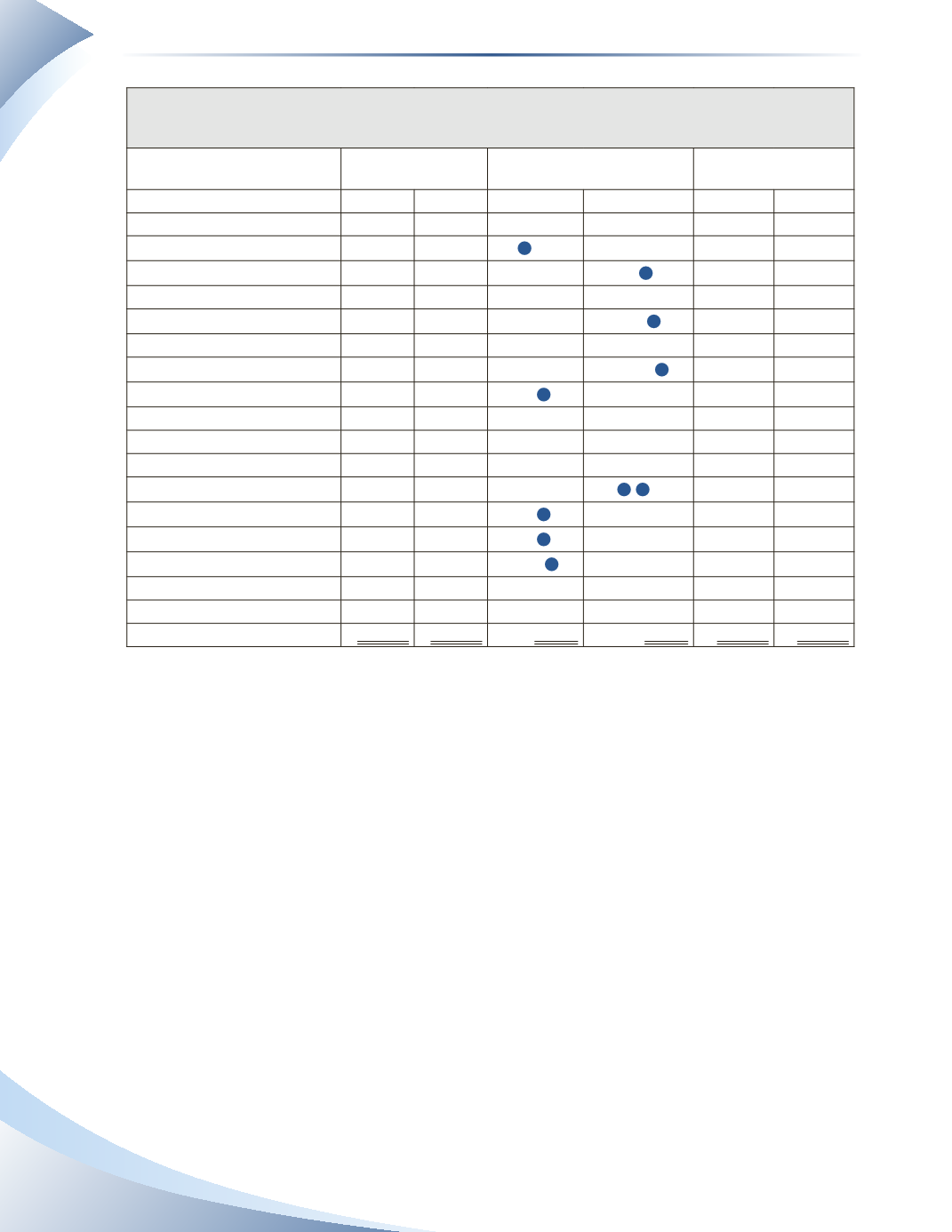

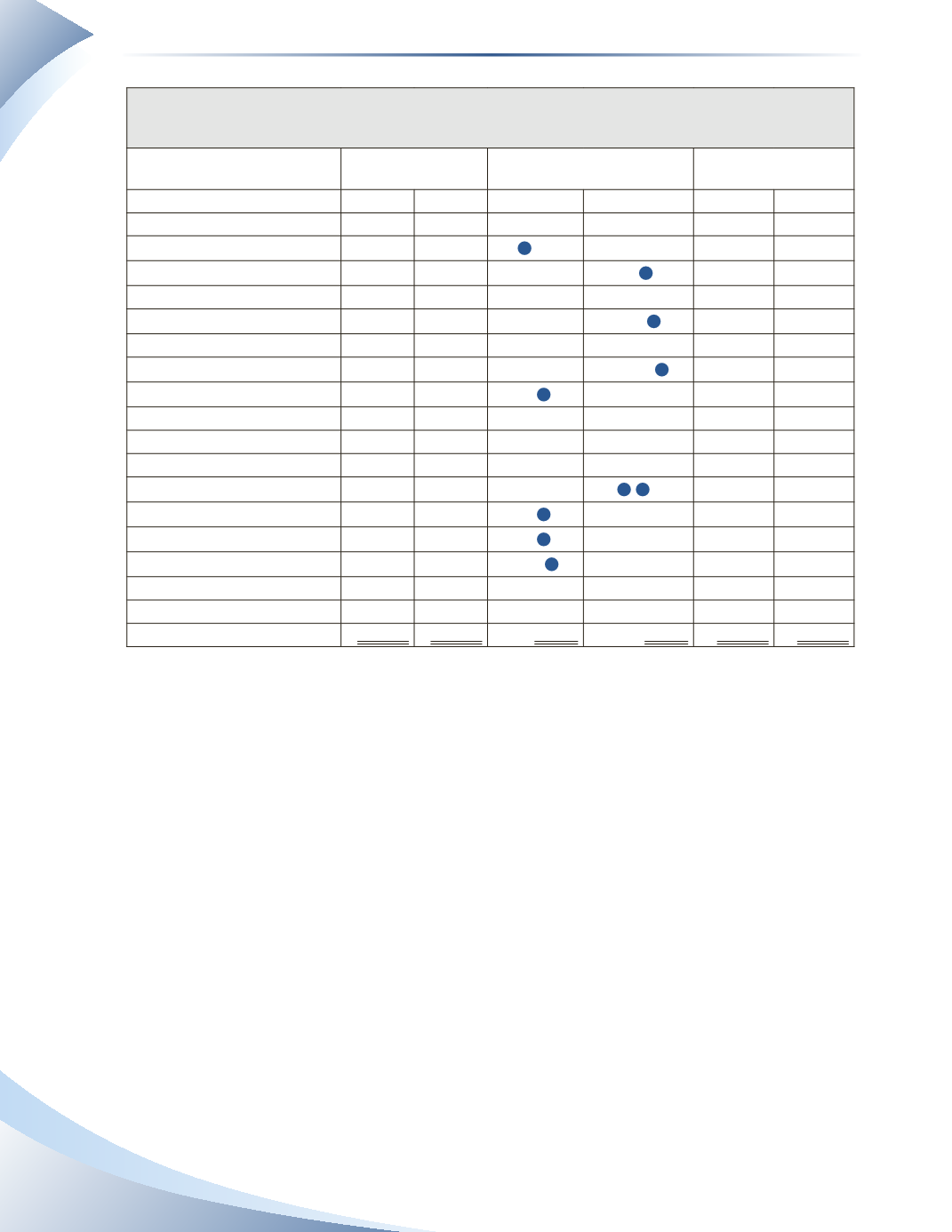

MP Consulting

Worksheet

January 31, 2016

Unadjusted Trial

Balance

Adjustments

Adjusted Trial

Balance

Account Titles

DR

CR

DR

CR

DR

CR

Cash

$3,800

$3,800

Accounts Receivable

3,000

5

$1,000

4,000

Prepaid Insurance

1,200

2

$100

1,100

Equipment

8,300

8,300

Accumulated Depreciation

$0

4

150

$150

Accounts Payable

1,250

1,250

Interest Payable

0

1

25

25

Unearned Revenue

2,000

3

200

1,800

Bank Loan

2,500

2,500

Parish, Capital

10,300

10,300

Parish, Drawings

2,000

2,000

Service Revenue

3,300

3

5

1,200

4,500

Depreciation Expense

0

4

150

150

Insurance Expense

0

2

100

100

Interest Expense

0

1

25

25

Rent Expense

800

800

Telephone Expense

250

250

Total

$19,350 $19,350

$1,475

$1,475 $20,525 $20,525

______________

FIGURE 5.22

Once the worksheet is prepared and the adjusted trial balance is in balance, the journal entries for

the above transactions would be recorded in the general journal and posted to the general ledger.

The journal entries are shown in Figure 5.23. All the postings to general ledger accounts, including

these adjustments, are shown in the next chapter.